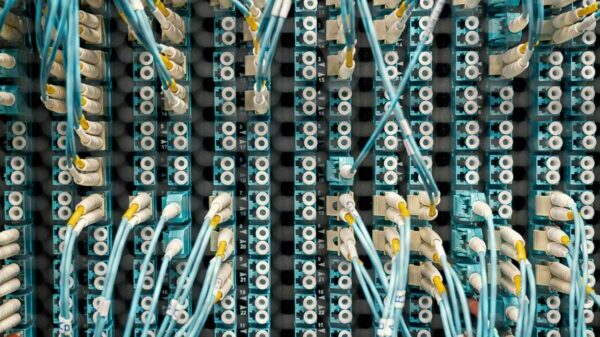

The artificial intelligence (AI) sector is shifting gears as major players pivot from developing advanced chips and models to enhancing data center capacity with AI-optimized infrastructure. Hyperscalers, cloud providers, and enterprise customers are increasingly investing in data centers that feature high power density and sophisticated cooling systems, aiming to alleviate existing bottlenecks that could impede growth.

One company that stands out in this evolving landscape is Applied Digital (NASDAQ: APLD), which has carved out significant market opportunities. The firm is already on track to generate nearly $16 billion in prospective lease revenue over the next 15 years through its Polaris Forge 1 and Polaris Forge 2 campuses in North Dakota, having contracted approximately 600 megawatts of data center capacity. Of this, 400 megawatts at Polaris Forge 1 has been leased to CoreWeave, while 200 megawatts at Polaris Forge 2 is under lease to an unnamed “investment-grade” hyperscaler. This strong demand visibility has notably enhanced the company’s revenue and cash flow predictability.

Applied Digital’s campuses are designed with expansion in mind, each capable of scaling to at least 1 gigawatt of total capacity, with potential for even more depending on the availability of power and infrastructure. The company is also progressing on the Delta Forge 1 project, a 430-megawatt AI data center campus, signaling confidence in sustained demand for data centers and its operational capabilities.

The company’s financial performance has also been noteworthy. In the second quarter of fiscal 2026, which ends on November 30, 2025, Applied Digital reported a staggering 250% year-over-year revenue increase, reaching $126.6 million. Analysts project revenues to rise to approximately $346.7 million in fiscal 2026 and around $546 million in fiscal 2027.

Given these positive indicators, many analysts view Applied Digital as an attractive investment opportunity. Some forecasts suggest that a 1,000% return could be achievable, potentially turning a $1,000 investment into $1 million over time.

However, prospective investors should exercise caution. The Motley Fool Stock Advisor analyst team recently published a list of what they deem the ten best stocks for investors, notably excluding Applied Digital. Historical data indicates that previous selections, such as Netflix and Nvidia, have led to substantial returns for early investors. For instance, if one had invested $1,000 in Netflix when it made the list in December 2004, that investment would now be worth approximately $464,439. Similarly, an investment in Nvidia when it was recommended in April 2005 would have grown to about $1,150,455.

The Stock Advisor program boasts an average return of 949%, significantly surpassing the S&P 500’s 195% return. Investors are encouraged to stay informed about the latest recommendations through Stock Advisor, which aims to connect individual investors with valuable insights.

As the AI infrastructure sector continues to expand, Applied Digital’s ability to capitalize on this trend will be closely monitored. The company’s strategic positioning and robust financial growth may present a compelling case for investors looking to navigate this rapidly evolving industry.

See also DJ Masatane Muto Uses AI to Overcome ALS, Achieving 90% Accuracy in Brain Wave Control

DJ Masatane Muto Uses AI to Overcome ALS, Achieving 90% Accuracy in Brain Wave Control Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse