Robotaxis are poised to transform the transportation landscape similarly to the advent of the automobile in the late 1800s. With the integration of artificial intelligence (AI) into autonomous driving, this technology represents what some experts consider a once-in-a-lifetime opportunity. According to Grand View Research, robotaxi sales are projected to surge at an annual rate of 74% through 2030, while the ride-sharing market for driverless vehicles is estimated by Straits Research to reach a staggering $918 billion by 2033. Meanwhile, analysts from Morgan Stanley predict that sales of autonomous vehicles could exceed $3 trillion by 2040.

For investors looking to capitalize on this burgeoning market, several AI stocks are particularly noteworthy: Nvidia, Uber Technologies, Tesla, and Alphabet. Each of these companies is positioned to benefit from the rapid evolution of transportation technology and the rising demand for autonomous vehicles.

Image source: Getty Images.

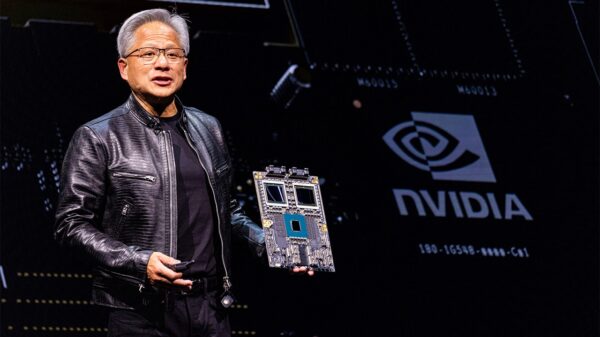

Nvidia is a key player in this arena, having dedicated over a decade to developing autonomous driving technologies. CEO Jensen Huang highlighted the company’s role at the GTC conference, stating, “We’ve been working on self-driving cars now for over a decade. We build technology that almost every single self-driving car company uses.” Nvidia’s offerings include a comprehensive autonomous driving platform encompassing both hardware and software, enabling various companies such as Alphabet’s Waymo, Uber, and Amazon‘s Zoox to utilize its technology. Market analysts project Nvidia’s earnings to grow annually by 38% over the next three years, suggesting a reasonable valuation ratio of 45 times earnings.

Uber Technologies, which dominates the ride-sharing market, is well-positioned as a partner for autonomous vehicle firms. CEO Dara Khosrowshahi noted, “Uber can deliver the lowest operational costs for our AV partners because we are leaps and bounds ahead on every aspect of the go-to-market capabilities critical for commercialization.” The company collaborates with over 20 AV partners, facilitating access to robotaxis in several U.S. cities, including Phoenix and Austin, as well as abroad in locations such as Riyadh and Dubai. Morgan Stanley estimates that Uber will manage 22% of autonomous ride-sharing trips in the U.S. by 2032, solidifying its place as a major player in this sector. The company’s earnings are expected to rise 28% annually over the next three years, making its current valuation of 11 times earnings appear attractive.

Today’s Change

(-0.30%) $-0.25

Current Price

$82.31

Market Cap

$171B

Day’s Range

$81.47 – $83.56

52wk Range

$60.63 – $101.99

Volume

15M

Avg Vol

19M

Gross Margin

32.74%

Tesla‘s approach to autonomous driving centers on its full self-driving (FSD) platform, which relies exclusively on computer vision, utilizing cameras without the supplementary radar or lidar systems employed by its competitors. This methodology is not only cost-effective but also enhances scalability. According to Morgan Stanley, Tesla incurs approximately $3,000 per vehicle for its camera systems compared to $30,000 for sensors used by Waymo. Furthermore, Tesla intends to leverage its existing fleet of nearly 8 million vehicles to create a crowd-sourced network of robotaxis, allowing owners to earn income similar to Airbnb hosts. This strategy may enable rapid scaling in urban areas. Analysts predict that Tesla could secure 25% of the U.S. autonomous ride-sharing market by 2032, placing it in close competition with Waymo.

Alphabet, primarily recognized for its Google subsidiary, is also making strides in autonomous driving through its Waymo division, which currently offers commercial services in five U.S. cities and is testing in numerous others. While Alphabet’s core businesses—digital advertising and cloud computing—provide a strong foundation, analysts expect its earnings to grow by 15% annually over the next three years. The current valuation of 32 times earnings is seen as somewhat steep but manageable. Morgan Stanley anticipates that Waymo will maintain its market leadership, capturing 34% of U.S. autonomous ride-sharing trips by 2032.

The rise of robotaxis represents not just a significant technological shift but also a potential paradigm shift in transportation, with many experts suggesting that the future of mobility will be heavily intertwined with AI advancements. As the industry evolves, companies that effectively leverage these innovations could redefine how we navigate our urban landscapes.

See also Alibaba Accelerates AI Hardware Push with T-Head Listing and Nuclear Power JV

Alibaba Accelerates AI Hardware Push with T-Head Listing and Nuclear Power JV Michael Dell Unveils $6.25B Investment for Children and Predicts AI Breakthrough in 2026

Michael Dell Unveils $6.25B Investment for Children and Predicts AI Breakthrough in 2026 Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT