The recent ratification of the High Seas Treaty is set to reshape marine conservation efforts, addressing overfishing, plastic pollution, and global heating—issues that threaten the long-term health of the oceans and, by extension, future food security. The treaty, which aims to regulate the exploitation of marine resources, will come into force in January 2026, impacting companies across various sectors, according to EOS’s Q3 2025 Public Engagement Report.

In their report, EOS engagers Ming Yang, Xinyu Pei, and Shoa Hirosato outline significant challenges and opportunities related to ocean health, particularly for sectors such as retail and consumer goods, oil and gas, transportation, chemicals, and financial services. The report addresses critical themes including food security, plastic pollution, deep-sea mining, alternative shipping fuels, and renewable energy initiatives like offshore wind. “Better management of the risks and opportunities that these companies are exposed to through their value chains will support business resilience and long-term value for investors,” the report states.

The High Seas Treaty also signals a notable shift in global expectations regarding marine conservation, with commitments from 60 countries to protect 30% of marine and coastal areas by 2030. For investors, this translates to heightened scrutiny of ocean-linked value chains and a pressing need for companies to showcase responsible practices. The engagement efforts from EOS highlight that addressing ocean acidification, waste management, and biodiversity loss can significantly bolster long-term resilience for businesses.

Moreover, EOS is actively engaging with companies to navigate the emerging risks posed by deep-sea mining, which threatens fragile ecosystems and could trigger a reputational backlash. Firms in shipping and logistics are being urged to investigate alternative fuels and cleaner technologies, while those in the financial sector must evaluate their exposure to ocean-related risks within their lending and investment portfolios.

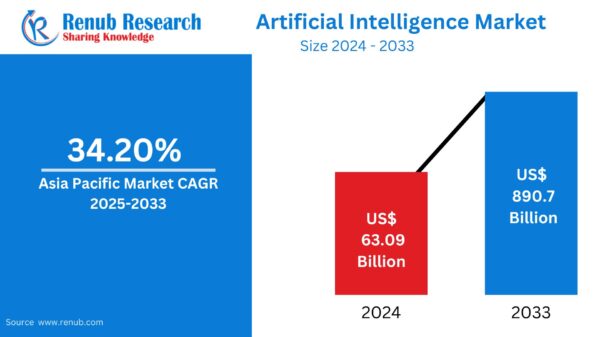

As the demand for data centers continues to surge, the strain on electricity providers and energy grids has become more pronounced. EOS engagers Velika Talyarkhan and Michael Yamoah highlight these challenges, detailing how EOS collaborates with companies in the utilities, technology, and oil and gas infrastructure sectors to mitigate these issues. The facilities required for AI data processing consume vast amounts of electricity and water, raising concerns about grid stability, carbon emissions, and local environmental impacts.

EOS emphasizes the necessity for companies to enhance transparency regarding energy consumption and to invest in low-carbon infrastructure. The report cautions that, without proactive planning, the growth of AI could undermine climate goals and strain public resources. Engagements are focused on urging firms to align data center development with national decarbonization strategies and to disclose climate-related risks in accordance with the TCFD recommendations.

Additionally, Shoa Hirosato observes key trends from this year’s voting season across developed Asia and emerging markets. In China, climate disclosure is gaining traction, with an increasing number of companies publishing emissions data and setting targets. South Korea’s Value-Up programme is pushing for enhanced shareholder returns and governance reforms. Across the region, board independence remains a central topic, with EOS advocating for diverse and accountable leadership.

As corporate stewardship becomes increasingly strategic, the insights provided by EOS serve as a valuable lens into how companies are responding to systemic risks and how investors can drive meaningful change. The report underscores the significance of proactive engagement in shaping corporate behavior and fostering long-term value, particularly as the landscape of marine conservation evolves.

For professional investors only. Capital at risk.

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested.

The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

Issued and approved by Hermes Investment Management Limited (“HIML”), as distributor, which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.

See also GPT-5.1 Tops LLM Council Rankings, Surpassing Gemini 3.0 and Claude in New Experiment

GPT-5.1 Tops LLM Council Rankings, Surpassing Gemini 3.0 and Claude in New Experiment Trump Approves 35,000 Nvidia Chips to Gulf States, Weighs H200 Exports to China

Trump Approves 35,000 Nvidia Chips to Gulf States, Weighs H200 Exports to China Google Accelerates AI Transformation with Gemini 3 Amidst Rising Competitive Pressure

Google Accelerates AI Transformation with Gemini 3 Amidst Rising Competitive Pressure AI Chips Drive Laptop Market Recovery Amid Rising Prices and Supply Chain Challenges

AI Chips Drive Laptop Market Recovery Amid Rising Prices and Supply Chain Challenges VAST Data and Microsoft Launch AI OS on Azure for High-Performance Cloud Infrastructure

VAST Data and Microsoft Launch AI OS on Azure for High-Performance Cloud Infrastructure