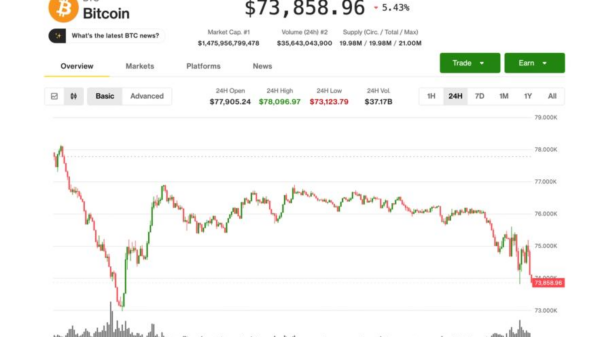

Advanced Micro Devices (AMD) shares fell more than 16% on Wednesday, despite the company reporting better-than-expected fourth-quarter earnings and a favorable outlook for the first quarter. Analysts had anticipated a more robust performance in both the fourth-quarter results and first-quarter projections, leading to investor disappointment.

AMD’s stock had surged over 112% in the year leading up to the earnings announcement, reflecting investor optimism that the company could gain significant market share from rival Nvidia (NVDA), which itself saw a 54% increase during the same period.

In its earnings report, AMD disclosed earnings per share (EPS) of $1.53 on revenues of $10.3 billion, surpassing Wall Street’s estimates of $1.32 EPS on revenue of $9.6 billion. This marks a significant increase from the $7.7 billion revenue reported in the same quarter last year.

Looking ahead, AMD forecasted first-quarter revenue between $9.5 billion and $10.1 billion, slightly exceeding the Street’s estimate of $9.4 billion, although some analysts had anticipated revenue surpassing $10 billion. Last week, major tech companies including Microsoft (MSFT) and Meta (META) released their earnings, eliciting mixed responses from traders. While Microsoft faced criticism for its increased spending and modest growth, Meta’s performance was praised despite a substantial rise in its AI expenditures.

In its data center segment, AMD generated $5.4 billion in revenue, surpassing expectations of $4.97 billion. The company’s client business for PCs also performed well, with revenue hitting $3.1 billion, above the anticipated $2.9 billion. However, AMD’s gaming segment saw revenue of $843 million, falling short of estimates of $855 million.

CEO Lisa Su indicated that AMD, similar to Intel (INTC), is grappling with a global memory shortage, which may compel PC manufacturers to elevate prices and could negatively impact demand in AMD’s PC and gaming divisions.

The earnings report comes just weeks after AMD showcased several new products during Su’s keynote address at the Consumer Electronics Show (CES) 2026 in Las Vegas. One highlight was the unveiling of the upcoming Helios rack-scale server, which Su claimed to be the world’s best AI rack, aimed directly at Nvidia’s offerings.

Helios is designed to compete with Nvidia’s Vera Rubin-powered NVL72 rack-scale solution, both featuring 72 GPUs and capable of interlinking with other rack-scale systems to form a single, extensive AI computing environment. AMD also provided insights into its forthcoming MI500 series of GPUs, which the company asserts will deliver up to a 1,000x increase in AI performance compared to its older MI300X chips.

Su has expressed confidence that the market for AI data centers could reach as much as $1 trillion by 2030, presenting AMD with significant opportunities to capture potential customers from Nvidia. As the competition intensifies in the semiconductor industry, AMD’s strategic emphasis on innovation and performance enhancements will be crucial for maintaining its growth trajectory.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025