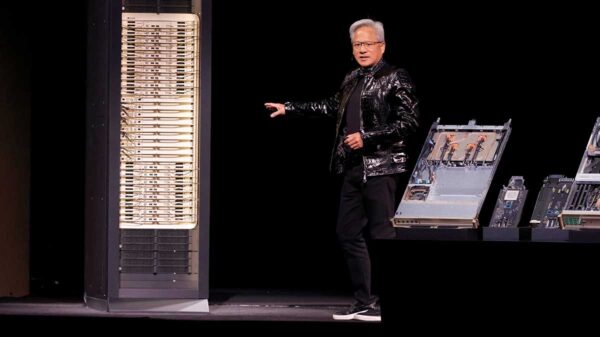

Western Digital (WDC) has seen a resurgence in investor interest, marked by a 7% intraday jump in its stock price, following reports of tightening supply in high-capacity storage solutions coupled with increasing demand driven by artificial intelligence infrastructure developments. This significant movement in share price builds on a robust trend, with Western Digital’s stock appreciating sharply over the past quarter, and its total shareholder return nearing an impressive 290 percent over the past year. The growing momentum suggests that demand for AI-driven storage is gaining traction in the market.

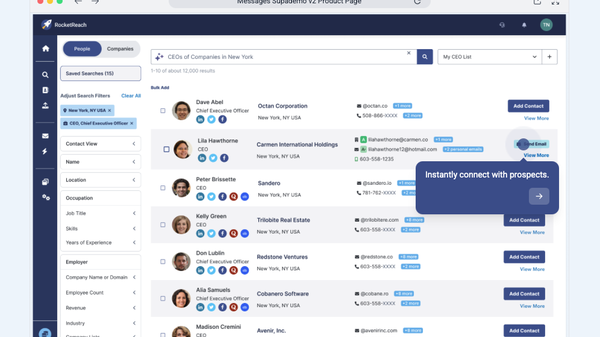

As the dynamics around Western Digital evolve, investors may wish to explore other high-growth technology and AI stocks likely to benefit from similar structural shifts. Currently, the company’s stock price is nearing analyst targets while trading at what appears to be a substantial intrinsic discount. This raises critical questions about whether the current price underestimates Western Digital’s potential in the AI storage arena or if the market has already factored in the next phase of growth.

At the close of the last trading session, Western Digital’s stock stood at $187.70, just above a narrative fair value estimate of $187. This situation indicates that the focus may not be solely on price discrepancies but rather on the underlying factors that support the current valuation. The surge in unstructured data generated by AI applications and the rise of cloud-based services across multiple industries are driving unprecedented storage requirements. With a strong foothold in partnerships with leading hyperscalers, including all top five firms that have placed firm purchase orders and long-term agreements covering the next 12 to 18 months, Western Digital is well-positioned to benefit from this secular demand.

Despite the narrative suggesting that the stock may be slightly overvalued, a discounted cash flow (DCF) model presents a contrasting perspective, indicating shares might be approximately 18.5% undervalued. If the cash flow projections prove more accurate than market sentiment, the recent rally could be just the beginning for Western Digital’s stock price.

Moreover, the reliance on a limited number of hyperscale customers, coupled with the potential disruption from emerging storage technologies, could pose substantial risks to the prevailing bullish outlook for AI storage solutions. Investors are advised to consider these factors carefully as they assess Western Digital’s future potential.

For those who may view the financial landscape differently or wish to examine their investment thesis, tools like the Simply Wall Street Screener can assist in creating personalized narratives based on individual insights. This can provide a more nuanced understanding of the stock’s potential rewards and the key warning signs that could impact investment decisions.

Moving forward, the burgeoning demand for advanced storage solutions in the AI sector is expected to create ripples throughout the technology landscape. As companies increasingly seek to leverage data for competitive advantage, firms like Western Digital will play a critical role in facilitating these needs. The unfolding scenario poses both challenges and opportunities, making it essential for investors to remain vigilant and informed about the shifting tides in the tech industry.

As analysts and investors continue to monitor the developments surrounding Western Digital, the implications of its current market valuation and growth potential will likely be a focal point for discussions in the coming months. With the technological revolution fueled by AI just beginning to take shape, Western Digital’s next moves will be critical in determining its position within the industry.

Western Digital | OpenAI | AWS | Nvidia | IBM

See also Transforming Police Leadership: Embracing AI Governance for Community Trust by 2026

Transforming Police Leadership: Embracing AI Governance for Community Trust by 2026 Aptiv Unveils AI-Powered Edge Solutions for Safer Autonomous Vehicles at CES 2026

Aptiv Unveils AI-Powered Edge Solutions for Safer Autonomous Vehicles at CES 2026 University of Toronto Launches $20M Hinton AI Chair Backed by Google

University of Toronto Launches $20M Hinton AI Chair Backed by Google Good Tokens Expands Blockchain and AI Solutions to Enhance Global Humanitarian Impact

Good Tokens Expands Blockchain and AI Solutions to Enhance Global Humanitarian Impact