Solana’s price action has weakened significantly, closing the weekend below $140 after facing rejection near the $150 level. This downturn comes amid growing caution within broader risk sentiment, further exacerbated by renewed tariff concerns and modest outflows from exchange-traded funds (ETFs), creating a precarious atmosphere as the week begins. Despite this price pullback, on-chain and ecosystem indicators remain positive, suggesting that the recent decline may represent a period of consolidation rather than a definitive breakdown.

The recent decline in Solana’s price reflects a market grappling with macroeconomic uncertainty and shifting investment flows. Notably, Solana’s token (SOL) was rejected near the $150 mark, closing below $140, which has tilted the short-term market bias toward the bearish side. This sentiment has been further impacted by approximately $2.2 million in net outflows from Solana ETFs—the first such outflows since their launch. Although these figures are modest in absolute terms, they have influenced market momentum as traders reevaluate their exposure during a time of heightened risk aversion.

Even amid this price pressure, Solana’s ecosystem metrics continue to signal robust long-term engagement. The total value locked (TVL) in the real-world asset (RWA) ecosystem hovers around $1.12 billion, indicating expanding institutional participation. Continued capital inflows into application-level use cases are also notable, while liquidity and activity remain stable despite the ongoing price consolidation. This divergence between short-term flows and longer-term fundamentals suggests that the current market dip may represent a shakeout rather than a sustained trend change, contingent on buyers defending critical support levels.

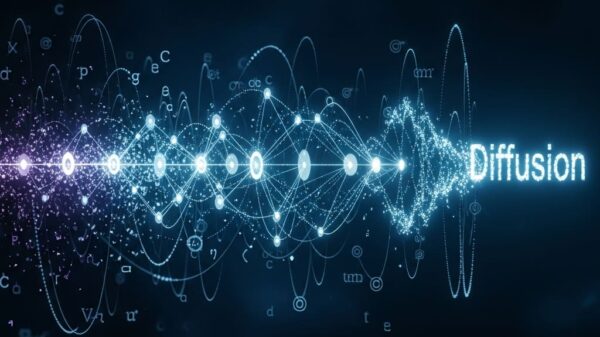

As the cryptocurrency landscape evolves, attention is turning to technical frameworks such as Zero Knowledge Proof (ZKP), which is now being assessed through a different lens. Market participants are increasingly focusing on how zero-knowledge proofs operate and the critical role that cryptographic verification plays in their design. This shift from price-led narratives to a more technical understanding underscores a growing sophistication among investors evaluating which cryptocurrencies to consider for the future.

Zero Knowledge Proof is fundamentally designed around the principle of cryptographic verification, enabling outcomes to be validated while keeping underlying data private. This structure prioritizes methodical processes over speculative ones, enforcing rules through mathematics instead of relying on intermediaries. Essentially, zero-knowledge proofs allow one party to demonstrate the truth of a statement without revealing the data itself. The process typically involves three steps: commitment, proof generation, and verification. The commitment phase encodes data and computation into a mathematical statement, followed by the generation of a cryptographic proof that affirms the statement’s validity. Finally, anyone can verify the proof’s correctness without accessing the underlying data.

This mechanism of verification without exposure is becoming increasingly essential as blockchain technology moves beyond simple transactions into more complex, data-rich environments. The architecture of ZKP emphasizes correctness through mathematical principles rather than trust or visibility. It supports a privacy-first approach to computation, where sensitive inputs remain confidential while ensuring auditability since proofs can be verified on-chain without disclosing the actual data. The separation of verification from disclosure aligns execution with real-world constraints where privacy and regulatory compliance are increasingly critical.

In light of these developments, Solana’s recent dip into a key demand zone highlights the tension between short-term ETF flows and the broader growth potential of its ecosystem. While immediate market sentiment has weakened, the underlying on-chain fundamentals suggest that the broader structure remains intact, assuming support levels hold. Furthermore, the emphasis on Zero Knowledge Proofs as a cornerstone of cryptographic systems reflects a notable shift among market participants, prioritizing privacy-centric and mathematically validated frameworks as the cryptocurrency landscape matures.

For more information about Zero Knowledge Proof, visit their official website at zkp.com.

Why did Solana weaken despite strong ecosystem metrics? Short-term ETF outflows and macroeconomic risk weighed on sentiment, even as on-chain fundamentals remained robust.

What does a zero-knowledge proof actually prove? It verifies that a computation or statement is correct without revealing the underlying data.

Why is cryptographic verification important for blockchains? It enables trust without exposure, reducing execution risk and accommodating sensitive use cases.

See also UiPath’s Maestro Positions It to Lead AI Agent Orchestration Amid Market Shift

UiPath’s Maestro Positions It to Lead AI Agent Orchestration Amid Market Shift Perplexity AI Launches Google Drive Connector for Enhanced File Search Capabilities

Perplexity AI Launches Google Drive Connector for Enhanced File Search Capabilities Davos 2026: Leaders Assess AI’s Impact on Jobs, Surveillance, and Global Industry Growth

Davos 2026: Leaders Assess AI’s Impact on Jobs, Surveillance, and Global Industry Growth Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT