NVIDIA (NASDAQ:NVDA) has unveiled the NVIDIA Inference Context Memory Storage Platform, which utilizes the BlueField-4 data processor. This AI-native storage platform targets long-context, agentic AI workloads and was announced on January 5, 2026, during the CES event in Las Vegas. Designed to enhance the capabilities of GPU memory, this platform promises a significant boost in processing efficiency, claiming to improve tokens-per-second performance and power efficiency by up to 5x compared to traditional storage solutions.

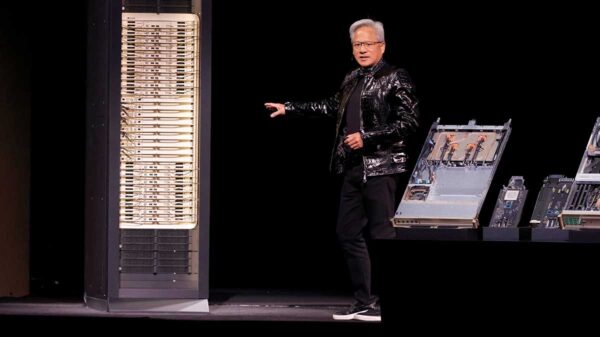

The NVIDIA Inference Context Memory Storage Platform extends GPU memory through a cluster-level key-value (KV) cache, enabling high-bandwidth data sharing across rack-scale systems. This infrastructure is essential for managing the vast amounts of context data generated by modern AI models, which often scale into trillions of parameters. As noted by Jensen Huang, NVIDIA’s founder and CEO, the platform is part of a broader transformation in the computing stack driven by AI, moving beyond simple chatbot functionality to enabling intelligent systems capable of long-term reasoning and memory retention.

Key components of the platform include advanced hardware acceleration via BlueField-4, the NVIDIA DOCA framework, the NIXL library, and the Dynamo software, all integrated with Spectrum-X Ethernet for high-performance networking. As such, the platform is designed to maximize the efficiency of KV cache access, ensuring rapid data retrieval and enhanced multi-turn responsiveness for AI applications.

NVIDIA’s strategy emphasizes collaboration with major storage vendors, including AIC, Cloudian, Dell Technologies, and IBM, who are developing systems based on the BlueField-4 processor. These systems are set to launch in the second half of 2026, marking a significant step in the evolution of AI storage infrastructure. The anticipated improvements in throughput and power efficiency could drive further adoption across various sectors relying on advanced AI technologies.

On the stock market, NVIDIA’s shares closed at $188.12, with trading volume exceeding the 20-day average by approximately 10%. This heightened interest is indicative of investor enthusiasm surrounding the company’s latest announcements, particularly the new AI-native storage platform. Interestingly, while NVIDIA’s stock has experienced a modest gain of 1.26%, its key peers, including AVGO, TSM, and AMD, have seen declines, suggesting that the market reaction is largely specific to NVIDIA’s developments rather than a general movement in the semiconductor sector.

The introduction of the NVIDIA Inference Context Memory Storage Platform aligns with a series of strategic initiatives the company has undertaken in recent months. Following the announcement of record Q3 FY26 revenues of $57.0 billion on November 17, 2025, which included substantial contributions from data center operations, NVIDIA has focused on expanding its AI infrastructure. This includes the NVQLink technology designed to integrate quantum processors with NVIDIA GPUs, highlighting a commitment to building a comprehensive AI computing ecosystem.

As NVIDIA prepares for the launch of its BlueField-4-powered storage solutions, the market will be closely watching the adoption rates among storage partners and the overall execution timeline. This new platform not only enhances the capability of AI agents to process and retain context but also sets the stage for future advancements in AI applications across various industries. The implications of this technology extend beyond mere storage, potentially revolutionizing how intelligent systems interact with their environments and manage data on a large scale.

Overall, NVIDIA’s latest announcements underscore the rapid evolution of AI technologies and their integration into every facet of computing. As these innovations materialize, the landscape of AI and data processing is poised for significant transformation, signifying a new era for both developers and end-users.

For further details on NVIDIA’s initiatives and products, visit the official website at nvidia.com.

See also Boston Dynamics Unveils Production-Ready Atlas Robot at CES 2026: 56 Degrees of Freedom, 110-Pound Lift Capacity

Boston Dynamics Unveils Production-Ready Atlas Robot at CES 2026: 56 Degrees of Freedom, 110-Pound Lift Capacity Microsoft Reports $77.7B Q1 Revenue Amid Rising AI Scrutiny and Market Debate

Microsoft Reports $77.7B Q1 Revenue Amid Rising AI Scrutiny and Market Debate Finpace Unveils AI-Driven Workflow Automation, Transforming Financial Advisory Efficiency

Finpace Unveils AI-Driven Workflow Automation, Transforming Financial Advisory Efficiency Invest Smart: Invest in AI Infrastructure Firms, Avoid NVIDIA’s Bubble Risk

Invest Smart: Invest in AI Infrastructure Firms, Avoid NVIDIA’s Bubble Risk Google DeepMind and Boston Dynamics Collaborate to Enhance Atlas Humanoid Robot with AI

Google DeepMind and Boston Dynamics Collaborate to Enhance Atlas Humanoid Robot with AI