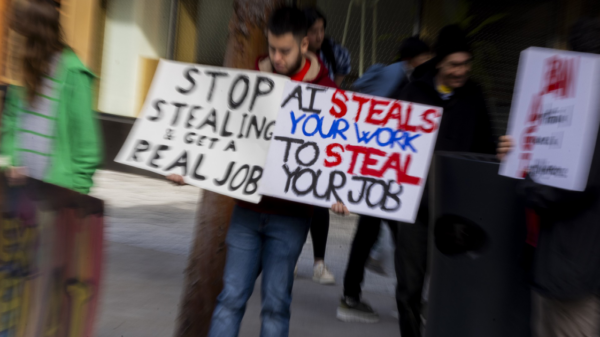

Recent discussions on social media have highlighted C3.ai, Inc. amid an increased interest in artificial intelligence stocks. This surge in dialogue reflects a broader enthusiasm for AI-driven innovations, with many investors pointing to recent price movements within the sector as indicative of a promising momentum. However, amidst this optimism, there are cautionary notes regarding the sustainability of the AI boom. Some analysts have expressed concerns about potential volatility, referencing the market’s recent fluctuations and a risk of over-optimism prevalent in tech-heavy portfolios.

In terms of insider trading activity, C3.ai, Inc. insiders have executed trades involving $AI stock on 19 occasions over the past six months, with no purchases reported and all transactions consisting of sales. Executive Chairman Thomas M. Siebel has notably sold 3,877,356 shares, totaling approximately $73,176,780, while Chief Executive Officer Stephen Bradley Ehikian sold 234,918 shares for an estimated $3,185,488. This trend raises questions about insider sentiment regarding the company’s future performance.

Financially, C3.ai reported revenues of $70.3 million for the first quarter of 2026, representing a decrease of -19.44% compared to the same period last year. This decline could be a red flag for investors assessing the company’s growth trajectory within a rapidly evolving market.

Institutional investor activity surrounding C3.ai has also been notable, with 166 institutional investors increasing their holdings, while 187 reduced their positions in the most recent quarter. Among the largest movements, Voya Investment Management LLC divested 3,893,122 shares, signaling a significant reduction in confidence. Conversely, Morgan Stanley and Susquehanna International Group, LLP increased their stakes by 2,897,574 and 1,802,726 shares, respectively, suggesting a more bullish outlook from some major players.

Wall Street analysts remain divided in their assessments of C3.ai. Recent reports show two firms issuing buy ratings while two others recommended sell positions. Wedbush issued an “Outperform” rating as recently as December 4, 2025, contrasting with Morgan Stanley‘s “Underweight” rating from September 9, 2025. Analysts have also provided varying price targets for the stock, with a median target of $16.00. Targets range from $10.00 set by Eric Heath of Keybanc to a more optimistic $24.00 from Patrick Walravens of JMP Securities.

As the AI sector continues to attract attention from both investors and analysts, the path ahead for C3.ai will hinge on its ability to deliver consistent financial performance and navigate the competitive landscape marked by rapid technological advancements. Stakeholders will be closely monitoring upcoming earnings reports and industry developments to gauge the company’s resilience in an unpredictable market.

See also AI-Driven Hyper-Personalisation Set to Generate $1 Trillion in Banking Value by 2030

AI-Driven Hyper-Personalisation Set to Generate $1 Trillion in Banking Value by 2030 AI Revolutionizes Social Media: Boost Engagement with Data-Driven Insights and Timing

AI Revolutionizes Social Media: Boost Engagement with Data-Driven Insights and Timing UK Advertisers Face 56% Brand Safety Risk from AI Content Surge, Reports IAS

UK Advertisers Face 56% Brand Safety Risk from AI Content Surge, Reports IAS Generative AI Transforms African Banking with 600% Revenue Growth by 2030

Generative AI Transforms African Banking with 600% Revenue Growth by 2030