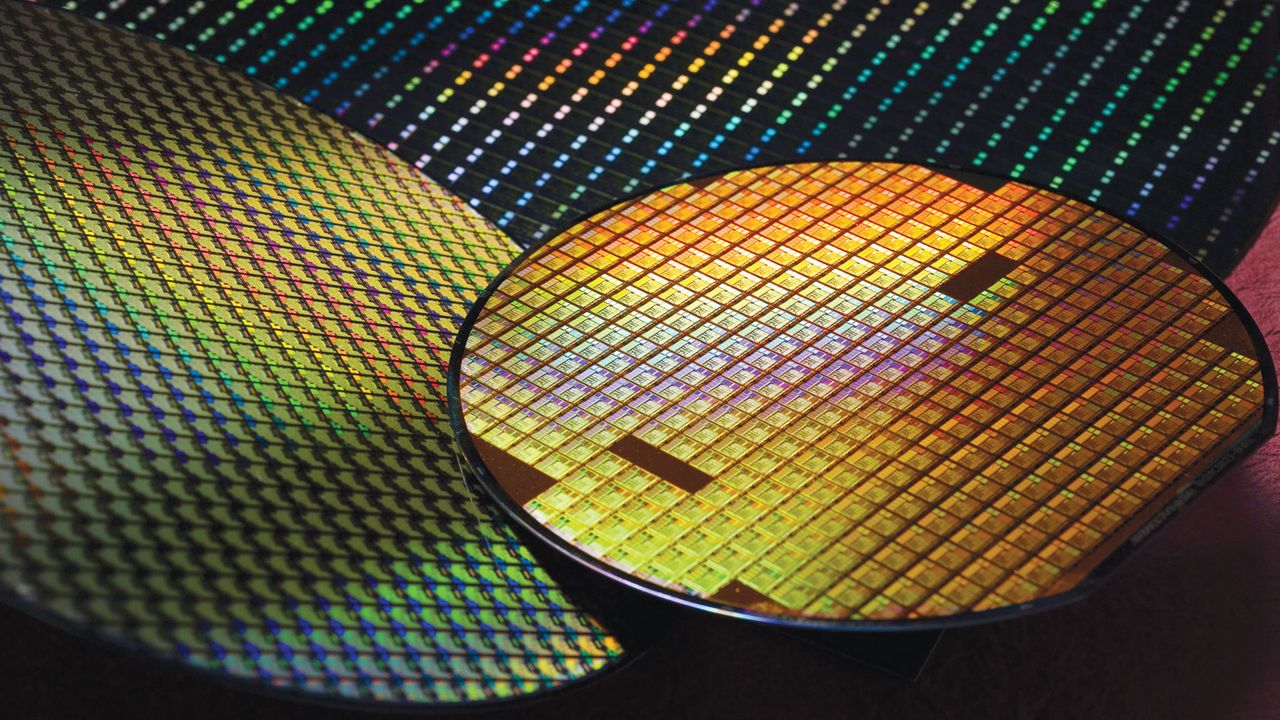

Taiwan is poised to deepen its ties with the United States through a significant trade and investment deal that signals a new wave of chip industry collaboration. The agreement aims to reduce tariffs on Taiwanese exports to the US, while Taiwan commits to investing approximately $250 billion in US technology and energy projects, particularly those related to silicon production for artificial intelligence.

Central to this initiative is TSMC, the world’s leading advanced semiconductor manufacturer and a vital supplier of CPUs, GPUs, and AI accelerators utilized in gaming PCs, workstations, and data centers. The strategic decisions made by TSMC and Taiwan regarding the location of semiconductor fabrication plants (fabs) and capacity allocations will significantly influence pricing, availability, and technological advancements across the hardware landscape.

Although the deal remains politically sensitive and is yet to be finalized, it provides insight into the evolving trajectory of the global chip industry and its implications for gamers and PC enthusiasts over the coming decade.

As per US commerce officials, Taiwan’s investment will not only focus on AI and semiconductor production but also encompass energy projects that support large chip fabs and AI data centers. Around $100 billion of this commitment is related to previously announced TSMC investments in new fabs in the US, which are expected to concentrate on advanced process nodes. These facilities will ultimately manufacture cutting-edge chips within the five-nanometre range and below, essential for high-performance gaming GPUs, next-generation desktop and laptop CPUs, AI accelerators for cloud gaming and machine learning services, and custom silicon for consoles and handheld devices.

Beyond the initial $250 billion, Taiwan is also offering up to another $250 billion in credit guarantees. The intention is to facilitate financing for Taiwanese and US tech companies looking to establish new fabs and related infrastructure. In return, Taiwan hopes to lure more US investment back into its own tech ecosystem, fostering a mutually beneficial relationship.

Vice Premier Cheng Li-chiun of Taiwan framed the initiative as a strategy to build a shared supply chain rather than merely relocating chip production abroad. The message underscores Taiwan’s desire to extend its technology footprint into the US while maintaining its core manufacturing capabilities on the island.

The political pressure surrounding this deal is considerable. US officials, particularly during the Trump administration, have expressed a desire for a greater portion of Taiwan’s semiconductor supply chain to be established within the US. Commerce Secretary Gina Raimondo indicated a target of approximately 40% of that supply chain relocating to the US, alongside the threat of 100% tariffs if major chipmakers like TSMC fail to comply.

This represents a substantial ultimatum from the US perspective. Taiwan’s economy minister has raised questions regarding the feasibility of the 40% target, suggesting a more conservative approach. Taiwan anticipates that by 2036, production will be distributed approximately 80% in favor of Taiwan. This scenario still allows for a meaningful US presence in advanced chip production, including some of the most modern nodes below five nanometres, while ensuring Taiwan retains its status as the primary hub.

The location of semiconductor fabs has critical implications for the PC hardware landscape, affecting supply chain resilience to regional tensions or natural disasters, manufacturers’ capacity to respond to new GPU or CPU launches, pricing pressures arising from tariffs or trade restrictions, and lead times for significant US-based customers such as Nvidia, AMD, and Intel.

While the establishment of more advanced capacity in the US could stabilize supply for Western markets in the long term, it may also introduce higher costs linked to more expensive construction and labor. Such costs could eventually impact GPU and CPU prices unless offset by subsidies or improvements in productivity.

Despite the optimistic outlook surrounding the deal, numerous uncertainties remain. Taiwan’s government must still ratify the agreement, and the opposition, which holds a significant number of seats, has voiced concerns about the potential erosion of Taiwan’s vital chip industry if too much production and expertise is transferred abroad. In response, Taiwan has asserted that its most advanced chip nodes will remain on the island for the foreseeable future, positioning US fabs as an expansion strategy rather than a relocation of its semiconductor expertise.

The geopolitical climate, particularly with regard to China, adds another layer of complexity. Beijing continues to assert its claim over Taiwan and has criticized the island’s deepening semiconductor relationship with the US, warning against allowing the US excess control over Taiwan’s key industry. Additionally, the ongoing turbulence in US-China trade relations, featuring 100% tariffs on Chinese goods as potential bargaining tools, complicates long-term planning for tech companies aiming to invest tens of billions of dollars in new fabs.

For gamers and PC users, the key takeaway is that the global chip supply chain is undergoing a significant transformation fueled by political agreements, tariffs, and security concerns. Taiwan’s ambition to act as a long-term AI and semiconductor partner to the US is crucial to this evolving narrative. This development could lead to an increase in advanced fabs on US soil, a slightly less concentrated manufacturing base in Taiwan, and an ongoing geopolitical tug-of-war involving China. Over the next decade, these dynamics will shape the pace of new GPU and CPU releases, their pricing, and the stability of supply during product launches.

See also Alphabet Commits $93 Billion to Quantum Computing, Targets Industry Leadership

Alphabet Commits $93 Billion to Quantum Computing, Targets Industry Leadership Andrej Karpathy Challenges Nvidia’s Huang on AI’s Role in Coding and Productivity Gains

Andrej Karpathy Challenges Nvidia’s Huang on AI’s Role in Coding and Productivity Gains Anthropic Reveals AI’s Dependency on Human Input Quality in New Economic Index Report

Anthropic Reveals AI’s Dependency on Human Input Quality in New Economic Index Report Nvidia Allows H200 Chip Exports to China, Unlocking $54 Billion AI Market Potential

Nvidia Allows H200 Chip Exports to China, Unlocking $54 Billion AI Market Potential Tesla Revives Dojo AI Chip Project, Targets $16.5B Chip Market with AI5 Development

Tesla Revives Dojo AI Chip Project, Targets $16.5B Chip Market with AI5 Development