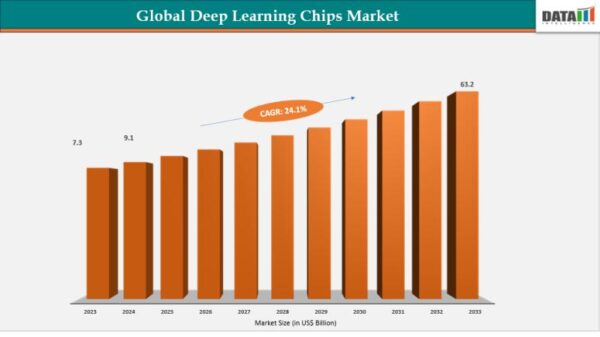

Investors are eyeing several key players in the AI hardware sector as promising long-term investment options, despite some fatigue regarding the AI trade. Spending on artificial intelligence is projected to surge again by 2026, with substantial investments being funneled into AI computing power. While many companies are still awaiting returns from generative AI technologies, others have already begun reaping significant profits, with Nvidia, Broadcom, Advanced Micro Devices (AMD), and Taiwan Semiconductor Manufacturing (TSMC) emerging as standout choices for investors looking toward 2026.

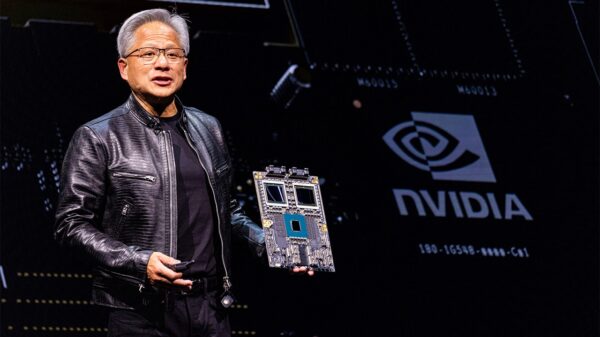

Nvidia, a leader in AI hardware, has established itself through its graphics processing units (GPUs), which have become the preferred choice since the surge in AI spending began in 2023. The company reported being sold out of cloud GPUs, indicating an unprecedented demand for its products. This demand is not expected to diminish; Nvidia anticipates global data center capital expenditures could escalate from $600 billion in 2025 to between $3 trillion and $4 trillion by 2030, presenting a massive opportunity for growth.

AMD, while offering a similar product lineup, faces challenges due to perceptions that its ecosystem is not as robust as Nvidia’s. Currently, AMD’s data center business is approximately one-tenth the size of Nvidia’s. However, the company aims to capitalize on emerging opportunities as clients, unable to procure Nvidia’s GPUs, may turn to AMD as an alternative. AMD projects that its data center division will achieve a 60% compound annual growth rate (CAGR) through 2030, positioning it as a compelling buy if it can deliver on these growth targets.

In contrast, Broadcom is taking a different approach by focusing on application-specific integrated circuits (ASICs). ASICs deliver superior performance for particular workloads compared to general-purpose GPUs, and Broadcom is collaborating with various AI hyperscalers to design these chips tailored to specific AI models. The company anticipates its AI semiconductor revenue will double year-over-year in the first quarter, indicating strong growth potential as these chips may outpace Nvidia’s GPUs in popularity over the coming years.

Unlike Nvidia and AMD, which design but do not manufacture their chips, TSMC plays a critical role in the supply chain as the world’s largest chip foundry. Its capabilities are essential for the development of AI technology. TSMC is projecting a mid- to high-50% CAGR for its AI chip business from 2024 to 2029, emphasizing the robust demand for its services and further solidifying its status as a strong investment alongside Nvidia, AMD, and Broadcom.

Collectively, these four companies are positioned to thrive as the AI hardware race intensifies. Investors might be wary of the current AI sentiment, but the underlying financial growth and technological advancements suggest that maintaining exposure to this sector could yield substantial returns in the future. As the landscape evolves, the interplay between these companies and their strategies will be crucial in shaping the next wave of AI innovation and investment.

See also Georgieva Warns of AI ‘Tsunami’ Reshaping 60% of Jobs; Lagarde Sounds Alarm on Wealth Inequality

Georgieva Warns of AI ‘Tsunami’ Reshaping 60% of Jobs; Lagarde Sounds Alarm on Wealth Inequality Character AI Enforces Strict NSFW Ban, Enhances Moderation for User Safety

Character AI Enforces Strict NSFW Ban, Enhances Moderation for User Safety Nvidia CEO Warns AI Expansion Sparks ‘Largest Infrastructure Boom’ in History

Nvidia CEO Warns AI Expansion Sparks ‘Largest Infrastructure Boom’ in History Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT