Broadcom’s stock saw an uptick of approximately 1.8% in pre-market trading on Friday, indicating a possible rebound after a slow start to the year. This rise can be attributed to a combination of favorable developments, including a significant artificial intelligence infrastructure expansion by Meta Platforms utilizing Broadcom’s semiconductor technology and a revised price target announced by a prominent investment bank.

Analysts at Susquehanna Financial Group raised their price target for Broadcom, citing a strong first-quarter order book. They noted accelerated advancements in AI and extended lead times within the semiconductor sector as signs of robust, ongoing demand.

At the same time, a notable strategic development emerged from Meta Platforms. CEO Mark Zuckerberg’s initiative to significantly increase the company’s AI data center capacity is expected to enhance its collaboration with Broadcom. Observers predict that Broadcom will play an essential role in manufacturing Meta’s custom-developed AI accelerators, known as MTIA. The company supplies the specialized application-specific integrated circuits (ASICs) necessary for these high-performance applications, positioning its semiconductor division to gain directly from multi-billion dollar investments.

In addition to these developments, Broadcom secured a significant government contract this week. The U.S. General Services Administration (GSA) finalized a “OneGov” agreement that allows federal agencies to access discounts of up to 64% on VMware products, including the Tanzu platform and vDefend security software. Effective until May 2027, this deal establishes a recurring revenue stream for Broadcom’s software segment within the public sector.

Despite these positive indicators, not all metrics reflect unanimous optimism regarding Broadcom’s prospects. A recent discounted cash flow analysis by Simply Wall St. suggests that the stock may be trading at a roughly 13% premium to its estimated intrinsic value, particularly from a conservative valuation perspective. However, institutional investor sentiment remains robust. In a notable show of long-term confidence, Cathie Wood’s Ark Invest purchased over 143,000 shares of Broadcom in mid-January, a transaction valued at approximately $50.7 million.

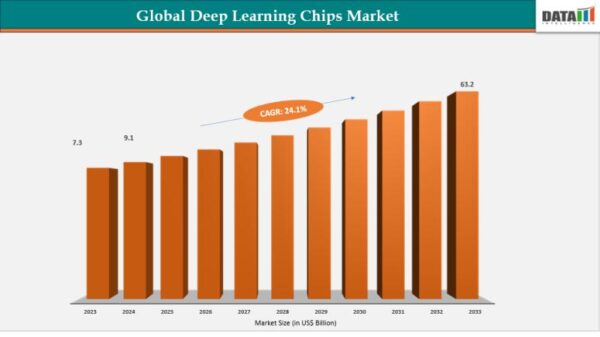

The semiconductor industry is currently influenced by an “AI arms race,” with forecasts indicating that global data center investments could soar to between $3 and $4 trillion by 2030. Broadcom, with its dual expertise in AI networking technology and custom silicon, is well-positioned to capitalize on both aspects of this trend. The company’s upcoming quarterly results in March will provide critical insights into whether analyst expectations are being met, as investors weigh the implications of these developments for their portfolios.

See also AI Technology Enhances Road Safety in U.S. Cities

AI Technology Enhances Road Safety in U.S. Cities China Enforces New Rules Mandating Labeling of AI-Generated Content Starting Next Year

China Enforces New Rules Mandating Labeling of AI-Generated Content Starting Next Year AI-Generated Video of Indian Army Official Criticizing Modi’s Policies Debunked as Fake

AI-Generated Video of Indian Army Official Criticizing Modi’s Policies Debunked as Fake JobSphere Launches AI Career Assistant, Reducing Costs by 89% with Multilingual Support

JobSphere Launches AI Career Assistant, Reducing Costs by 89% with Multilingual Support Australia Mandates AI Training for 185,000 Public Servants to Enhance Service Delivery

Australia Mandates AI Training for 185,000 Public Servants to Enhance Service Delivery