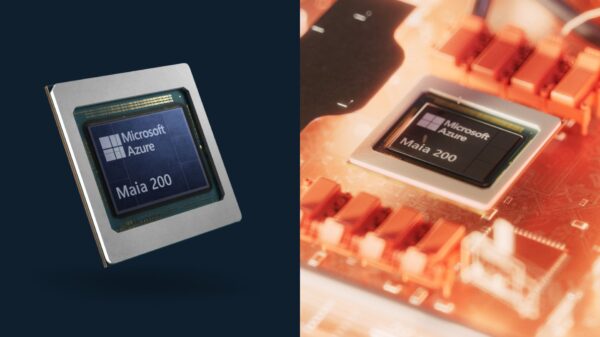

Microsoft Corporation (NASDAQ:MSFT) is drawing attention as Jim Cramer discussed its recent stock performance during his weekly investment guidance on January 7. Cramer pointed out that the company’s valuation has significantly declined, partly due to pressures on the software industry stemming from advancements in generative AI.

Cramer, who leads the CNBC Investing Club, forecasted a wave of activity for that Wednesday, with several companies including Microsoft, Meta, and Tesla scheduled to report earnings. He noted that while a number of the “Magnificent Seven” stocks had struggled, Microsoft had been particularly affected. He remarked, “Microsoft’s been weak in part because all software companies are under pressure from generative AI.” Cramer views the market’s apprehension as misplaced, suggesting that it has substantially reduced Microsoft’s price-to-earnings multiple.

The broader context reveals a challenging landscape for technology companies as they navigate the rapid evolution of AI technologies. Despite a strong track record, Microsoft’s stock has faced headwinds, particularly after the company invested heavily in AI development. Cramer highlighted the stock’s decline since its last earnings report, stating, “Ever since Microsoft reported its latest quarter, the stock’s going pretty much straight down.” He urged investors to take note of the current stock price of $485, especially when compared to its peak of $555 during the previous summer.

Microsoft, known for its diverse portfolio that includes products like Windows, Azure, Office, LinkedIn, and Xbox, is attempting to reposition itself amid evolving market dynamics. Cramer acknowledged the company’s strong operational performance but emphasized the challenges brought by its extensive spending on AI initiatives. This investment strategy, while potentially transformative in the long run, has impacted short-term investor sentiment.

Analysts have noted that while Microsoft remains a solid option for long-term investors, there may be other AI-related stocks that present more attractive near-term opportunities. The market’s focus on generative AI has led to a reevaluation of various tech stocks, prompting some investors to consider alternatives with potentially higher upside and lower risk profiles. In this atmosphere, various reports have surfaced highlighting other undervalued AI stocks that could benefit from ongoing trends such as onshoring and tariff implications from previous administrations.

As the earnings season unfolds, Microsoft’s performance will be closely scrutinized, particularly in light of Cramer’s insights. The company’s ability to navigate the complexities of AI integration while maintaining a solid financial footing will be critical in determining its stock trajectory in the coming months. Investors remain keenly aware that opportunities within the tech sector can shift rapidly, necessitating a careful approach to portfolio management.

Looking ahead, the implications of generative AI on the software industry will continue to be a topic of debate among investors and analysts alike. As companies explore new technologies and frameworks, the competitive landscape is likely to evolve, creating both challenges and opportunities for established players like Microsoft. The forthcoming earnings reports from major tech companies will serve as a barometer for market sentiment and can influence trading strategies across the sector.

See also Sam Altman Praises ChatGPT for Improved Em Dash Handling

Sam Altman Praises ChatGPT for Improved Em Dash Handling AI Country Song Fails to Top Billboard Chart Amid Viral Buzz

AI Country Song Fails to Top Billboard Chart Amid Viral Buzz GPT-5.1 and Claude 4.5 Sonnet Personality Showdown: A Comprehensive Test

GPT-5.1 and Claude 4.5 Sonnet Personality Showdown: A Comprehensive Test Rethink Your Presentations with OnlyOffice: A Free PowerPoint Alternative

Rethink Your Presentations with OnlyOffice: A Free PowerPoint Alternative OpenAI Enhances ChatGPT with Em-Dash Personalization Feature

OpenAI Enhances ChatGPT with Em-Dash Personalization Feature