Investors looking to diversify their portfolios have a range of options through exchange-traded funds (ETFs) that feature exposure to companies partnered with Hugging Face, a prominent player in the artificial intelligence sector. Several top technology ETFs provide a pathway for investors to indirectly benefit from Hugging Face’s innovations and collaborations.

The Vanguard Information Technology ETF (VGT), for instance, focuses on stocks within the electronics and computer industries. It has recently recorded a gain of 0.95% and boasts a low expense ratio of 0.09%, translating to $9 in annual fees for every $1,000 invested. This fund allows investors to tap into a broad spectrum of tech companies while keeping costs manageable.

Another strong contender is the Invesco QQQ Trust (QQQ), which tracks the Nasdaq-100 index. This index includes the 100 largest non-financial companies listed on the Nasdaq stock market and has shown an increase of 1.00%. It charges a slightly higher expense ratio of 0.20%, making it an appealing choice for those seeking exposure to high-growth stocks in technology and beyond.

Similarly, the Technology Select Sector SPDR Fund (XLK) aims to replicate the performance of the technology sector within the S&P 500 index. XLK has recently climbed by 1.32% and offers an expense ratio of just 0.08%. This ETF provides a focused approach to investing in technology, capturing significant players in the sector.

Lastly, the Fidelity MSCI Information Technology Index ETF (FTEC) represents the performance of the U.S. information technology sector, recently gaining 1.02%. It features a competitive expense ratio of 0.084%, making it an attractive option for investors looking to gain exposure to a well-rounded portfolio of tech stocks.

As interest in artificial intelligence continues to surge, the landscape for investment in tech ETFs remains vibrant. Companies like Hugging Face are at the forefront of this evolution, driving advancements in machine learning and natural language processing. The growth and partnerships formed by Hugging Face not only bolster its own standing but also enhance the portfolios of investors who choose to align with ETFs that feature its business associates.

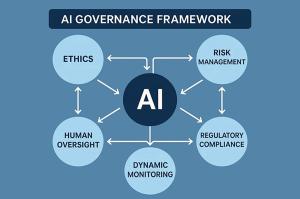

With the ongoing evolution of technology and increasing integration of AI across various sectors, these ETFs may serve as critical tools for investors aiming to capitalize on the growth potential of the tech industry. As market dynamics shift, maintaining a diversified portfolio through these investment vehicles could provide a strategic advantage for both short-term gains and long-term growth.

See also Gloo’s Flourishing AI Initiative Reveals Bias in AI Models Against Christian Worldview

Gloo’s Flourishing AI Initiative Reveals Bias in AI Models Against Christian Worldview Top 10 AI Stocks for 2026: Nvidia, Amazon, and Emerging Players Poised for Major Gains

Top 10 AI Stocks for 2026: Nvidia, Amazon, and Emerging Players Poised for Major Gains Revvity Soars 6.4% as Lilly Integrates TuneLab AI into Signals Platform, Boosting Drug Discovery Potential

Revvity Soars 6.4% as Lilly Integrates TuneLab AI into Signals Platform, Boosting Drug Discovery Potential Adobe Partners with Runway to Integrate Gen-4.5 AI Video in Firefly, Enhancing Creative Tools

Adobe Partners with Runway to Integrate Gen-4.5 AI Video in Firefly, Enhancing Creative Tools