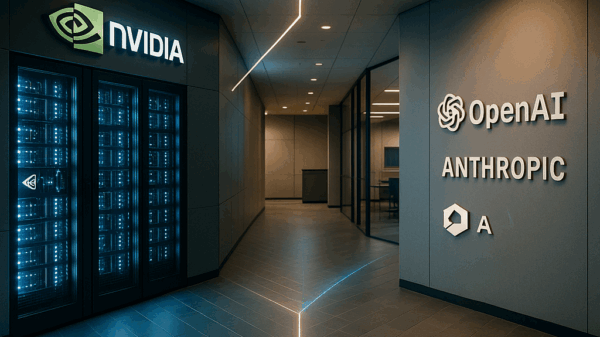

Investment analysts are increasingly optimistic about the prospects of companies involved in artificial intelligence (AI) infrastructure, with expectations for a surge in AI spending by 2026. Stocks from industry leaders such as Nvidia, AMD, Broadcom, Amazon, and Alphabet are highlighted as top picks. Central to this optimism is Nvidia’s dominance in AI computing, which is anticipated to drive significant market capitalization growth.

Nvidia currently holds a staggering market capitalization of $4.5 trillion, a testament to its leadership in the GPU market. The company faces an overwhelming demand for its products, with its GPU production capacity reported as sold out. As new data centers continue to roll out, the demand for Nvidia’s GPUs is expected to rise further, reinforcing its stronghold in the market.

Alongside Nvidia, Broadcom is positioning itself as a formidable contender in the AI hardware space. The company’s innovative strategy involves partnerships with AI hyperscalers to develop specialized ASIC chips. With a market cap of $1.7 trillion, Broadcom is set to benefit from this unique competitive advantage as the demand for specialized chips grows in the coming years.

Meanwhile, the cloud computing platforms of Alphabet and Amazon are experiencing robust growth, fueled by the increasing demand for AI. Google Cloud and Amazon Web Services (AWS) have reported year-over-year growth rates of 34% and 20%, respectively. As AI workloads continue to rise, these platforms are expected to capitalize on the trend, contributing to their long-term revenue growth.

Turning to AMD, Wall Street analysts forecast a positive outlook for the company’s stock price over the next 12 months. The average one-year price target for AMD stands at $284.10, with predictions ranging from a low of $200.00 to a high of $377.00. However, analysts caution that these price targets are subjective and often lag behind market trends, urging investors to consider the underlying fundamentals of the company.

Currently, AMD’s stock is priced at $227.92, reflecting a strong market interest in its potential for growth. As a global semiconductor company, AMD focuses on high-performance computing and graphics technologies across several segments, including Data Center, Client and Gaming, and Embedded. Its offerings include a range of products such as AI accelerators, microprocessors for servers, and graphics processing units (GPUs), which cater to various industries.

In its Data Center segment, AMD develops products essential for modern computing, including AMD EPYC processors and graphics processing units (GPUs), which are increasingly being utilized in AI applications. The Client and Gaming segment contributes significantly to its revenue, featuring CPUs, APUs, and semi-custom SoC products, while the Embedded segment focuses on more specialized applications.

As the demand for AI technologies and infrastructure expands, companies like Nvidia, AMD, and Broadcom are poised to play pivotal roles in shaping the future of computing. With analysts bullish on AMD and a growing recognition of the importance of AI in various sectors, the landscape appears favorable for these industry leaders. Moving forward, the interplay between AI advancements and semiconductor technology will likely dominate discussions in the investment community, reflecting the broader implications for the tech industry at large.

See also Brands Shift to Entertainment Infrastructure, Redefining Value in AI-Dominated Market

Brands Shift to Entertainment Infrastructure, Redefining Value in AI-Dominated Market China’s Tech Stocks Surge 13% in 2026 Rally, Fueled by AI Breakthroughs Despite Economic Strains

China’s Tech Stocks Surge 13% in 2026 Rally, Fueled by AI Breakthroughs Despite Economic Strains AI-Powered MOSAIC Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds

AI-Powered MOSAIC Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds UAE Unveils AI-Powered Trade Platform to Transform Global Trade Dynamics

UAE Unveils AI-Powered Trade Platform to Transform Global Trade Dynamics