Vertical AI startups are set to confront a challenging landscape in 2026, as competition intensifies amidst a paradox of abundant funding and constrained enterprise budgets. Following an 85% surge in global AI startup funding in 2025, amounting to $211 billion, and significant backing from firms like Andreessen Horowitz, which invested $15 billion, the reality for these startups is stark. Enterprise IT budgets are projected to grow at a mere 2% annually, with companies increasingly consolidating their AI vendor relationships. As a result, many startups will find themselves squeezed out of the market.

This harsh mathematical reality threatens to eliminate 99.5% of AI startups before they reach $10 million in revenue. The primary reason is not a failure of technology, but rather an outdated go-to-market (GTM) strategy inherited from traditional SaaS models. The once-reliable approaches—such as outbound sequences and demo-first sales—are inadequate in a market where enterprise buyers demand proof before engagement.

During the boom years of 2023 and 2024, aggressive growth tactics borrowed from SaaS enabled many AI founders to thrive. However, 2026 marks a departure from this trend, as enterprise buyers grow overwhelmed by choices and begin making preliminary vendor selections before engaging with sellers. This shift demands a new approach: market shaping GTM. This strategy, historically used by deep tech companies, is essential for surviving the evolving enterprise landscape.

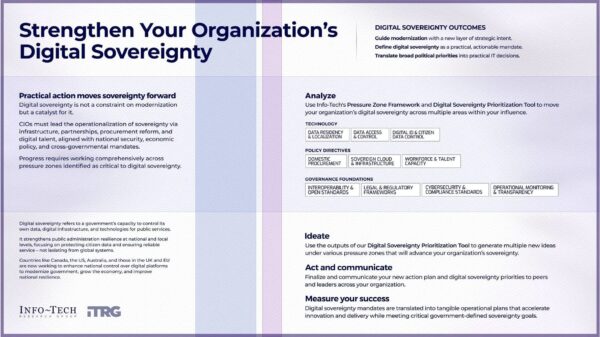

The first challenge vertical AI startups face is the “Buyer Attention Crisis.” Research indicates that 70% of B2B buyers feel inundated by sales and marketing information. Consequently, many establish a preliminary vendor preference during the early stages of their research—before any interaction with sellers. Once a buyer selects a preliminary favorite, the odds of purchasing from that vendor increase significantly, with a 77% likelihood. This scenario poses an existential threat for newcomers that fail to capture attention early in the process.

To combat this crisis, market shaping helps startups frame the narrative buyers encounter during their research. By establishing thought leadership, securing endorsements from third-party validators, and presenting customer success stories, startups can position themselves as preliminary favorites. For instance, Glean successfully shaped the market for AI-powered workplace search by addressing “enterprise search fragmentation,” ultimately achieving $270 million in annual recurring revenue and attracting major clients like Databricks and Reddit.

The second challenge is the “Budget Consolidation Trap.” With enterprise AI budgets consolidating, many vertical AI startups will likely be excluded from funding allocations. Gartner projects that AI infrastructure spending will soar from $18.3 billion to $37.5 billion in 2026. However, venture capitalists predict that this spending will largely favor a select few vendors that demonstrate clear results. Rob Biederman of Asymmetric Capital Partners emphasizes that enterprises will increasingly allocate budgets to a narrow range of “safe choice” vendors, leaving many startups without support.

Market shaping addresses this issue by creating commercial signals that position startups as safe choices. Recognition from analysts, strategic partnerships with major players like AWS, and compliance with regulatory standards are vital for reducing procurement risk. Enterprises will favor those vendors they believe will endure, making early proof of stability essential.

The final hurdle is the “Evidence Gap.” In 2025, only 39% of AI initiatives were reported to generate measurable impact, leading to skepticism among buyers. With enterprises demanding evidence before committing funds, vertical AI startups face an uphill battle. Traditional methods of customer acquisition are too slow; buyers expect proof of success at a rapid pace. As B2B buying cycles shorten, the pressure mounts for startups to provide credible proof sooner.

Market shaping can bridge this evidence gap by deliberately manufacturing external proof before a startup has built a robust customer base. Forming strategic partnerships with marquee clients can act as powerful endorsements, while industry pilot programs with regulatory bodies can provide third-party validation. This proactive approach allows startups to establish credibility swiftly, which is essential for securing enterprise deals.

As the landscape shifts in 2026, the opportunities once available to AI startups through traditional SaaS methodologies are dwindling. Investors are now prioritizing profitability and sustainable growth, while enterprise buyers are consolidating around established vendors. The volume of startups competing for limited budgets creates a structurally oversupplied market, and only those that can navigate the complexities of buyer attention, budget decisions, and proof of efficacy will thrive. The successful vertical AI startups of 2026 will not simply out-build their competitors; they will out-position them by adopting market shaping strategies that reframe the rules of engagement.

Mark M.J. Scott, founder and president of Northern Pixels Inc., emphasizes that the landscape has fundamentally changed. Startups that cling to outdated SaaS strategies risk becoming cautionary tales, while those who embrace new approaches will emerge as category leaders in a competitive market.

See also LG CNS Invests 10 Billion Won in Cha Biotech to Launch AI-Driven Connected Healthcare Services

LG CNS Invests 10 Billion Won in Cha Biotech to Launch AI-Driven Connected Healthcare Services Woori Financial Group Advances AI Transformation with 344 Use Cases by 2024

Woori Financial Group Advances AI Transformation with 344 Use Cases by 2024 Salesforce Reinvents CRM with Einstein 1 Platform and Generative AI for Efficiency Gains

Salesforce Reinvents CRM with Einstein 1 Platform and Generative AI for Efficiency Gains IBM Study Reveals AI Investment Set to Surge 150%, Driving 42% Productivity Growth by 2030

IBM Study Reveals AI Investment Set to Surge 150%, Driving 42% Productivity Growth by 2030 Moonshot AI Valued at $4.8B as Chinese AI Market Grows Amid Geopolitical Shifts

Moonshot AI Valued at $4.8B as Chinese AI Market Grows Amid Geopolitical Shifts