InScope has raised $14.5 million in a Series A funding round aimed at addressing a persistent challenge in the finance sector: transforming complex, multi-source data into compliant financial statements ready for submission. The funding was led by Norwest, with contributions from Storm Ventures and existing investors Better Tomorrow Ventures and Lightspeed Venture Partners. This backing underscores a growing confidence in the potential for artificial intelligence to enhance the often labor-intensive processes involved in creating 10-Ks, 10-Qs, and annual audits.

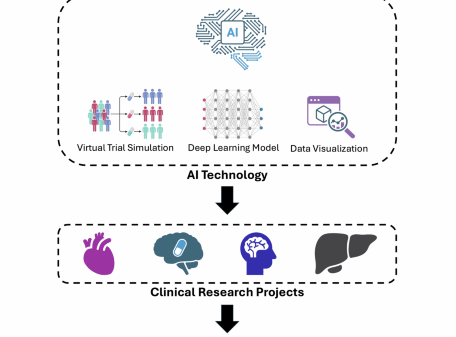

Founded by seasoned accountants-turned-operators Mary Antony and Kelsey Gootnick, InScope targets the meticulous checks that can delay reporting teams. The firm focuses on elements such as arithmetic verification, formatting consistency, and cross-document tie-outs, rather than attempting to generate entire financial statements instantaneously. InScope’s approach aims to reduce the time spent on the tedious 20% of tasks that still consume valuable review cycles.

InScope’s platform is designed to catch the details that can derail filings, such as inconsistent dollar signs, rounding errors, and discrepancies between tables and footnotes. According to CEO Mary Antony, these controls can reclaim as much as 20% of an accountant’s time during peak reporting periods. Notably, the platform incorporates a human-in-the-loop model, ensuring that outputs are intended for review and accompanied by transparent change logs and justification trails. This focus on auditability aligns well with a profession that values documentation and oversight.

The financial reporting software market is ripe for innovation, already a multibillion-dollar space dominated by established players like Workiva and Donnelley Financial Solutions. Workiva reported annual revenues exceeding $600 million, and Donnelley operates around the $1 billion mark. As compliance requirements grow—fueled by initiatives such as the SEC’s Inline XBRL mandate and the European Union’s Corporate Sustainability Reporting Directive—many finance teams find themselves spending over half of their time on data collection and reconciliation, precisely the bottlenecks that AI technology like InScope aims to alleviate.

InScope positions itself strategically between ERP data and the final submission package, addressing the error-prone assembly phase where spreadsheets, narrative drafting, and last-minute edits converge under tight deadlines. Over the past year, the company has seen a fivefold increase in customers, including significant adoption by CohnReznick, one of the largest accounting firms in the U.S. This traction is vital, as familiarity and trust with external auditors can significantly influence a firm’s willingness to integrate new tools into their reporting processes.

InScope’s dual focus on in-house reporting teams and service providers reflects the reality that many mid-market and late-stage private companies rely on advisors during critical peak periods. The goal remains consistent: to reduce the number of review cycles, expedite tie-outs, and ensure smoother auditor handoffs. Accountants, who often operate with a risk-averse mindset, require any AI tool employed in their filings to be traceable, deterministic, and secure. To this end, InScope plans to emphasize features such as SOC 2 compliance, role-based access controls, and immutable audit logs that align with PCAOB and AICPA standards during audits.

The near-term objective is not to generate income statements from scratch but to eliminate avoidable errors and hasten consensus among stakeholders. InScope’s human-in-the-loop framework, combined with clear, explainable checks rather than opaque recommendations, may well distinguish successful implementations from those that falter in pilot phases.

InScope’s competitive landscape includes established names like Workiva and Donnelley, as well as platforms such as BlackLine, FloQast, and Trintech, which streamline earlier stages of the reporting process. InScope’s specific niche focuses on the last-mile assembly of external reports and disclosures, where challenges such as format fidelity and narrative-data alignment frequently create costly obstacles. With backgrounds as former finance leaders, Antony and Gootnick possess firsthand experience in managing the rapid pace of quarter-end reporting while maintaining robust controls, giving them an edge in building a trusted product for finance teams.

Looking ahead, InScope plans to leverage its newly acquired capital to deepen integrations with ERP systems, enhance reconciliation logic, and develop policy-aware drafting tools that reference FASB codifications without straying into ambiguity. As global reporting regulations converge, features like XBRL validation and ESG narrative-data consistency are also key areas of focus. Ultimately, the most critical metric will be cycle time: fewer rounds of review, minimized tie-out breaks, and reductions in time-to-file. If InScope can achieve measurable time savings across multiple reporting periods while ensuring audit readiness, it will solidify its position within the toolkit of finance teams navigating high-stakes reporting deadlines.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025