The artificial intelligence (AI) arms race is poised to intensify as investments in the sector continue to flourish, with data from various hyperscale companies signaling robust spending initiatives through at least 2026. This growing trend suggests that several key players in the AI space, particularly in data centers, offer promising opportunities for investors looking to capitalize on this burgeoning field.

Among the leading candidates for investment are Nvidia, AMD, and Broadcom. Each of these companies has distinct strengths and strategies that position them for significant growth as AI spending escalates. Time is of the essence for investors, as market conditions may soon reflect a premium on these stocks, making early investment all the more advantageous.

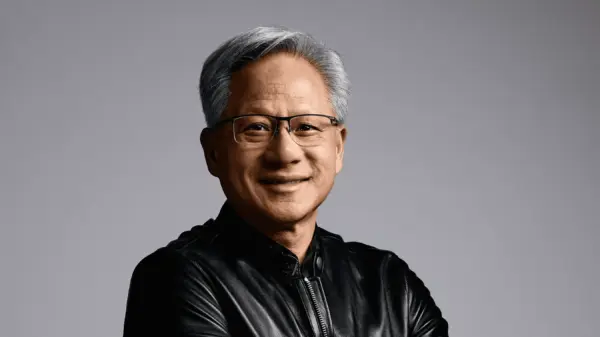

Nvidia (NVDA 0.29%) has consistently topped investment lists since 2023, primarily due to its pivotal role in AI computing. The company’s graphics processing units (GPUs) are integral for training and deploying AI models, and its ascent to become the world’s most valuable company by market capitalization correlates directly with the rise of generative AI technologies. In fiscal year 2027, analysts project a remarkable 50% revenue growth, underscoring the sustained momentum in AI spending.

Despite Nvidia’s success, its current trading valuation of approximately 40 times forward earnings is slightly lower than last year’s peak of 50 times. While still considered expensive, the growth potential justifies this premium. Nvidia’s continuous innovation and strategic positioning make it a compelling choice for growth investors seeking exposure in the AI sector.

Turning to AMD (AMD +1.79%), the company has not experienced the same level of success as Nvidia but is making strides to close the gap. Historically, AMD’s ROCm software has been viewed as inferior to Nvidia’s CUDA. However, AMD reported a tenfold increase in ROCm downloads year-over-year by November 2025, signaling growing interest from AI companies in exploring AMD’s offerings. Management expects a 60% compound annual growth rate (CAGR) in its data center business through 2030, indicating a significant turnaround that could position AMD favorably in the competitive landscape.

Broadcom (AVGO +2.63%), meanwhile, is approaching the AI domain from a different angle than its rivals. Rather than focusing solely on GPUs, Broadcom is partnering with hyperscale AI providers to develop custom AI chips, known as application-specific integrated circuits (ASICs). These devices are optimized for specific workloads, providing better performance at reduced costs compared to traditional GPUs. This strategy positions Broadcom as a vital player in an area that promises substantial growth, with AI semiconductor revenue reportedly increasing 74% year-over-year to $6.5 billion in the fourth quarter of fiscal 2025.

Broadcom’s ventures into custom chip design have already begun to pay dividends, as the company anticipates its AI semiconductor revenue to double year-over-year to $8.2 billion in the coming quarter. This trajectory suggests that Broadcom is well-prepared to carve out a significant niche in the evolving AI landscape.

In summary, the AI landscape continues to evolve rapidly, with Nvidia, AMD, and Broadcom emerging as critical players in this sector. As these companies adapt to the growing demands for AI capabilities, they are likely to outperform broader market expectations in the coming years. For investors keen on capitalizing on the ongoing AI spending spree, these three stocks represent solid opportunities worth considering.

As the market continues to respond to the increasing reliance on AI technologies, stakeholders should remain vigilant in monitoring these companies for potential growth and investment opportunities. The AI revolution is only just beginning, and its implications for technology and finance will resonate for years to come.

For more information on these companies, visit their respective websites: Nvidia, AMD, and Broadcom.

See also AustralianSuper Seizes AI Investment Opportunities Amid Geopolitical Tensions and Risks

AustralianSuper Seizes AI Investment Opportunities Amid Geopolitical Tensions and Risks AI to Displace 50% of Entry-Level Jobs by 2026, Warns Top Experts Amidst Economic Shifts

AI to Displace 50% of Entry-Level Jobs by 2026, Warns Top Experts Amidst Economic Shifts IAIS Reports Stable Insurance Sector Amid Rising AI, Geopolitical Risks and Private Credit Concerns

IAIS Reports Stable Insurance Sector Amid Rising AI, Geopolitical Risks and Private Credit Concerns 1min.AI Launches Advanced Business Plan for $74.97, Compare Top AI Models Instantly

1min.AI Launches Advanced Business Plan for $74.97, Compare Top AI Models Instantly