In a notable shift within the rapidly evolving artificial intelligence sector, several prominent investors are pulling back or betting against leading AI stocks, despite the sector’s explosive growth anticipated through 2025. High-profile figures such as Michael Burry, famed for his role in the “Big Short,” have taken positions exceeding $1 billion in bearish options against AI giants like Nvidia and Palantir. Meanwhile, tech mogul Peter Thiel has fully liquidated his stake in Nvidia, and SoftBank has divested its entire $5.8 billion position in the company to redirect funds towards investments in ChatGPT creator OpenAI.

Even quantitative funds are showing caution; Bridgewater Associates and Tiger Global Management have trimmed their holdings in major AI and Big Tech firms, reflecting unease surrounding inflated market valuations. Short-selling activity in the AI sector is on the rise, with data indicating a significant shift in sentiment among hedge funds.

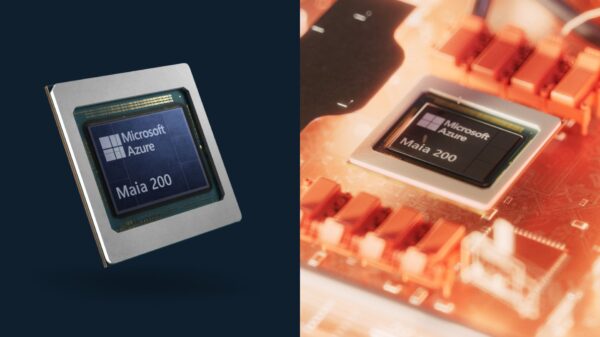

Commenting on the current landscape, Andrew Sobko, founder of Argentum, noted the unprecedented scale of investment in AI infrastructure. He stated, “Today’s largest tech firms are raising debt at scale to fund AI infrastructure, signaling we’re in the middle of one of the biggest compute-buildouts in history.” However, he also raised concerns about how borrowed billions could impact investor sentiment if demand does not meet expectations.

Amidst these investor moves, the broader context reveals that while AI remains in a nascent phase of infrastructure development, the hype has led to significant revenue growth for companies like Nvidia. Indeed, hyperscale firms are projected to increase their capital expenditures to over $500 billion by 2026, a sharp rise from previous growth projections.

However, the recent trend of large technology companies resorting to borrowing to fund their AI ventures has raised alarms. Notably, Meta and Oracle borrowed a combined $70 billion in October alone. Concerns about off-balance sheet debt have also surfaced, with Meta and Musk’s xAI accumulating almost $40 billion in debt in just a month. Such debt accumulation has triggered comparisons to past financial collapses and raised questions about the sustainability of current investments.

Investor anxiety is heightened by the observation that these AI investments now represent over 40% of U.S. GDP growth, raising fears of systemic risk should firms like OpenAI—which may not turn a profit until 2029—fail to realize their ambitious financial commitments.

Despite the turbulence, experts assert that the core players in AI remain fundamentally strong, continuing to drive innovation. Shahrzad Rafati, founder and CEO of RHEI, emphasized that while leading firms are expanding, a wave of lower-quality “AI slop” is creating market noise and inflated expectations. “Sophisticated investors are right to be concerned about the divergence between sky-high valuations and the companies demonstrating real technology,” she remarked.

Rafati further clarified that investors like Burry and Thiel are not against AI technology itself but are reacting to what they deem inflated valuations in undifferentiated companies. “Their actions emphasize that smart money is focused on AI entities that have real tech and real customers,” she added.

Looking ahead, market analysts suggest that investors should remain cautious while focusing on long-term strategies rather than succumbing to market hype. Historical trends reveal that revolutionary technologies often face turbulence before achieving widespread adoption. Pei-ju Lee, deputy director of research at Bradley, Foster & Sargent, stated, “The over-investment bubble had to pop before applications took off,” drawing parallels to the dot-com era.

As AI continues to evolve, experts predict a shift towards investment in innovative sectors like robotics and practical AI solutions. Jason Hardy, chief technology officer for AI at Hitachi Vantara, expressed optimism, stating that enterprise momentum makes a collapse like the dot-com bubble unlikely. Instead, he noted that the strongest players are laying foundations for lasting value.

In the midst of these developments, financial advisors urge everyday investors to focus on diversification and individual portfolio strategies rather than getting swept up in the ongoing debate about whether AI represents a “boom” or a “bubble.” Alex Michalka, head of investments at Wealthfront, emphasized that trying to predict market movements can lead to poor investment decisions. “Ultimately, your long-term success hinges not on predicting the future of tech,” he concluded, “but on maintaining discipline, diversification, and time in the market.”

See also Dell Technologies Expands AI Factory with Automated Solutions for Enhanced Enterprise Performance

Dell Technologies Expands AI Factory with Automated Solutions for Enhanced Enterprise Performance Dr. Bhargav Patel Sues Sully.AI for Termination After FDA Compliance Concerns

Dr. Bhargav Patel Sues Sully.AI for Termination After FDA Compliance Concerns Backbase and Unblu Unite to Enhance Digital Banking with AI-Powered Human Engagement

Backbase and Unblu Unite to Enhance Digital Banking with AI-Powered Human Engagement AI Tools Risk ‘Deskilling’ Workforce, Warns UC Irvine Philosophy Professor

AI Tools Risk ‘Deskilling’ Workforce, Warns UC Irvine Philosophy Professor Services as Software: AI Redefines Business Operations for Enhanced Efficiency

Services as Software: AI Redefines Business Operations for Enhanced Efficiency