NEW YORK, Nov 28 (Reuters) – Investors are poised to focus on profitability signals from artificial intelligence companies and the overall health of the U.S. economy as they seek to stabilize the equity market in the coming week. Following the most significant pullback since April, stocks experienced a rebound, bolstered by increasing optimism surrounding a potential interest rate cut by the U.S. Federal Reserve in December. However, volatility persisted among major stocks, particularly as recent developments in AI influenced trading in companies like Nvidia (NVDA.O) and Alphabet (GOOGL.O).

The S&P 500 is up about 16% in 2025, entering a historically strong year-end period, with December averaging a 1.43% gain since 1950, according to the Stock Trader’s Almanac. Yet, concerns about overheated valuations have tempered some market enthusiasm. “The narrative surrounding the profitability of AI is coming under question,” noted Matthew Maley, chief market strategist at Miller Tabak. He added, “If that becomes a bigger issue as we move through December, that’s going to be a big problem for the market.”

As investors scrutinize risk appetite, the recent decline in bitcoin, which fell below $90,000 from over $125,000 in early October, has drawn attention. “Bitcoin serves as a risk proxy for equities, so we’ll be monitoring it closely,” said King Lip, chief strategist at BakerAvenue Wealth Management. The S&P 500 was 1% off its late-October all-time high, while the Nasdaq Composite (.IXIC) was down 3% from its late-October peak. Technology stocks, in particular, have weighed on indexes amid uncertainty over the timing of returns on significant investments in AI infrastructure.

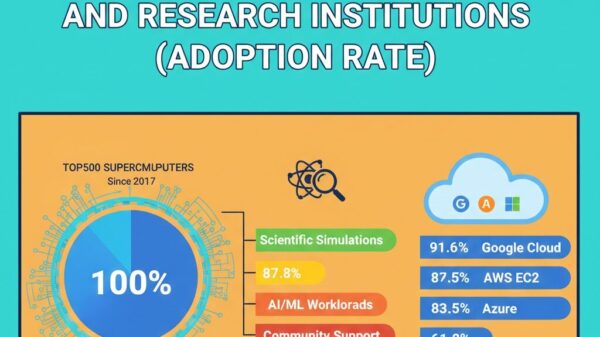

“Investors are starting to rethink how quickly some of this … is going to have an impact on bottom lines,” commented Paul Nolte, senior wealth adviser and market strategist at Murphy & Sylvest Wealth Management. Alphabet has recently attracted investor focus, with shares soaring in value, pushing its market capitalization to around $4 trillion. The company has garnered positive reviews for its new Gemini 3 AI model, although a report suggesting Meta Platforms (META.O) was in discussions to invest billions in Google’s chips unsettled shares of semiconductor leader Nvidia.

ECONOMIC INDICATORS IN THE SPOTLIGHT

Upcoming economic releases will cover manufacturing and services activity, alongside consumer sentiment indicators. Earnings reports from cloud software provider Salesforce (CRM.N) and retailers such as Kroger (KR.N) and Dollar Tree (DLTR.O) are also anticipated as the robust third-quarter reporting season winds down. Investors will be keen to glean insights about the economic backdrop from these results, especially in light of early indications regarding holiday consumer spending following the Black Friday and Cyber Monday sales.

Many economic reports have been delayed or canceled due to the recent 43-day U.S. government shutdown, which concluded this month. It may take until January for investors to obtain a clearer picture of the economy, according to Anthony Saglimbene, chief market strategist at Ameriprise Financial. “Investors are going to have to deal with this fog … through year-end,” he remarked.

Despite the uncertain economic horizon, traders have ramped up bets that the Federal Reserve will implement a rate cut at its December 9-10 meeting, following remarks from several central bank officials signaling a readiness to ease monetary policy. Late Wednesday, Fed funds futures indicated over 80% odds for a quarter-point cut, a significant increase from the previous week’s near 50% probability.

The anticipation of further monetary easing could benefit broader segments of the market beyond the tech and AI stocks that have dominated this year. “What I’m watching is through year-end if we do see the Fed cut rates, can we see more positive momentum in other areas outside of technology?” Saglimbene stated. As investors navigate these developments, the interplay between economic indicators and AI market dynamics will remain critical to shaping market sentiment.

Reporting by Lewis Krauskopf; Editing by Alden Bentley and Rod Nickel

See also OpenAI Limits Sora to 6 Free Videos Daily; Google Caps Nano Banana Pro to 2 Images

OpenAI Limits Sora to 6 Free Videos Daily; Google Caps Nano Banana Pro to 2 Images Trump’s Draft EO Aims to Override State AI Laws, Centralizing Federal Control Over AI Regulation

Trump’s Draft EO Aims to Override State AI Laws, Centralizing Federal Control Over AI Regulation Google Deletes Infographic After Plagiarism Allegations from Food Blogger; Faces Backlash Over AI Practices

Google Deletes Infographic After Plagiarism Allegations from Food Blogger; Faces Backlash Over AI Practices Accenture Partners with OpenAI to Upskill 50,000 Professionals with ChatGPT Enterprise

Accenture Partners with OpenAI to Upskill 50,000 Professionals with ChatGPT Enterprise AI Pioneer Fei-Fei Li’s World Labs Achieves $1B Valuation, Pioneering Spatial Intelligence

AI Pioneer Fei-Fei Li’s World Labs Achieves $1B Valuation, Pioneering Spatial Intelligence