Maas Group, an industrial conglomerate, has made headlines by agreeing to a billion-dollar sale of its core construction materials business without the assistance of financial advisers. This significant maneuver is part of a strategic shift towards artificial intelligence infrastructure, a move that has not been well received by the market. Following the announcement, shares of Maas Group plummeted nearly 25% on Thursday, dropping its market valuation to below $1.7 billion—a figure that now sits beneath the potential proceeds from the sale of its construction business to Heidelberg, a German-based company.

In addition to the divestiture, Maas Group also revealed a $100 million investment into Firmus Group, an ASX-listed data centre company. The responses from investors have been harsh, yet one of Maas’ largest stakeholders, Wilson Asset Management, expressed support for the transactions. Lead portfolio manager Oscar Oberg, whose funds maintain shares in both Maas and Firmus, remarked to Capital Brief that the market’s reaction was surprising, given that the price Maas achieved for its construction materials business is “excellent and well above peers that have transacted recently.”

The decision to sell its construction division marks a notable pivot for Maas Group, which previously enjoyed a reputation as a darling among smaller ASX companies. The company’s strategic shift comes at a time when many industries are vying to incorporate AI solutions into their operations, particularly in the construction sector, which has been slower to adapt than other fields. The investment in Firmus Group further underscores Maas’s commitment to becoming a player in the evolving AI infrastructure landscape.

Despite the immediate backlash from the market, there are signs that investors may see long-term value in these decisions. The construction materials sector has faced various headwinds, including supply chain disruptions and rising costs. By divesting from this segment, Maas Group can reallocate its resources and focus on more innovative and potentially lucrative ventures, such as AI-driven data centers.

Moreover, with the exponential growth of data generation and the increasing demand for data processing capabilities, investments in the data center space appear to be a timely move. The convergence of AI and data infrastructure is a critical area for future growth, and Maas Group’s investment in Firmus could position it favorably in a competitive market.

As the landscape of technology and infrastructure continues to evolve, Maas Group’s shift towards AI infrastructure may represent a broader trend among traditional industries seeking to innovate. The reactions from investors and analysts will likely continue to unfold as the company executes its strategic vision. While the initial market response was negative, the long-term implications of this pivot may reveal a different narrative for Maas Group, especially if its investments in AI and data infrastructure yield positive results.

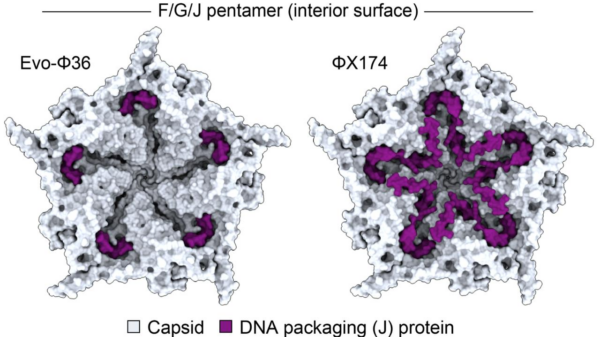

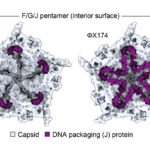

See also AI-Designed Virus Breakthrough: Evo-Φ2147 Targets E. coli, Sparks Biosecurity Debate

AI-Designed Virus Breakthrough: Evo-Φ2147 Targets E. coli, Sparks Biosecurity Debate Meta Tests Standalone Vibes App for AI-Generated Videos in Brazil and Mexico

Meta Tests Standalone Vibes App for AI-Generated Videos in Brazil and Mexico Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032