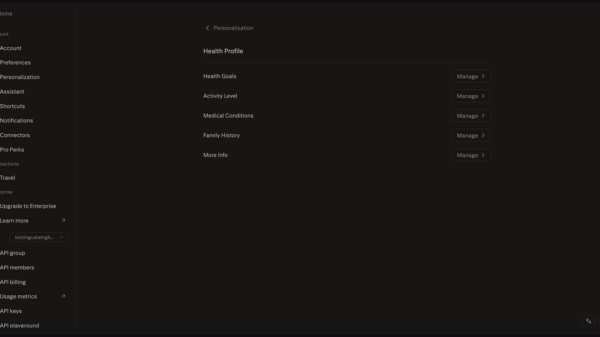

Five years after a seismic shift in its corporate trajectory, Ant Group Co. is embarking on a strategic pivot aimed at merging artificial intelligence and healthcare in a market projected to reach $69 billion. The financial technology giant, once stymied by Chinese regulatory actions that halted its record-setting initial public offering in late 2020, is now leveraging its extensive data infrastructure and AI capabilities to address critical challenges in China’s healthcare landscape.

Reported by Bloomberg, this move signifies a significant transformation in Ant Group’s identity. The company is moving beyond its dependence on Alipay and consumer lending to establish an AI health division, which executives believe could rival its payments business. This shift comes as China grapples with strains on its healthcare system due to an aging population, rising rates of chronic diseases, and uneven access to quality medical care, particularly in rural areas.

Understanding Ant Group’s urgency in pursuing healthcare requires insight into its post-IPO evolution. Following the cancellation of its $37 billion public offering in November 2020, a decision that reverberated through global markets, Ant was compelled to restructure. The company transitioned into a financial holding entity under the oversight of the People’s Bank of China, curtailed its consumer lending activities, and witnessed founder Jack Ma retreat from the public eye. This backdrop of regulatory scrutiny has catalyzed the strategic creativity within Ant Group, which has sought new avenues for deploying its technology amid tightened data usage regulations.

Healthcare emerged as an attractive sector, particularly as the Chinese government has actively encouraged private participation in digital health under its “Healthy China 2030” initiative. Ant Group’s healthcare ambitions are underpinned by advanced technical foundations, highlighted by its development of specialized large language models tailored for medical applications. These tools include diagnostic support systems capable of analyzing patient symptoms, medical imaging, and electronic health records to assist healthcare professionals in clinical decision-making. This capability draws on Ant’s extensive experience in managing vast datasets through Alipay, which serves over one billion users across China and Southeast Asia.

In addition, Ant Group is investing substantially in what it calls “intelligent health management,” creating AI-driven platforms that enable individuals to monitor chronic conditions like diabetes and hypertension. These platforms integrate with wearable devices and mobile applications to deliver real-time health insights, medication reminders, and early warning alerts. Given that an estimated 300 million people in China suffer from chronic diseases, the market potential is significant. Ant’s leadership views this venture not only as a potential revenue stream but also as a way to demonstrate social value, a critical factor in today’s regulatory environment.

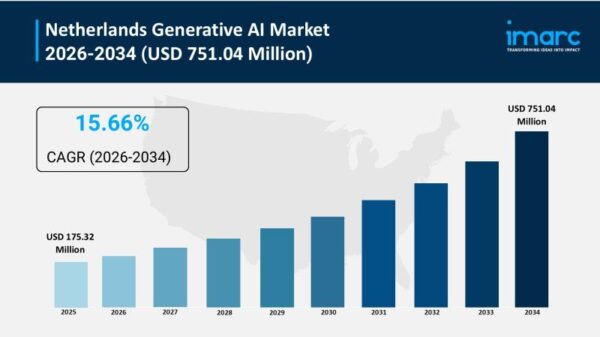

The projected $69 billion AI healthcare market in China is fueled by increasing government investment, private capital, and a growing consumer appetite for digital health solutions. This trend aligns with global observations by the World Health Organization, which has identified AI as a transformative force in healthcare delivery. With its comprehensive health data systems and robust AI initiatives, China is poised to be a leader in this evolving landscape.

However, Ant Group faces stiff competition from other tech giants in China. As noted by Bloomberg, Tencent Holdings Ltd. is advancing its AI health initiatives through WeChat-integrated telemedicine services, while Baidu Inc. is utilizing its deep learning expertise to create clinical decision support systems. Additionally, JD Health is aggressively expanding into online consultations, and Ping An Good Doctor, backed by Ping An Group, has long been a major player in the telemedicine space.

Analysts suggest that Ant Group’s competitive edge lies in its vast distribution network. With Alipay embedded in the daily lives of over a billion users, Ant can seamlessly integrate health services within its extensive ecosystem of financial offerings, creating a “closed loop” that encompasses payments, insurance, and healthcare solutions. For example, users may purchase health insurance via Alipay, receive AI-driven health monitoring through an Ant platform, and pay medical bills all within the same app.

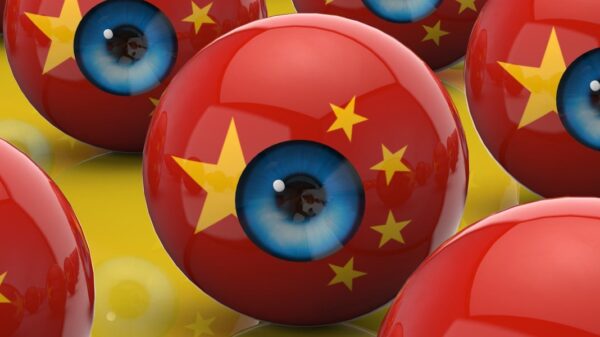

Nonetheless, significant challenges remain. Concerns regarding data privacy and security loom large, particularly in the healthcare sector, where compliance with China’s Personal Information Protection Law and health data regulations are paramount. Ant Group, which has previously faced scrutiny over its handling of financial data, must ensure rigorous compliance to avert past pitfalls. Additionally, questions about the clinical validation of AI tools pose challenges in gaining trust from hospitals and physicians, who may be hesitant to rely on algorithmic recommendations over established clinical practices.

The participation of Jack Ma in this shift is a topic of speculation. Following his diminished public presence post-IPO cancellation, Ma has re-emerged, reportedly engaging more actively with Ant’s strategic direction and expressing personal interest in healthcare technology. However, the extent of his influence on day-to-day operations remains uncertain.

Geopolitical considerations also play a role in Ant’s healthcare venture. As tensions between the U.S. and China shape global technology dynamics, Chinese firms advancing AI capabilities face increased scrutiny, especially in sensitive sectors like healthcare. Despite this, Ant Group’s AI health tools could tap into substantial markets in Southeast Asia, where the company already operates local payment platforms such as GCash in the Philippines and Dana in Indonesia, potentially offering international growth avenues.

Ant Group’s foray into healthcare reflects a broader trend among Chinese tech giants seeking new growth opportunities amid regulatory pressures. Companies like Alibaba Group and ByteDance are pivoting toward sectors aligned with Beijing’s industrial priorities. With healthcare recognized as a strategic priority by China’s State Council, local governments have begun implementing incentive programs to foster AI adoption in hospitals.

The stakes for Ant Group could not be higher. The company’s valuation, once estimated at over $300 billion, has significantly declined since its failed IPO attempt. A successful healthcare initiative could restore investor confidence and possibly open doors to a future public listing, though the immediate future may see the AI health division operating at a loss as significant investments in technology, regulatory compliance, and healthcare partnerships are made. Ant Group has evolved since its peak in 2020, and its commitment to navigating the complexities of the Chinese market positions it to tackle one of the most pressing challenges of our time: transforming healthcare for 1.4 billion people in a rapidly changing demographic landscape.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics