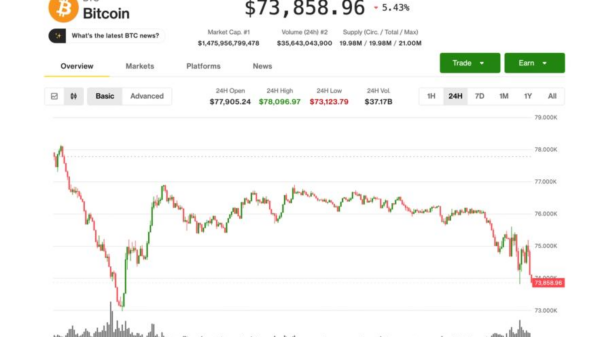

The artificial intelligence sector experienced a significant downturn last week, dropping an additional 12.1% and erasing $2.8 billion from its total market capitalization. This decline comes amidst broader turbulence in the cryptocurrency market, where Bitcoin (BTC) fell below $60,000 for the first time since September 2024.

Across the cryptocurrency landscape, most altcoins broke through long-held support levels, reaching values not seen in years. The CMC Altcoin Season Index has plummeted to around 23, while Bitcoin’s market dominance has risen to 58.7%, indicating a stark relative weakness among alternative cryptocurrencies.

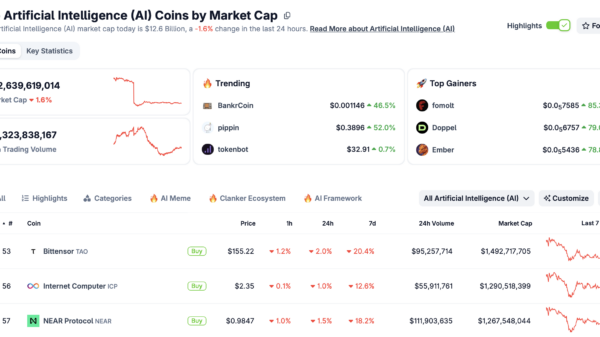

The AI sector’s dip reflected a challenging week for various altcoin categories, with three-quarters of major AI tokens reporting losses. Notably, Bittensor (TAO) plummeted by 19.6% week-over-week, marking its lowest value in over two years. Similarly, Near Protocol (NEAR) fell by 16.9% week-over-week, dropping below the $1 mark for the first time in more than five years.

Despite the market’s downward trend, a small number of tokens managed to thrive. These resilient tokens, though not widely detailed in the available reports, displayed notable gains amidst the prevailing bearish conditions. The context of these fluctuations is critical, as many investors and stakeholders reassess their positions in light of recent events.

In terms of industry developments, the intersection of AI and blockchain technology has spurred significant infrastructure advancements this week, with particular attention on autonomous agents and RealFi integration. Barry Silbert, CEO of Digital Currency Group, expressed optimism about the downturn, labeling it a “gift” for investors. He included Bittensor (TAO) among his high-conviction picks for the next investment cycle, alongside Bitcoin and Ethereum.

Meanwhile, NEAR Protocol has taken proactive steps by launching a decentralized AI Agent Marketplace, powered by its NEAR Intents framework. This innovative platform allows autonomous agents to execute tasks and transact using NEAR tokens, promoting a model of “agentic commerce” that enables users to conduct financial operations without relying on centralized intermediaries.

Layer-1 blockchain Pharos also made headlines with the introduction of a $10 million RealFi incubator named “Native to Pharos.” Backed by Hack VC and Lightspeed Faction, this initiative aims to accelerate the development of on-chain financial infrastructure, providing essential funding, mentorship, and AI-driven development tools to builders seeking to optimize protocol efficiency.

In a more cautionary tale, Humanity Protocol highlighted the risks associated with AI in social contexts. A recent social experiment revealed that AI-generated profiles successfully bypassed Tinder’s Know Your Customer (KYC) protocols, engaging 296 users and convincing 40 of them to meet for a date. This experiment underscores the critical identity vulnerabilities posed by generative AI technologies.

As the AI and cryptocurrency markets continue to navigate these turbulent waters, the developments in infrastructure and investor sentiment will play a significant role in shaping the sector’s trajectory. Investors and stakeholders alike are keenly watching for indicators that could signal a recovery or further declines in this fast-evolving landscape.

For more information on the latest in AI and cryptocurrency developments, check out OpenAI, Nvidia, and Microsoft.

See also Nvidia’s Rubin Chip Revolutionizes AI Inference, Ensuring Dominance Amidst Competition

Nvidia’s Rubin Chip Revolutionizes AI Inference, Ensuring Dominance Amidst Competition Google’s AI Tools Block Disney Character Prompts Amid Copyright Concerns

Google’s AI Tools Block Disney Character Prompts Amid Copyright Concerns OpenAI Experiments with Conversational Ads in ChatGPT, Shifting Digital Advertising Focus

OpenAI Experiments with Conversational Ads in ChatGPT, Shifting Digital Advertising Focus