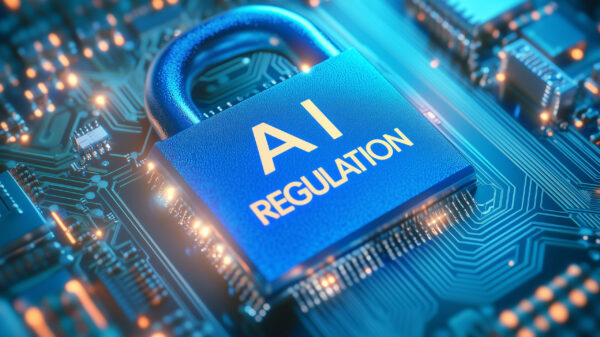

Industry stakeholders have broadly welcomed the Financial Conduct Authority’s (FCA) decision to initiate a comprehensive review of artificial intelligence (AI) on January 27. The review aims to assess the potential of AI to reshape markets, influence consumer behavior, and disrupt existing business models, while also identifying new risks associated with its integration into the financial services sector.

Richard Pinch, senior risk director at Broadstone, remarked that the FCA’s initiative signals a shift in regulatory focus towards the long-term implications of AI on retail financial services, consumer outcomes, and overall market stability. “The FCA’s Mills Review is a clear signal that regulators are looking beyond today’s use of AI and towards its long-term impact,” he stated. Pinch emphasized that as AI becomes increasingly embedded in customer interactions and operational processes, there is a pressing need for governance and accountability measures to safeguard consumer interests.

Pinch also pointed out that firms must demonstrate that their AI-driven models align with the ethos of the Consumer Duty. He noted, “Firms that invest in strong oversight frameworks now will be better placed to innovate with confidence.” This sentiment reflects a growing understanding that the responsible deployment of AI technology is vital for maintaining consumer trust and market integrity.

Tom Callaby, a financial services partner at law firm CMS, added that while the use of AI in retail applications has been relatively limited in the UK market thus far, firms are beginning to explore new use cases, especially in light of forthcoming regulatory reforms. “The FCA should not close itself off to updating or adjusting its approach,” he cautioned, underlining that the absence of tailored rules and guidance in critical areas has hindered progress for many firms.

The urgency of addressing AI’s rapid evolution was echoed by Mike Barrett, consulting director at the lang cat. He welcomed the FCA’s engagement but questioned whether the review’s pace would keep up with technological advancements. “AI is moving so quickly that it’s going to be hard for any regulator to stay ahead,” he said. Barrett expressed concern that a review reporting back to the board this summer does not adequately reflect the urgency surrounding the issue, noting, “We hope this is the first step towards a broader strategy.”

He further stated that while the Consumer Duty is designed to ensure that firms use AI safely, there may be a need for stronger regulatory measures as AI intersects with financial products and advice. These perspectives illustrate the balancing act that regulators must perform: fostering innovation while protecting consumers in an increasingly digital landscape.

The FCA’s effort comes at a time when AI technologies are rapidly evolving, promising to enhance efficiencies and consumer engagement across various sectors. However, the integration of such technologies also raises significant ethical and operational questions that need to be addressed. Industry leaders are urging the FCA to take a proactive stance in crafting regulations that not only accommodate innovation but also establish a framework for accountability and transparency.

As the FCA embarks on this review, the outcome will likely shape the future trajectory of AI in the financial services sector. The challenge ahead lies in creating regulations that are adaptable to the fast pace of technological change while ensuring that consumer protection remains at the forefront. The dialogue sparked by this review could set a precedent for how financial regulators around the world engage with emerging technologies in the years to come.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics