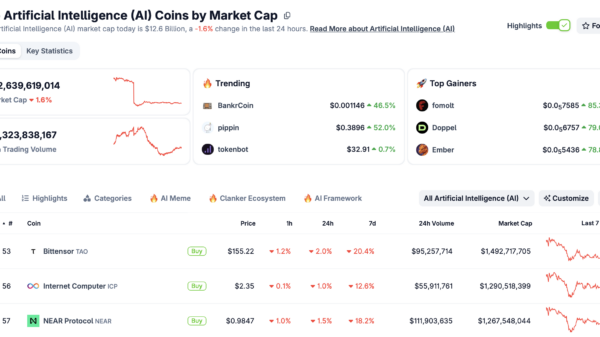

On Thursday, December 12, the U.S. stock market faced significant turmoil as concerns over the potential disruption caused by **Artificial Intelligence (AI)** spread beyond the technology sector into logistics, real estate, and various industries, prompting a wave of panic selling. The three major U.S. stock indexes each fell by at least 1%, with the **Nasdaq Composite** closing down approximately 2%, marking its third consecutive decline. The **Dow Jones Industrial Average**, which had reached new closing records earlier in the week, fell below the 50,000-point mark for the first time in a week.

Tech stocks were primarily responsible for the sharp decline in U.S. equities. Shares of **Cisco** plummeted 12% after the company’s gross margin guidance disappointed investors. Meanwhile, all members of the so-called “Mag 7” tech stocks closed lower, with **Apple** suffering a notable loss of about $202 billion in market value in a single day—the second-largest daily market cap loss since its IPO. The tech industry ETF declined by 2.7%.

The **Dow Jones Transportation Index** also fell significantly, as concerns regarding AI’s impact on logistics and commercial real estate services have intensified. Notably, firms like **CBRE** and **Jones Lang LaSalle** experienced cumulative declines exceeding 25% over a two-day period. This sell-off coincided with increasing skepticism about the returns on AI investments across multiple sectors. Although major tech companies such as **Amazon**, **Google**, **Meta**, and **Microsoft** are projected to collectively invest around $650 billion this year in AI initiatives, doubts remain about the effectiveness of these capital expenditures.

Over the past two years, AI has emerged as a key driver of the U.S. stock bull market, with a concentration of investments in **chipmakers**, **cloud computing**, and **AI application companies**. However, the market narrative has shifted from identifying beneficiaries of AI to recognizing potential victims. Analysts suggest that the market is transitioning from an “AI-phoria” phase into an “AI-phobia” stage, as investors reassess whether AI-related spending may be overheated and whether the technology poses a threat to profitability in certain traditional industries.

The pressure on tech stocks was exacerbated by rising concerns regarding profitability models reliant on human labor. Sectors such as software, insurance brokerage, and commercial real estate services were notably hit, as investor caution grew in anticipation of the release of inflation data. This context has contributed to a broader market repricing influenced by AI narratives.

Market sentiment shifts as investors seek potential losers

The anxiety surrounding AI investments continued to escalate on Thursday, as tech stocks experienced a steep decline. Shares of **Cisco** dropped 12% after the company reported weaker-than-expected adjusted gross margins for its current fiscal quarter, with rising memory chip prices cited as a key factor eroding profit margins. Following a warning from **Lenovo** regarding shipment pressures, shares of **HP Inc** and **Dell Technologies** fell 4.5% and 9.2%, respectively.

Software stocks faced renewed pressure, with the **S&P 500 Software Index** dropping approximately 1.5%, just after the sector had previously rebounded from earlier losses. Despite reporting better-than-expected Q4 earnings, shares of ad software company **AppLovin** fell 20%. Conversely, some storage chip stocks maintained positive momentum: **Seagate Technology** rose nearly 5.9%, while **Western Digital** gained 3.8%.

In after-hours trading, **Applied Materials**, a leader in chip equipment, saw its shares surge over 10% following an earnings report that projected a relatively optimistic outlook. This suggests that while some segments of AI capital expenditure remain robust, clear divergences are evident within the sector. Market commentators note this period of uncertainty for tech-driven rallies could represent a significant moment of reassessment for investors.

Investor sentiment has fundamentally shifted, with a growing focus on identifying potential losers in the AI landscape. **Steve Sosnick**, Chief Strategist at **Interactive Brokers**, remarked that the market is increasingly filled with AI-related pitfalls, particularly for companies in the software industry, insurance brokerage, and wealth management. This sentiment has led to dramatic stock price declines, indicating that momentum-driven markets may overreact to both positive and negative news.

Concerns extend into the commercial real estate sector, where firms such as **CBRE**, **Jones Lang LaSalle**, and **Cushman & Wakefield** have seen their shares decline significantly. Analysts argue that the market reaction may be excessive, given that previous fears regarding technology undermining brokerage and advisory services have not materialized. Despite reporting record fourth-quarter revenue and profit growth, **CBRE** faced scrutiny during its earnings call centered on AI’s potential to automate traditional tasks, diminishing the demand for large advisory teams.

Transportation stocks also experienced a downturn, with the **Dow Jones Transportation Index** falling amid concerns over AI’s impact on logistics. **Apple** recorded a staggering 5% drop in stock price, erasing approximately $202 billion in market value, amid reports indicating delays in the rollout of anticipated AI features and scrutiny from regulatory authorities concerning its content policies.

Investors remain cautious as they await the release of the January **U.S. Consumer Price Index (CPI)** report, which is anticipated to show a slowdown in year-over-year growth. Concerns about inflation persist, while traders see little likelihood of a Federal Reserve rate cut in March, although a cut in July is already reflected in market pricing. As the landscape evolves, the implications of AI on various sectors remain a focal point for investors navigating this turbulent market environment.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics