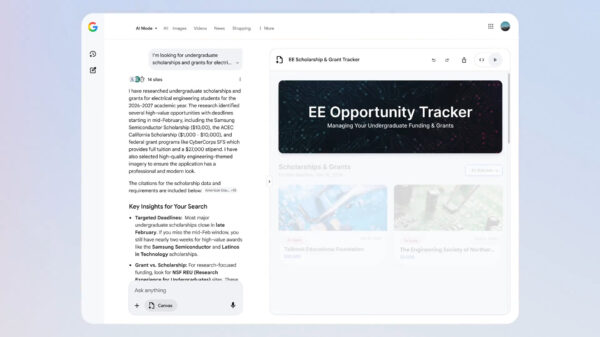

Artificial intelligence (AI) has emerged as a pivotal force in global economic growth, particularly in the United States, where investments in technology hardware and software are projected to reach up to $1 trillion by 2025. This investment is anticipated to contribute nearly one-third of the GDP growth over that period, bolstering overall productivity and economic resilience amidst fluctuating traditional demand.

Since the launch of ChatGPT in late 2022, AI has significantly influenced stock market trajectories. The so-called “Mag7” stocks in the U.S. market accounted for approximately 45 percentage points (ppt) of the S&P 500’s impressive 84% return, illustrating AI’s substantial impact on investor sentiment and market performance. In Hong Kong, a similar trend was observed after the rollout of DeepSeek in early 2025, where seven leading tech stocks contributed 14 ppt to the Hang Seng Index’s 37% return.

As major players, both the United States and China are developing their AI capabilities, with key markets in South Korea, Japan, and Taiwan also forming crucial links in the global AI ecosystem. Despite the enthusiasm surrounding AI, concerns about a potential market bubble echo historical precedents like the dot-com bubble of the late 1990s. The current phase of AI investment may not be entirely negative, as it could serve as a catalyst for fostering technological progress.

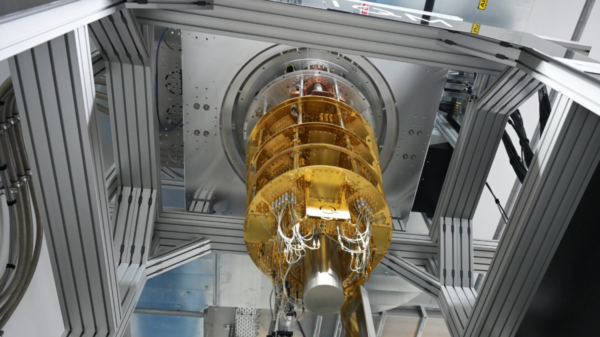

The differences in funding sources and investment focuses between the U.S. and China are striking. While both countries allocate around 87-88% of their investments to foundational layers of AI infrastructure, including hardware and computing power, the U.S. faces challenges with energy supply, making it “power-constrained.” In contrast, China is navigating a “chip shortage,” reflecting the distinct challenges each country faces as they advance in the AI race. Each country’s investment strategies reflect respective aims; for instance, the U.S. prioritizes data centers and energy infrastructure, while China’s investments are increasingly directed towards chip development and model innovation.

In the realm of cloud computing, the U.S. currently dominates the market, accounting for 54.3% of the global cloud computing market, valued at $692.9 billion in 2024. However, China’s share is projected to grow, reaching 18.3% in 2025. The rapid development of AI in China has been facilitated by significant policy support and a burgeoning domestic market, creating a dynamic landscape where the U.S. continues to leverage its first-mover advantage.

Data from the Semiconductor Industry Association (SIA) indicates that the U.S. semiconductor market reached $318 billion in 2024, commanding over half of global sales. Although China’s share remains relatively modest at 4.5%, it is witnessing rapid growth. In 2024, Chinese AI chip shipments surged by 310%, reflecting the country’s determination to establish a more autonomous supply chain for critical technologies.

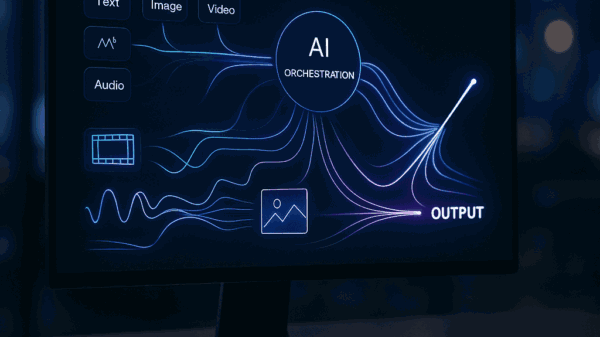

Despite the U.S. leading in the total number of AI models, China has made significant strides in open-source models. As of 2025, Chinese large models such as Zhipu GLM and DeepSeek have gained traction in the global market, illustrating China’s capability to innovate rapidly and assert its influence in the AI domain.

The talent pool available for AI research is increasingly tilting in favor of China, which saw the number of AI researchers grow from fewer than 10,000 in 2015 to 52,000 by 2024. This growth has resulted in China filing three times more AI patents than the U.S. by 2022. This expanding workforce is paramount to sustaining the momentum of AI innovations across various sectors.

As investment intensifies, the macroeconomic implications of AI in both countries are becoming more profound. In the U.S., the information technology sector contributed 0.6 ppt to overall GDP growth in the first half of 2025, while China’s IT industry contributed 0.55 ppt to its GDP growth over the same period. The contrasting investment patterns—predominantly private in the U.S. versus a blend of government and private in China—further illustrate the divergent paths both nations are taking in the AI landscape.

In this rapidly evolving environment, the interplay of investments, societal demand, and policy formulation will be critical in shaping the future of AI technology in both countries. The collaboration potential between the U.S. and China could foster innovative synergies, particularly at the foundational level, while diverging paths in chip autonomy and application technologies may dictate future developments in the sector. With substantial implications for global markets, the future of AI remains a crucial area for attention.

For further details, visit NVIDIA, OpenAI, and Microsoft.

See also Yale’s MOSAIC AI Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds

Yale’s MOSAIC AI Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds Grok Faces Global Backlash Over Deepfake Nudes Amid Australia’s Regulatory Challenges

Grok Faces Global Backlash Over Deepfake Nudes Amid Australia’s Regulatory Challenges World Economic Forum 2026 Opens Amid Geopolitical Tensions and AI Innovations

World Economic Forum 2026 Opens Amid Geopolitical Tensions and AI Innovations Hassabis Reveals Trillion-Dollar Opportunity in Physical AI; 51WORLD Leads Breakthroughs

Hassabis Reveals Trillion-Dollar Opportunity in Physical AI; 51WORLD Leads Breakthroughs OpenAI Achieves $20B Revenue as Computing Capacity Triples to 1.9 Gigawatts

OpenAI Achieves $20B Revenue as Computing Capacity Triples to 1.9 Gigawatts