UiPath is poised to carve out a significant role in the rapidly evolving market for agentic artificial intelligence (AI). This new frontier of AI transcends traditional generative models, such as chatbots from OpenAI and Alphabet’s Gemini, by enabling AI agents to autonomously complete tasks. Though it may sound futuristic, agentic AI is garnering considerable attention from various industry players.

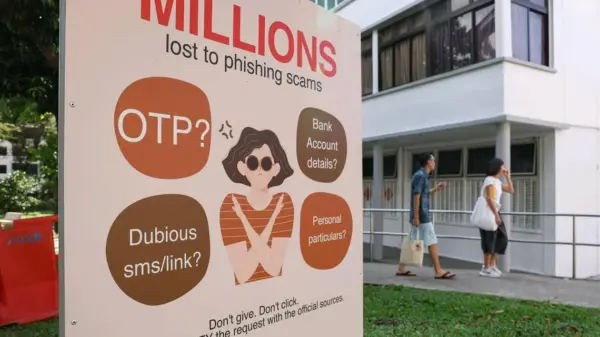

One of the critical challenges in deploying agentic AI lies in its susceptibility to “hallucinations,” where the AI generates inaccurate information. This issue is less acute in generative AI, as humans can easily validate the output. However, the stakes rise dramatically when AI agents are integrated into a business’s virtual workforce, potentially leading to actions that could harm operations. Compounding the issue is the fact that organizations now frequently manage AI agents from multiple vendors, as numerous software providers develop their own solutions.

The company best situated to emerge as a leader in this dynamic landscape is UiPath (PATH 0.40%). Historically recognized for its leadership in robotic process automation (RPA), UiPath has laid the groundwork for future AI agents. RPA allowed businesses to automate straightforward, rule-based tasks—like data entry and customer onboarding—but did so under strict governance to ensure compliance. Notably, UiPath’s platform also facilitates access to legacy systems, a crucial aspect for many organizations.

Building on its RPA foundation, UiPath recently launched an AI agent orchestration platform called Maestro. This innovative platform is designed to serve as a neutral hub for managing AI agents from various vendors, allowing clients to govern and oversee the deployment of AI resources effectively. Furthermore, Maestro optimally assigns tasks to humans, software bots, and AI agents based on their capabilities. Since software bots generally cost less than AI agents, this strategic allocation can lead to significant cost savings for businesses, enabling them to reserve AI agents for more complex tasks.

Although UiPath is still in the early stages of its AI agent orchestration journey, the company recently reported an acceleration in revenue growth, suggesting a promising outlook. As demand for AI agent orchestration continues to rise, UiPath appears strategically positioned to lead in this burgeoning sector. Currently, the company’s stock is attractively valued, trading at a forward price-to-sales multiple below 4.5 and a forward price-to-earnings (P/E) ratio of 19. If UiPath can maintain its momentum in revenue growth, its stock may well symbolize the next chapter in the AI market.

Analysts and investors alike will be closely monitoring how UiPath navigates this evolving landscape. With a combination of established expertise in RPA and innovative advancements in AI orchestration, the company is on track to play a pivotal role in shaping the future of agentic AI.

For further details, visit UiPath and OpenAI for more information on their respective platforms.

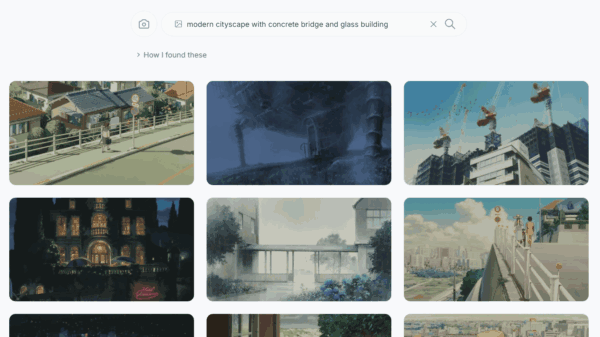

See also Perplexity AI Launches Google Drive Connector for Enhanced File Search Capabilities

Perplexity AI Launches Google Drive Connector for Enhanced File Search Capabilities Davos 2026: Leaders Assess AI’s Impact on Jobs, Surveillance, and Global Industry Growth

Davos 2026: Leaders Assess AI’s Impact on Jobs, Surveillance, and Global Industry Growth HUMAIN and Infra Secure $1.2B AI Financing Agreement to Transform Saudi Digital Infrastructure

HUMAIN and Infra Secure $1.2B AI Financing Agreement to Transform Saudi Digital Infrastructure OpenAI Announces Codex Update, Elevating Cybersecurity Risk Level to “High”

OpenAI Announces Codex Update, Elevating Cybersecurity Risk Level to “High” Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere