The rapid expansion of artificial intelligence (AI) has prompted significant investments from major cloud providers, known as hyperscalers, in data centers to meet surging demand. Companies like Amazon, Microsoft, and Alphabet‘s Google collectively disbursed $305 billion for capital expenditures in 2025, with expectations for even greater spending in 2026. This investment underscores a growing reliance on Nvidia (NASDAQ: NVDA), whose graphics processing units (GPUs) have become essential for AI applications due to their unmatched computing power.

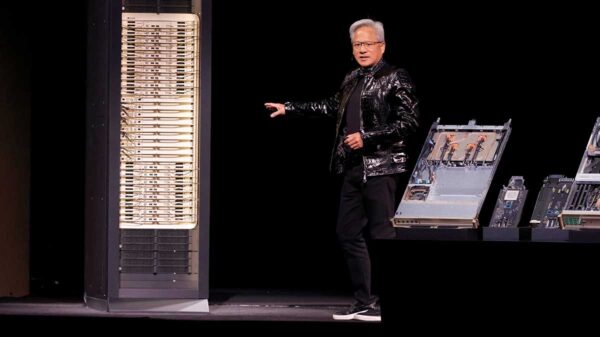

Nvidia’s data center revenue surged 66% year over year in its fiscal third quarter, reaching $51 billion and accounting for a staggering 89% of the company’s total business. Analysts forecast a 67% increase in Nvidia’s total revenue for the fiscal fourth quarter, reinforcing the company’s position in the burgeoning AI landscape. CEO Jensen Huang described the current phase as a “virtuous cycle of AI,” where increased development of AI applications drives further demand for Nvidia’s technology.

In a pivotal partnership, Nvidia struck a deal with OpenAI, which boasts over 800 million users of its ChatGPT platform. This arrangement includes the deployment of at least 10 gigawatts’ worth of AI data centers powered by Nvidia technology, facilitating the eventual use of millions of GPUs by OpenAI. As major hyperscalers prepare for extensive chip deployment, Nvidia’s upcoming Rubin chips are expected to deliver superior AI performance compared to the previous Blackwell generation, enhancing the investment appeal for data centers.

While Nvidia’s growth trajectory appears robust, some analysts believe its current stock price does not fully reflect its long-term potential. The company’s forward price-to-earnings ratio is about 24, which is relatively modest in light of the anticipated 57% earnings growth this year and an annualized 37% growth projected for the coming years. This suggests that Nvidia could be undervalued, despite the increased competition in the AI chip market, with many cloud providers opting for customized chips to cut costs.

However, Nvidia’s profitability remains impressive, with earnings reaching $99 billion over the last four quarters, yielding a 53% profit margin. The company’s unique position in the market stems from its GPUs, which are currently irreplaceable for a wide range of AI applications, providing a critical edge over emerging competitors.

For investors considering Nvidia, the outlook appears favorable, yet potential buyers should approach with caution. Notably, the analyst team at The Motley Fool recently identified a list of the “10 best stocks” for investors, and Nvidia did not make the cut. Historical context highlights the potential of stocks selected by the advisory service; for instance, if an investor had put $1,000 into Netflix when it was first recommended in 2004, it would have grown to $424,262 by February 2026. Similarly, an investment in Nvidia upon its recommendation in 2005 would have escalated to $1,163,635.

Despite Nvidia’s strong performance and the critical role it plays in AI infrastructure, the competitive landscape is evolving. With numerous companies experimenting with bespoke chip solutions, Nvidia’s established dominance may face challenges ahead. Nevertheless, the ongoing demand for AI capabilities continues to foster a compelling environment for Nvidia, making it a noteworthy consideration for investors navigating the fast-paced tech sector.

See also Samsung Integrates Perplexity AI with ‘Hey Plex’ Command in Galaxy S26 Series

Samsung Integrates Perplexity AI with ‘Hey Plex’ Command in Galaxy S26 Series Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs