The rise of artificial intelligence tools is prompting Chief Financial Officers (CFOs) to intensify their focus on investor relations, according to new research conducted by Gartner. In a survey of 146 finance leaders, 43% indicated they are dedicating more time to preparing for earnings calls in 2025 compared to 2024. Additionally, 34% reported increases in various metrics related to investor communications and engagements, highlighting the growing importance of effective communication in a technology-driven landscape.

Dymah Paige, director analyst for research in Gartner’s finance practice, noted that companies must adapt to meet investors’ escalating capabilities in AI. “It is going to become increasingly difficult for organizations to control their narrative and influence investors with manual tools alone,” Paige stated. “To keep pace, CFOs should be considering private AI solutions that can help them to spend more of their time and effort on higher-impact priorities.” This signifies a shift in how financial leaders must operate, as they seek to leverage technology to maintain a competitive edge.

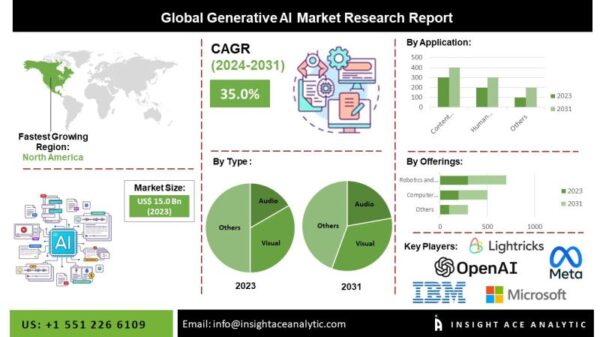

While Gartner did not specify particular tools, it outlined categories of AI applications designed for investors. These include fundamental and equity research terminals that automate the analysis of financial documents; technical analysis and trading bots that facilitate automated trading decisions; portfolio management “co-pilots” that serve as digital advisers; and alternative data and sentiment trackers that analyze non-traditional data sources.

As finance teams begin to utilize these advanced tools, they can also enhance their investor relations (IR) workflows, increasing operational efficiency and intelligence depth. Companies can adopt these solutions quickly and deploy them in secure environments, according to Paige, ensuring they meet both immediate and strategic needs. However, the research also highlights significant challenges that CFOs face in managing the financial implications of AI investments.

Gartner emphasized that initial AI investments often concentrate on experimentation and deployment, yet as adoption grows, the associated costs can escalate rapidly. The report points out that organizations lacking governance or relying heavily on external vendors are particularly vulnerable. “CFOs must act now to prevent AI-related expenses from undermining financial health,” it warned. Identifying volatile cost drivers specific to AI will be crucial for organizations aiming to control their budgets effectively.

Three key cost drivers were identified in the report. The first is the pace of consumption: as AI usage increases, costs also rise. CFOs are encouraged to advocate for governance tools that monitor and regulate this usage. Secondly, vendor dependency poses a challenge, particularly for organizations with lower AI maturity. Gartner advised CFOs to seek transparency in pricing models and to negotiate flexible terms with vendors. Finally, data management is highlighted as a significant expense, prompting CFOs to champion adaptive data governance strategies to maintain high-quality data while minimizing duplication.

The insights from Gartner’s research underscore a broader trend in the financial sector, where technology increasingly dictates the pace and effectiveness of investor engagement. As more CFOs recognize the need to adapt to AI advancements, the dynamic between finance teams and investors will likely evolve, necessitating new strategies and tools to navigate this changing environment. The capacity to harness AI effectively may soon become a defining characteristic of successful investor relations and financial performance.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025