In a significant move to enhance operational efficiency, Sumitomo Mitsui Banking Corp. (SMBC) has launched an independent artificial intelligence (AI) startup in Singapore. This initiative, initially revealed in June 2025, aims to accelerate the development of enterprise AI tools while attracting talent that traditional banking structures often find challenging to secure.

The new venture is designed to function with a degree of autonomy, facilitating rapid experimentation and testing of automation solutions without the bureaucratic hurdles typically associated with large financial institutions. “We are trying to bring the best of both worlds: having an independent entity incubated and invested by SMBC to attract talent, do experiments faster, and have the nimbleness and agility,” said Mayoran Rajendra, managing director and head of the AI transformation office at SMBC, in an interview with Asian Banking & Finance.

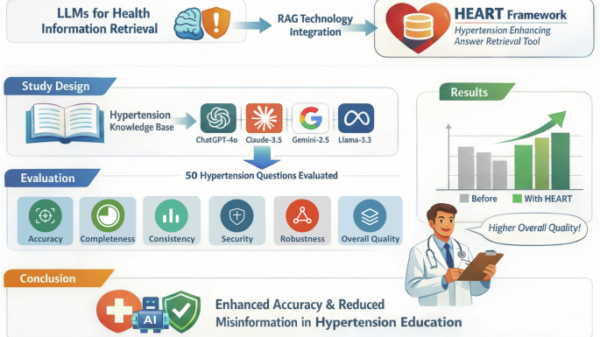

Unlike generative AI models that create content based on prompts, agentic AI is capable of making decisions and taking actions towards achieving multi-step objectives with limited supervision. This technology enables the pursuit of complex goals autonomously while mitigating the risks often associated with broad, open-ended language models. Rajendra emphasized that this approach allows the bank to reduce uncertainty and variability in its processes by breaking workloads into smaller, defined tasks. “You are not overly relying on a large language model (LLM), but the small, small judgements that are needed in a repetitive workflow,” he noted.

Initial development efforts by SMBC will concentrate on automating the onboarding of corporate clients and enhancing know-your-customer (KYC) reviews. These areas demand extensive documentation and considerable labor, particularly for multinational clients engaging with various SMBC services, such as loans, trade finance, remittances, and foreign exchange. In many instances, compliance teams may need to sift through 400 to 500 pages of documentation to gather necessary data for each jurisdiction.

Agentic AI is poised to streamline this process significantly. Rajendra indicated that it could automate much of the data extraction, accuracy checking, and validation against multiple authorized sources. As a result, the time required for corporate account opening could decrease from five days to just two. Similarly, the lengthy loan processing time, which can extend up to seven months depending on the borrower and specific regulatory requirements, could be reduced to five days.

Importantly, Rajendra assured that automation will not eliminate human oversight. SMBC’s agentic workflows are structured to ensure that staff can always access the original text or source page from which data points were extracted. “You automate a lot of the repetitive work, but we always design it in a way that is auditable, traceable, observable,” he explained. “There is always a possibility that it cannot be 100% [accurate].”

To address data security concerns, SMBC is committed to keeping all information processed by AI strictly within its own infrastructure. Sensitive data will not be utilized to train external models or fed into open LLMs. “First and foremost, we make sure any information is not going to an LLM to train the LLM. It sits within SMBC premises,” Rajendra stated.

In addition to AI development, SMBC is also rolling out tools for its corporate clients, including complimentary CFO dashboards that provide real-time operational visibility through analytics and data visualization. Furthermore, SMBC is actively investing in startups across India and Southeast Asia via the SMBC Asia Rising Fund.

Rajendra summarized the venture’s overarching goal: “We are bringing these agentic AI applications or capabilities to support our customers’ operation automation.” This strategic direction not only underscores SMBC’s commitment to innovation but also enhances its competitive edge in the rapidly evolving financial landscape.

See also Finance Committee Approves Wage Ordinance, Adding 3 Positions for 2026 Budget

Finance Committee Approves Wage Ordinance, Adding 3 Positions for 2026 Budget Fed’s Lisa Cook Warns AI Trading Risks Could Manipulate Markets, Impair Competition

Fed’s Lisa Cook Warns AI Trading Risks Could Manipulate Markets, Impair Competition AI Tools Mislead Users: Which? Study Reveals Accuracy Scores Below 70% for Finance Advice

AI Tools Mislead Users: Which? Study Reveals Accuracy Scores Below 70% for Finance Advice Principal Financial Upskills 20,000 Employees with New AI Literacy Program

Principal Financial Upskills 20,000 Employees with New AI Literacy Program AI to Transform B2B Finance by 2030, Boosting Efficiency and Redefining Roles

AI to Transform B2B Finance by 2030, Boosting Efficiency and Redefining Roles