Arm Holdings (NasdaqGS:ARM) marked a significant milestone by reporting its strongest quarter to date, fueled by an increasing demand for its chip designs associated with artificial intelligence (AI) workloads. The results reflect the growing reliance on advanced processing capabilities amid an evolving technological landscape, where efficiency and performance are paramount.

In tandem with its earnings announcement, Arm revealed a new collaboration with Meta aimed at enhancing AI efficiency in both consumer devices and data centers. This partnership signifies an important step for Arm as it seeks to solidify its relevance in the rapidly expanding AI sector.

Additionally, Arm launched its new Lumex CSS mobile platform, tailored to support sophisticated on-device AI functionalities in forthcoming flagship smartphones. This development positions Arm to cater to the increasing computational demands of modern mobile technology, emphasizing the need for power-efficient solutions.

As of the latest reporting, Arm’s shares stand at $105.36, representing a notable decline of 34.0% over the past year. This backdrop underscores the importance of the record quarter, the collaboration with Meta, and the introduction of the Lumex CSS platform, particularly for investors focused on how Arm is adapting to the demands of AI-centric computing.

A critical point for investors is the potential adoption of Arm’s intellectual property (IP) and platforms across a diverse array of devices, from smartphones to consumer electronics and data centers. The new partnership with Meta, alongside a strong emphasis on on-device AI, suggests that Arm is positioning itself to play a central role in distributing AI workloads between edge devices and the cloud.

This strategic direction aligns with Arm’s broader goal of expanding its licensing and royalty income as AI applications migrate from traditional cloud environments into what the company refers to as physical and edge AI. Projects with Meta, in conjunction with earlier collaborations with firms like Amazon Web Services, Google, and Apple, reflect an ongoing trend of diversifying the use of Arm architectures beyond mere smartphone cycles.

The collaboration with Meta, along with the launch of Lumex CSS, is expected to deepen Arm’s penetration into the AI data center market and premium smartphone segment. Such initiatives support its objective of achieving higher-value IP and wider adoption across various sectors.

Arm’s asset-light, licensing-based model, complemented by long-term agreements with major technology players, provides a foundation of recurring royalties that can be leveraged for future growth. However, analysts have pointed to potential execution risks as Arm ventures into complex compute subsystems and custom silicon, where unexpected cost overruns or delays could negatively impact returns.

The company’s dependence on flagship smartphones and large clients, alongside a share price that some market observers consider high, could magnify the effects of any downturn in AI or handset demand.

Moving forward, it will be crucial to monitor how quickly Lumex CSS is integrated into flagship devices, as well as how rapidly Meta and other hyperscalers can scale Arm-based AI projects into greater volumes. Furthermore, trends in licensing and royalty revenues will be essential to observe, particularly in comparison to competitors such as Nvidia, AMD, and Intel.

For those interested in deeper insights into Arm Holdings, a visit to the dedicated Arm Holdings page and the community narratives can provide a range of perspectives on the company’s evolving story in the tech landscape.

This coverage is based on publicly available information and analyst forecasts. It is important to note that the article does not constitute financial advice and does not account for individual financial circumstances.

Companies discussed in this article include Arm Holdings.

See also OpenAI Reveals AI Agent Security Measures to Combat Malicious Links and Prompt Injection

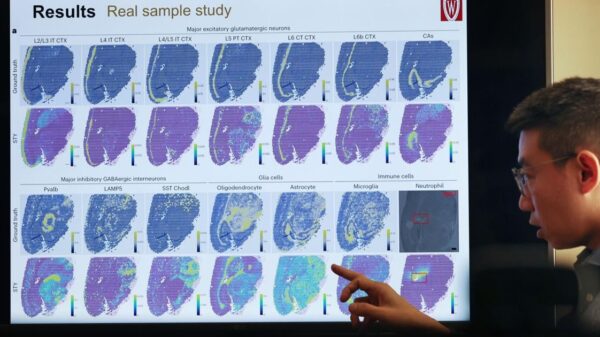

OpenAI Reveals AI Agent Security Measures to Combat Malicious Links and Prompt Injection Wisconsin Universities Lead AI Innovation with Groundbreaking Research and Collaborations

Wisconsin Universities Lead AI Innovation with Groundbreaking Research and Collaborations Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032