Microsoft’s substantial investment in artificial intelligence is igniting fresh concerns on Wall Street following the company’s report of record capital spending amid slower-than-expected growth in its cloud services, resulting in a significant drop in its share price during after-hours trading.

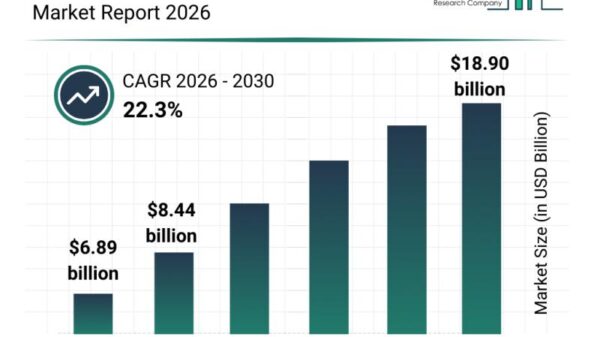

The tech giant disclosed an unprecedented $37.5 billion in capital expenditures for the October–December quarter, primarily attributed to investments in AI infrastructure and computing chips. Since the commencement of its 2024 fiscal year, Microsoft’s total spending related to AI has eclipsed $200 billion, underscoring its aggressive strategy to dominate the global AI landscape, as reported by News.Az, citing Reuters.

Despite the massive investment, Microsoft’s Azure cloud business recorded a growth rate of 39% for the quarter, only marginally surpassing market expectations. Investors were anticipating stronger returns from Microsoft’s collaboration with OpenAI and its preliminary advantage in AI-driven cloud services. However, the sluggish momentum in the cloud sector has raised questions about the pace at which AI investments may convert into enhanced profitability.

Following the earnings announcement, Microsoft shares plummeted by more than 6% in after-hours trading, reflecting growing investor apprehension regarding escalating costs and mounting competition. New AI models from competitors like Google’s Gemini and Anthropic’s Claude are gaining traction, intensifying pressure on Microsoft’s position in enterprise AI solutions.

CEO Satya Nadella aimed to reassure analysts by highlighting that AI adoption remains in its nascent stages. He revealed that Microsoft’s M365 Copilot AI assistant has reached 15 million annual users, marking the company’s first disclosure of core usage data for its flagship AI business tool.

Looking ahead, Microsoft projected Azure revenue growth of 37–38% for the current quarter, a figure that aligns closely with market expectations. Nonetheless, the company cautioned that rising prices for memory chips could exert pressure on cloud margins in the months to come.

As major technology firms collectively plan to invest over $500 billion in AI this year, investors are increasingly focused on whether Microsoft’s record-breaking AI expenditures will yield sustainable long-term returns. The outcome of these investments could determine Microsoft’s future trajectory in a highly competitive AI landscape.

See also NVIDIA, Microsoft, Amazon Eye $60B Investment in OpenAI to Fuel AI Revolution

NVIDIA, Microsoft, Amazon Eye $60B Investment in OpenAI to Fuel AI Revolution Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032