Jim Cramer, the host of CNBC’s “Mad Money,” shared his insights on Amazon.com Inc. (NASDAQ:AMZN) in a post on X on Wednesday morning, suggesting that owning shares of the company has become increasingly challenging. Cramer acknowledged the company’s declining free cash flow, which has been significantly impacted by rising debt, and advised investors to remain in the stock despite its fluctuating valuation. He noted, “Amazon is difficult to own because it has diminished free cash flow from debt… I say stay in it but I know it went from cheap to expensive for a lot of people after that last q…”

Cramer’s remarks come amid a worrying trend in Amazon’s financials. The company’s free cash flow has notably decreased over the past year, with projections indicating a continued decline through 2025 and into early 2026. This downturn is largely attributed to a surge in capital expenditures aimed at enhancing its artificial intelligence infrastructure and expanding its cloud services. The most recent quarterly figures highlight this trend; for example, Amazon reported a free cash flow of $25.9 billion in Q1 2025, down from $50.1 billion a year prior.

The reported figures for subsequent quarters reveal a stark decline: in Q2 2025, free cash flow was $18.2 billion, compared to $53.0 billion in the same period last year; Q3 saw a drop to $14.8 billion from $47.7 billion; and Q4 is projected to end at $11.2 billion, down from $38.2 billion. These numbers underscore the severity of the cash flow contraction as the company invests heavily in AI initiatives.

Amazon’s strategic pivot towards AI infrastructure entails a substantial financial commitment, with capital expenditures expected to reach approximately $200 billion in 2026, reflecting a $70 billion increase from the previous year. This aggressive investment strategy aims not only to enhance its existing services but also to position Amazon as a leader in the burgeoning AI market.

The commentary from Cramer also signifies a notable shift in his perspective on the tech sector’s so-called “Magnificent 7.” Earlier this month, he declared, “the Mag 7 is no more,” yet he expressed a commitment to support Amazon during a period of stock price volatility, particularly as shares hovered around $197. Recently, however, he has identified Alphabet Inc. (NASDAQ:GOOGL) as “the prize” within the mega-cap technology sphere, citing its own substantial investments in AI infrastructure.

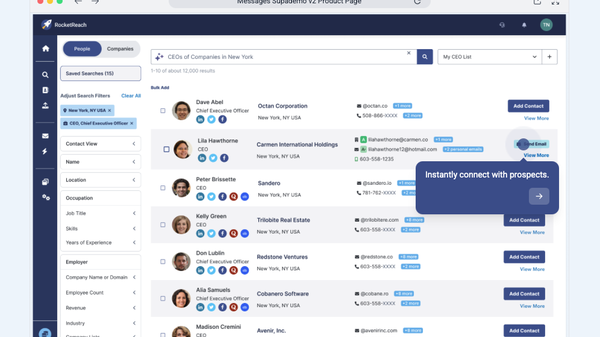

A deeper analysis of Amazon’s market positioning reveals a complex landscape. According to the Benzinga Edge scorecard, Amazon currently demonstrates a weak value score of 58.94, indicating that its stock trades at a premium compared to peers. Conversely, it boasts a strong quality score of 71.7, reflecting solid financial health and profitability. However, its momentum score is notably weak at 14.69, suggesting that the stock has been underperforming relative to the broader market.

As Amazon navigates these turbulent financial waters, investor sentiment may hinge on the company’s ability to balance its ambitious AI initiatives with the imperative to restore free cash flow levels. Cramer’s cautionary tale serves as a reminder of the volatility that characterizes high-growth tech stocks, particularly in light of significant capital expenditures. The landscape ahead appears fraught with challenges, yet also ripe with the potential for transformative growth, as Amazon continues to push the boundaries of technology and innovation.

See also Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs