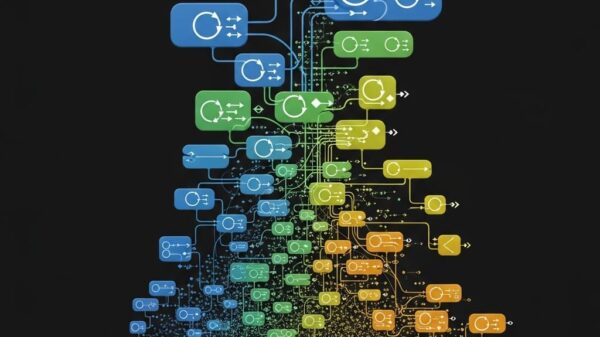

The latest index from Information Services Group (ISG) reveals that the technology services and software market is increasingly influenced by robust cloud adoption and shifting investments driven by artificial intelligence (AI). While overall growth remains strong, the data indicates a more selective and strategic buying environment as enterprises prepare for 2026.

Cloud and as-a-Service (XaaS) Offerings Propel Growth

Cloud and XaaS solutions have emerged as the primary engines of growth, with the combined market surpassing $34 billion in annual contract value for the first time. This surge is largely attributed to a record quarter for XaaS, which experienced a remarkable 26% year-over-year growth in Q425, and an impressive 29% for the full year. Among these offerings, Infrastructure-as-a-Service (IaaS) particularly stood out, posting a 33% annual growth rate driven by heightened demand from hyperscalers and AI-related workloads. While Software-as-a-Service (SaaS) maintained a healthy growth rate of 16%, ISG warns of potential deceleration as competition intensifies and AI redefines pricing and delivery models.

In stark contrast, growth in managed services showed notable regional disparities. The Americas experienced approximately 10% overall growth in 2025, whereas Europe remained relatively flat, and Asia Pacific faced a decline exceeding 25%. This uneven performance highlights the necessity for region-specific strategies from both service providers and enterprise buyers. ISG also reported that although deal durations and total contract values are increasing, market activity is becoming concentrated around fewer, larger strategic deals.

AI continues to dominate enterprise investment priorities, with ISG revealing that 77% of companies intend to boost AI spending in 2026. Most of these budgets are being directed towards new initiatives rather than minor pilot projects. Significantly, many AI pilots are transitioning into full production, reinforcing expectations for measurable returns on investment. However, ISG cautions that the pace of changing buyer behavior is outstripping the ability of providers to adapt their pricing and delivery models, creating a tension that is likely to influence market dynamics in the upcoming year.

Looking ahead, ISG suggests a modest acceleration in IT budgets for 2026, with spending increasingly focused on AI adoption, cloud migration, and cybersecurity, rather than broad cost-cutting measures. Enterprises are prioritizing high-impact outcomes, indicating ongoing opportunities for service providers that can connect AI innovations to tangible business value.

For organizations reassessing or renegotiating outsourcing agreements, ISG’s findings recommend a more selective and outcome-oriented approach. The slowdown in managed services growth and the concentration of deals suggest that buyers are favoring fewer, more strategic partnerships, often with larger providers capable of facilitating AI-enabled transformations at scale. Concurrently, enterprises are turning to niche specialists to gain targeted skills in areas such as AI, cloud optimization, and industry-specific solutions.

Clients should anticipate ongoing flexibility in deal structures, emphasizing shorter commitments, modular scopes, and performance-based outcomes rather than traditional long-term, labor-centric contracts. As AI continues to reshape delivery models and pricing expectations, outsourcing strategies that balance scale, specialization, and adaptability are likely to be best positioned for delivering sustained value through 2026.

See also Google.org Unveils $20M AI Fund to Propel 12 Breakthroughs in Health and Agriculture

Google.org Unveils $20M AI Fund to Propel 12 Breakthroughs in Health and Agriculture Meta Cuts Teen Access to AI Characters Amid Growing Safety Concerns and Redesign Efforts

Meta Cuts Teen Access to AI Characters Amid Growing Safety Concerns and Redesign Efforts Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032