The global software sector faced a major upheaval on January 29, 2026, as widespread “sympathetic” selling plunged the industry’s heavyweights into disarray. The catalyst for this downturn was a disappointing second-quarter report from Microsoft Corp. (NASDAQ: MSFT), which hinted that the rapid growth of cloud services might be reaching a turning point. This shift came as investor enthusiasm for the ongoing artificial intelligence boom waned, leading to a significant pullback from high-valuation software stocks and a loss of hundreds of billions in market value.

The selloff marked a stark transition from the “AI optimism” that characterized the previous two years to a more skeptical outlook, with the market now demanding tangible evidence of return on investment beyond mere potential. This change in sentiment was palpably felt across the tech landscape, which had previously been buoyed by the prospects of AI-driven growth.

The downward trajectory began late on January 28, 2026, when Microsoft unveiled its quarterly financials. Although the company reported $81.3 billion in revenue and non-GAAP earnings per share of $4.14, concerns quickly focused on Azure, Microsoft’s flagship cloud computing platform. Azure’s revenue growth of 39% revealed a slight deceleration from the previous quarter, and the company further guided for a slowdown to 37%–38% in the coming quarter.

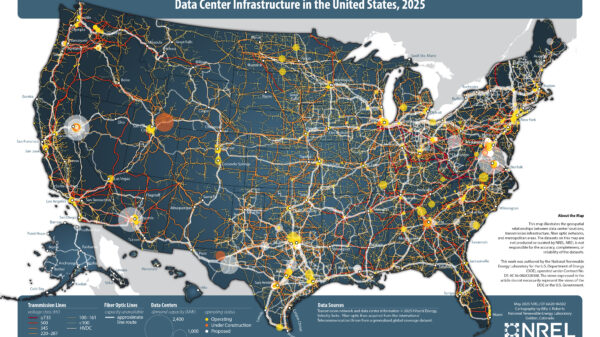

Adding to the investors’ unease was a staggering 66% year-over-year surge in capital expenditure, reaching $37.5 billion. For the first time, questions arose about the sustainability of Microsoft’s push to build “AI Factories” at such a hefty cost. Alarmingly, nearly 45% of its $625 billion backlog was linked to OpenAI, introducing significant “concentration risk” that cast doubt on the overall bullish narrative. As markets opened on January 29, Microsoft shares plummeted over 10%, resulting in a $400 billion loss that reverberated throughout the tech sector.

The ramifications of Microsoft’s report were felt acutely among other enterprise software firms. ServiceNow (NYSE: NOW), previously an AI favorite, saw its stock tumble by 12%. Despite a recent earnings beat, the market reassessed IT budgets, suggesting funding might pivot from workflow applications to the costly infrastructure necessary to support foundational AI models. Similarly, Salesforce (NYSE: CRM) experienced an 8% decline, with analysts growing concerned that its “Agentforce” initiative and AI-integrated CRM tools might not monetize quickly enough to justify their valuations in a high-interest environment. Oracle Corp. (NYSE: ORCL), which had enjoyed significant growth with its Oracle Cloud Infrastructure (OCI), was also impacted, falling 5% as the Microsoft guidance hinted at potential supply-side bottlenecks affecting even the most efficient cloud providers.

This widespread selloff signifies a critical moment in the technology lifecycle, often termed the “Trough of Disillusionment.” For the past two years, the “AI trade” was fueled by the fear of missing out and the belief that AI would usher in a productivity revolution. However, the January 2026 market reaction suggests a shift toward what some analysts term the “Death of Software” theory. This bearish view posits that AI-driven autonomous agents and “vibe coding,” where non-programmers generate complex software through natural language, could eventually disrupt the longstanding “per-seat” licensing models that have supported the SaaS industry.

Moreover, this situation highlights a widening divide between “AI Enablers”—those developing the hardware and powering the chips—and “AI Adopters,” the software companies attempting to sell AI as an added service. As IT budgets for 2026 are finalized, it is evident that the rising costs of compute are constraining budgets for application development. This recalibration has driven the iShares Expanded Tech-Software Sector ETF (BATS:IGV) into bear market territory, down more than 20% from recent peaks, as investors reassess long-term margins across the software landscape.

In the aftermath of this selloff, it is likely that software companies will undertake significant strategic changes. The period of “AI for the sake of AI” appears to be over; the emphasis must now shift to demonstrable ROI. Firms like Salesforce and ServiceNow will need to demonstrate that their AI agents can effectively replace human labor or create new revenue opportunities for clients, rather than acting merely as advanced search tools. This shift could potentially catalyze a wave of consolidation, as smaller, cash-strapped software firms struggle to keep up with the research and development costs necessary to compete in an AI-dominated market.

Short-term volatility is expected to persist as the enterprise earnings season continues. Nevertheless, this “reality check” could lay a healthier foundation for the market in the future. By eliminating speculative “AI wash” companies—those that have merely rebranded themselves with “AI” without substantial technological backing—the market may ultimately reward genuine innovators capable of transitioning from traditional software-as-a-service to autonomous-agent-as-a-service.

The January 2026 software selloff serves as a poignant reminder that even the most transformative technologies must navigate periods of intense scrutiny and valuation reassessment. For investors, the key takeaway is that the “AI narrative” alone can no longer sustain elevated valuations; execution, margin preservation, and supply-chain resilience have become the new criteria for success in the enterprise sector. As the market keenly observes cloud growth rates and the impact of 2025’s capital expenditures on profitability for 2026 and beyond, the software sector remains in a defensive posture, bracing for the “Great AI Reality Check” to unfold.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics