The Gulf Cooperation Council (GCC), comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE), is witnessing a significant transformation as it shifts from traditionally oil-based economies to a more diversified economic landscape. The region’s sovereign wealth funds (SWFs) and state-owned enterprises (SOEs) are at the forefront of this diversification strategy, implementing substantial investments in sectors that promise to underpin future growth, notably in artificial intelligence (AI), renewable energy, and financial services.

According to recent analysis from PwC, the Middle East’s mergers and acquisitions (M&A) activity surged by 19% in the first half of 2025, a notable contrast to global trends. This uptick is largely driven by GCC’s sovereign funds and public enterprises, which are transitioning from co-investors to leaders in substantial capital deployment aimed at diversifying their economies. In particular, non-oil exports from the GCC are projected to reach $1 trillion by 2030, highlighting the region’s commitment to economic transformation.

While top oil producers, such as Saudi Arabia and the UAE, continue to dominate the global oil market, they are simultaneously expanding their non-oil sectors. For instance, Abu Dhabi’s non-oil economy is expected to represent 56.2% of its GDP by 2025. This shift is not just theoretical; recent M&A activity illustrates a strategic approach to realigning investments toward more sustainable sectors.

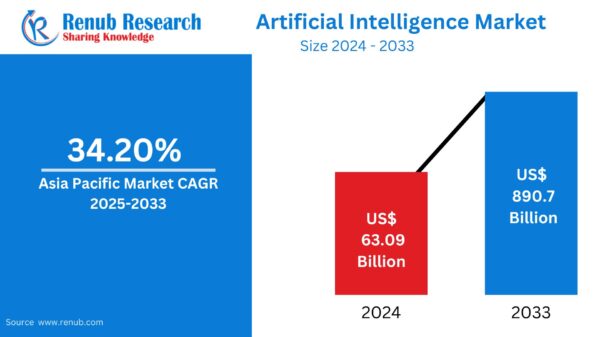

The GCC is making strides to become a global hub for AI and digital infrastructure. Strategic partnerships with international firms are central to this ambition. Notable investments include Blackstone’s partnership with Saudi Arabia’s Humain, committing approximately $3 billion to build data centers, and OpenAI collaborating with G42, backed by Mubadala Investment Company, to establish a 5-gigawatt data center cluster in Abu Dhabi. Furthermore, the Qatar Investment Authority participated in Anthropic’s Series F fundraising round, securing a stake in an AI venture valued at $13 billion, while the Abu Dhabi Investment Authority invested $1.6 billion in Vantage Data Centers’ Asia Pacific platform.

A landmark $40 billion acquisition of Aligned Data Centers by MIC-backed MGX, in partnership with BlackRock’s Global Infrastructure Partners and others, underscores the GCC’s aggressive strategy in the AI domain. This approach to investing in leading technology players aims to enhance the region’s global tech profile and secure access to the capabilities necessary for future economic productivity. PwC estimates that by 2030, AI could contribute 12.4% of Saudi Arabia’s GDP and 14% of the UAE’s GDP.

Renewable Energy Development

As the GCC invests in AI infrastructure, renewable energy has emerged as a crucial element to sustainably power these developments. Each member state has set ambitious targets for their energy mix, with Saudi Arabia aiming for 50% of its electricity to come from renewable sources by 2030. The region is projected to attract over $75.6 billion in renewable energy projects by the same year, demonstrating a commitment to transitioning to sustainable energy sources.

Abu Dhabi Future Energy Company (Masdar) is taking a pioneering role, planning a global renewable energy portfolio of 100 gigawatts by 2030. Recent moves include a $3.5 billion acquisition of Greece’s Terna Energy and a $6.1 billion investment in the UK’s largest offshore wind project. Concurrently, initiatives like XRG and Altérra from Abu Dhabi signal a concerted effort to deploy significant capital towards clean energy and climate investments.

The intertwining of energy transition and AI infrastructure underscores the GCC’s strategic vision; investments in clean energy are not merely about sustainability but also serve as foundational elements for the region’s digital aspirations.

The financial services sector is another focal point for GCC diversification efforts, as it seeks to transform the region into a global financial hub. The UAE has made notable advancements, evidenced by a 72% increase in hedge funds registered in the Dubai International Finance Centre from July 2024 to July 2025. The Abu Dhabi Global Market has also seen a 26% growth in registered financial services firms in early 2025, attracting new players like the UK challenger bank Revolut.

As GCC investors pursue outbound investments in financial institutions, they are building a robust presence in international markets. This strategic focus on enhancing the financial landscape is essential for creating resilient and diversified economies in the future.

Looking ahead, M&A activity in AI, renewable energy, and financial services is poised to define the GCC’s economic landscape. The transition from passive investment to leading significant initiatives positions the region as a key player in global capital markets, reshaping its economic footprint and paving the way for a more diversified future.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025