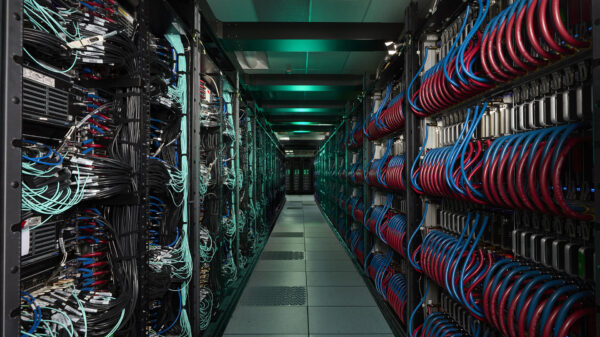

Suppliers of components for Nvidia’s H200 have halted production after Chinese customs officials blocked shipments of the newly approved artificial intelligence processors from entering China, according to a report. The Financial Times, citing two individuals familiar with the issue, indicated that this development could significantly impact Nvidia’s operations in a key market.

Reuters was unable to immediately verify the report, and Nvidia did not respond to a request for comment made outside regular business hours. The company had anticipated over one million orders from Chinese clients and its suppliers had reportedly been working around the clock to prepare for shipments as early as March.

This week, Chinese customs authorities informed customs agents that Nvidia’s H200 chips were not permitted to enter the country. Additionally, sources revealed that government officials summoned domestic tech firms to caution against purchasing the chips unless absolutely necessary. These sources, who requested anonymity due to the sensitive nature of the information, noted that customs authorities did not provide reasons for their directives and did not clarify whether this action was a formal ban or a temporary measure.

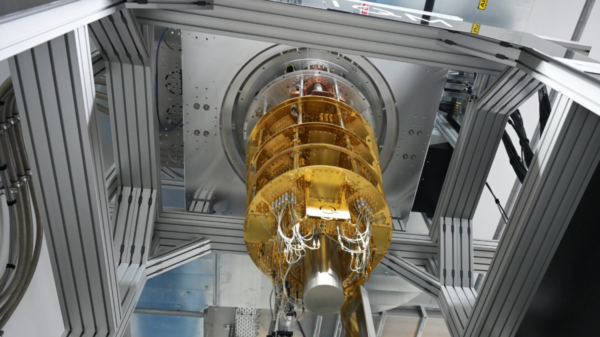

The H200, Nvidia’s second most potent AI chip, has emerged as a significant point of contention in US-China relations. Demand from Chinese firms remains robust; however, uncertainty looms over whether Beijing intends to ban the chip outright—potentially to promote domestic chip development—or if the government is still deliberating restrictions. Some industry analysts speculate this could also be a bargaining tactic in broader geopolitical negotiations.

If a formal import ban is confirmed, it would add another layer to an already complex landscape regarding chip exports. The Trump administration previously allowed the H200, which is designed in the US and manufactured in Taiwan, to be exported to China. Reports indicate that the US government would take a share of the profits from these sales.

Subsequent regulations mandated that instead of the completed chips being sent directly to China from Taiwan, they must first be routed through a US laboratory for testing. This maneuver enables a 25% tariff to be levied as the chips pass through US customs. This tariff has also been applied to chipmaker AMD’s MI325X processor, complicating the market further.

Experts and analysts remain divided on the strategic implications of selling the H200 to China. Proponents argue that making the chip available could slow China’s advancements in developing similar technology and keep Chinese companies reliant on US technology. Conversely, critics contend that the H200 is sufficiently advanced to be utilized in military applications, raising concerns about its potential use against the US or its allies in the future.

As the situation unfolds, the implications extend beyond corporate interests, encapsulating the broader tensions that define US-China relations in the technology sector. The evolving dynamics of chip production and export could influence not only market trends but also the geopolitical landscape in the coming months.

See also UK Government Launches New ‘School of Government’ to Train Civil Servants in AI Skills

UK Government Launches New ‘School of Government’ to Train Civil Servants in AI Skills Elon Musk Advocates for Grok’s ‘Moral Constitution’ Amid AI Image Misuse Controversy

Elon Musk Advocates for Grok’s ‘Moral Constitution’ Amid AI Image Misuse Controversy UK Government’s AI Copyright Reform Faces Setbacks as Industry Voices Concerns

UK Government’s AI Copyright Reform Faces Setbacks as Industry Voices Concerns New Zealand Launches Two-Year AI Work Programme to Enhance Public Service Efficiency

New Zealand Launches Two-Year AI Work Programme to Enhance Public Service Efficiency Nigeria Achieves 31-Place Jump in Global AI Readiness, Driven by Private Sector Innovation

Nigeria Achieves 31-Place Jump in Global AI Readiness, Driven by Private Sector Innovation