Nvidia (NVDA +0.86%) has solidified its position as the premier provider of GPU chips for artificial intelligence (AI) data centers since the onset of the AI boom in early 2023. With trailing-12-month sales of $187 billion, Nvidia continues to outpace competitors like Advanced Micro Devices and Broadcom, both of which are significantly smaller. Despite the inevitability of increased competition, investors need not shy away from Nvidia’s stock. For those with $200 to invest, the recommendation is clear: buy Nvidia shares and hold them for the long term.

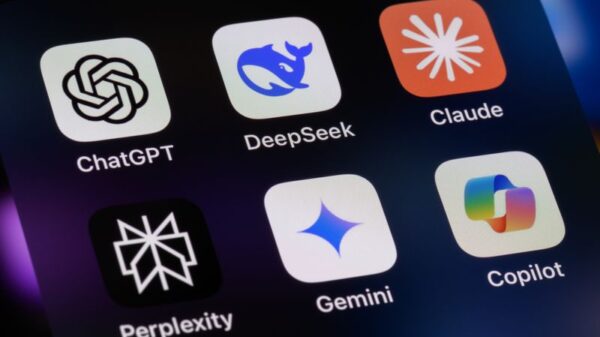

Traditionally, AI companies have relied on Nvidia’s GPU chips for training AI models. However, as the demand for AI inference grows, Nvidia’s upcoming innovations are becoming increasingly significant. Training involves equipping AI with data, while inference pertains to applying AI to real-world scenarios. With the rise of complex use cases, there is growing pressure on the memory resources of AI chips, often resulting in slower response times. Reports suggest that OpenAI expressed frustration with lagging performance from Nvidia’s GPUs and is exploring alternatives to meet 10% of its inference needs.

The anticipated Rubin chip platform, the successor to Nvidia’s Blackwell, is designed to address these challenges. Featuring Inference Context Memory Storage (ICMS), this new technology creates a specialized memory layer between a GPU’s fast but limited memory and slower external storage, allowing for improved management of data generated during AI processing. This enhancement is crucial as the industry pivots increasingly towards inference-driven AI.

Although OpenAI’s reported concerns might seem alarming, it remains improbable that a competitor will dethrone Nvidia in the near future. The company’s established hardware infrastructure provides a significant competitive edge that rivals would find challenging to replicate. As it stands, Nvidia remains the gold standard in AI chip technology.

In a further demonstration of its commitment to innovation, Nvidia recently announced a $20 billion deal to acquire the assets of Groq, a startup specializing in AI inference chip technology. This acquisition includes a non-exclusive licensing agreement for Groq’s inference technology, along with the hiring of key personnel to bolster Nvidia’s development efforts. This strategic move underscores Nvidia’s recognition of the importance of continuous innovation in maintaining its market dominance.

Looking ahead, the prospects for Nvidia appear promising, particularly as the demand for advanced AI applications continues to expand. Current estimates suggest that Nvidia’s earnings could grow at an annualized rate of 37% over the long term. Trading at 46 times earnings, the stock offers a substantial opportunity for returns if Nvidia can sustain its performance in an evolving AI landscape. The company is at the forefront of next-generation AI applications, with significant opportunities on the horizon, including self-driving vehicles and humanoid robotics.

As the AI sector rapidly evolves, Nvidia’s ongoing investments in cutting-edge technologies position it to capitalize on emerging markets and challenges. The company’s ability to adapt to the shifting demands of AI will be critical as the industry continues its expansion into new territories and applications.

For continual updates on Nvidia and developments in AI technology, interested parties can visit Nvidia’s official website and follow significant industry news through platforms like OpenAI and Microsoft.

See also Google’s AI Tools Block Disney Character Prompts Amid Copyright Concerns

Google’s AI Tools Block Disney Character Prompts Amid Copyright Concerns OpenAI Experiments with Conversational Ads in ChatGPT, Shifting Digital Advertising Focus

OpenAI Experiments with Conversational Ads in ChatGPT, Shifting Digital Advertising Focus Delhi Luxury Hotels Surge Rates to ₹20 Lakh Amidst Global AI Leaders’ Summit 2026

Delhi Luxury Hotels Surge Rates to ₹20 Lakh Amidst Global AI Leaders’ Summit 2026