The global financial landscape has been significantly transformed as of February 11, 2026, with precious metals reaching unprecedented prices. Gold has surged past the $5,100 per ounce mark, while silver has eclipsed $112 per ounce, marking a historic rebasing of hard assets. This explosive rally, particularly in the first two weeks of February, is fueled by systemic currency volatility, escalating diplomatic tensions between the United States and Iran, and a structural shift in industrial demand driven by the artificial intelligence revolution.

The immediate implications of this price surge are profound, leading to a frantic scramble for physical delivery and a massive exit from traditional sovereign debt. For the first time in decades, the gold-to-silver ratio has compressed below 50:1, indicating that silver is no longer merely viewed as “poor man’s gold” but is instead recognized as a critical strategic technology metal. Institutional investors and central banks are rushing to hedge against a weakening U.S. Dollar, catalyzing the so-called “Great Revaluation” of 2026 and compelling a complete reassessment of global supply chains and monetary policy.

The catalyst for this latest price surge lies in the high-stakes diplomatic negotiations currently taking place in Muscat, Oman. Following a brief but destructive conflict between Israel and Iran in June 2025, which included U.S. strikes on Iranian nuclear facilities, urgent negotiations recommenced on February 6, 2026. While Iran has offered to surrender 400 kg of highly enriched uranium, its refusal to negotiate on its ballistic missile program has kept the “war premium” on precious metals at record highs. Investors fearing a collapse of the talks and a return to open hostilities are flocking to gold as the ultimate safe haven.

Simultaneously, the U.S. Federal Reserve is undergoing a transition that has rattled currency markets. The nomination of Kevin Warsh as the new Fed Chair was initially perceived as hawkish, but his recent push for lower interest rates to combat sluggish domestic growth has sent the U.S. Dollar Index (DXY) tumbling to the 94-97 range. This policy pivot, coupled with a 9.4% depreciation of the U.S. Dollar throughout 2025, has diminished the greenback’s appeal, allowing gold to reclaim its status as the primary store of value.

The market reaction has been chaotic. Following a “flash crash” in late January 2026, where silver briefly spiked to $121 before being affected by algorithmic selling, the market has engaged in a violent recovery throughout early February. Exchange-traded funds (ETFs) and physical bullion dealers are reporting record-long wait times for delivery as the available float of metal in the commercial market seems to be evaporating.

Corporate Winners and Strategic Pivots

The primary beneficiaries of this price surge are major mining companies like Newmont Corporation and Barrick Gold, which are now generating unprecedented free cash flow. These companies have seen their market capitalizations swell as they report record margins on each ounce extracted. In the silver sector, Pan American Silver and First Majestic Silver lead the way, with the latter benefiting from its decision to withhold bullion during the 2025 volatility, effectively timing the market for current sales.

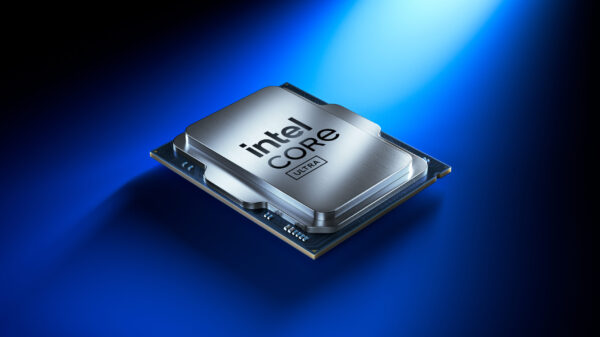

However, the narrative is shifting from traditional mining to strategic partnerships. The AI infrastructure boom has turned tech giants like Microsoft and NVIDIA into pivotal players in the silver market. As AI servers require significantly more silver than traditional servers for thermal management, these companies have initiated direct offtake agreements with miners, securing their supply chains and bypassing traditional exchanges. This direct-to-tech model further constricts the available supply for smaller industrial users.

Conversely, electronics manufacturers and solar panel producers that failed to hedge their silver exposure in 2024 and 2025 are facing severe cost pressures. Tesla, while proactive in securing its own supply for solar and electric vehicle components, is feeling the strain across its broader product line. For many mid-cap industrial firms, triple-digit silver prices have transitioned from an input cost to a structural threat, prompting a wave of product redesigns aimed at reducing or eliminating silver usage.

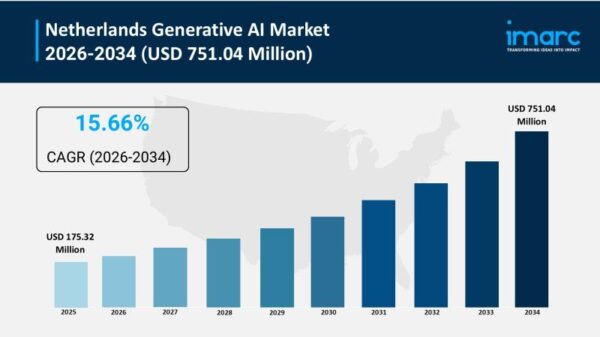

This rally is distinct as it merges 1970s-style geopolitical hedging with 21st-century technological demand. The AI-driven market shift extends beyond trading algorithms; it involves physical infrastructure. The massive data centers required for generative AI consume vast amounts of power, pushing big tech toward silver-intensive solar energy for rapid deployment. This dual demand—silver in AI chips and in the solar panels powering them—has created a price-insensitive market segment that is likely to sustain high silver prices independent of the macroeconomic environment.

Moreover, the rise of AI-driven trading funds has introduced a new layer of volatility, enabling high-frequency systems to trigger “flash FX super-cycles” where currency pairs fluctuate by 3-5% within hours. In this scenario, the relative stability of gold at $5,100 is perceived as less risky than the erratic movements of G7 currencies. This trend aligns with broader efforts of “de-dollarization,” as emerging market central banks diversify their reserves into gold to mitigate exposure to U.S. fiscal uncertainties.

The trajectory of the market hinges largely on the resolution of the Muscat negotiations. Should a “Grand Bargain” emerge between the U.S. and Iran, a cooling of tensions could lead to a $400-$500 correction in gold prices. However, many analysts, including those at J.P. Morgan, believe any dip will be shallow, forecasting gold to reach $6,300 by year-end 2026, spurred by a rebasing of the global monetary system that no longer views the U.S. Dollar as the sole anchor.

Investors must remain vigilant for potential regulatory shifts. With silver now classified as a “strategic technology metal,” discussions are increasing in Washington and Brussels regarding export controls or strategic stockpiling mandates akin to those for lithium and cobalt. If Western governments begin competing with tech firms for physical silver reserves, the $112 price floor may soon become a distant memory.

The events of February 2026 have underscored that traditional financial strategies are inadequate in today’s landscape. Gold at $5,100 and silver at $112 symbolize a fundamental loss of confidence in fiat currency systems and a frantic search for stability in an AI-driven, geopolitically fragmented world. The industrialization of precious metals—particularly silver—has fundamentally shifted the supply-demand balance. As the market braces for high-altitude volatility, the risks are no longer confined to interest rates but extend to physical availability and unforeseen geopolitical events. For investors holding these metals, current prices represent significant gains, but for the global economy, they signal an end to the era of inexpensive commodities and stable currencies.

See also AI Researchers Overcome Geometric Limits with Riemannian Flow Matching, Achieving FID of 3.37

AI Researchers Overcome Geometric Limits with Riemannian Flow Matching, Achieving FID of 3.37 Mistral AI Invests €1.2B in Swedish Data Center to Boost European AI Infrastructure

Mistral AI Invests €1.2B in Swedish Data Center to Boost European AI Infrastructure AI Sector Plummets 12.1%, Losing $2.8B as TAO and NEAR Hit Record Lows

AI Sector Plummets 12.1%, Losing $2.8B as TAO and NEAR Hit Record Lows Nvidia’s Rubin Chip Revolutionizes AI Inference, Ensuring Dominance Amidst Competition

Nvidia’s Rubin Chip Revolutionizes AI Inference, Ensuring Dominance Amidst Competition Google’s AI Tools Block Disney Character Prompts Amid Copyright Concerns

Google’s AI Tools Block Disney Character Prompts Amid Copyright Concerns