The global financial landscape has undergone a dramatic transformation in February 2026, with precious metals reaching unprecedented prices. As of February 11, 2026, Gold has surged past $5,100 per ounce, while Silver has skyrocketed beyond $112 per ounce. This remarkable price surge is fueled by a confluence of factors including systemic currency volatility, a tense diplomatic standoff between the United States and Iran, and an industrial demand shift driven by the artificial intelligence revolution.

The implications of these price changes are significant, with many investors seeking physical delivery and moving away from traditional sovereign debt. For the first time in decades, the gold-to-silver ratio has compressed below 50:1, signaling that silver has evolved from being merely “poor man’s gold” to a vital strategic technology metal. Institutional investors and central banks are increasingly turning to precious metals as a hedge against a weakening U.S. Dollar, marking what many are calling the “Great Revaluation” of 2026 and prompting a re-evaluation of global supply chains and monetary policy.

The catalyst behind this rally is linked to high-stakes diplomatic negotiations taking place in Muscat, Oman. A brief but destructive conflict between Israel and Iran in June 2025, which included U.S. airstrikes on Iranian nuclear facilities, has led to renewed talks beginning on February 6, 2026. While Iran has reportedly offered to surrender 400 kg of highly enriched uranium, its refusal to negotiate on its ballistic missile program has maintained a “war premium” on precious metals, pushing investors toward Gold as a safe haven.

Simultaneously, the U.S. Federal Reserve is experiencing a transition that has unsettled currency markets. The appointment of Kevin Warsh as the new Fed Chair was initially seen as a hawkish move, but his recent advocacy for lower interest rates to stimulate sluggish domestic growth has led to a drop in the U.S. Dollar Index (DXY) toward the 94-97 range. This shift, combined with a 9.4% depreciation of the U.S. Dollar throughout 2025, has diminished the currency’s appeal, allowing Gold to reclaim its status as a primary store of value.

The market response has been chaotic. Following a “flash crash” in late January 2026, where silver briefly reached $121 before being pushed down by algorithmic selling, the market has seen a “violent recovery” in early February. Exchange-traded funds (ETFs) and physical bullion dealers are reporting unprecedented wait times for delivery as the availability of metal in the commercial market shrinks.

Major mining companies are among the primary beneficiaries of this price escalation, experiencing record free cash flow. Newmont Corporation (NYSE: NEM) and Barrick Gold (NYSE: GOLD) have seen soaring market capitalizations as they report unparalleled margins on gold extraction. In the silver market, Pan American Silver (NASDAQ: PAAS) and First Majestic Silver (NYSE: AG) are leading the way, with the latter benefiting from its decision to withhold bullion during 2025’s volatility, successfully timing its current sales.

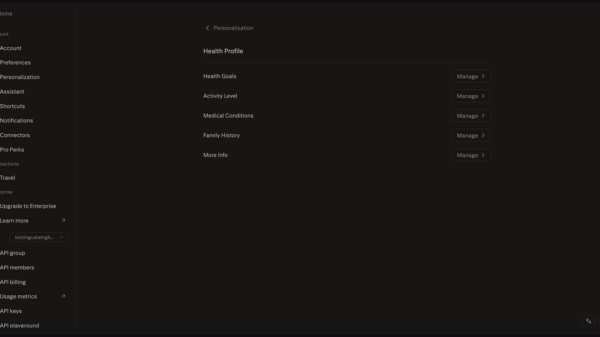

However, the dynamics are shifting from traditional mining to strategic partnerships, particularly in light of the AI infrastructure boom. Companies such as Microsoft (NASDAQ: MSFT) and NVIDIA (NASDAQ: NVDA) have emerged as significant players in the silver market due to the increased silver usage in AI server thermal management. They have begun establishing direct “offtake agreements” with miners, which bypass traditional exchanges and further tighten supply for smaller industrial users.

In contrast, electronics manufacturers and solar panel producers that did not hedge their silver exposure in 2024 and 2025 are now facing challenges. Tesla (NASDAQ: TSLA), despite its aggressive supply chain strategies for solar and EV components, is encountering significant cost pressures across its broader product lines. Many mid-cap industrial firms now view the triple-digit silver price as a structural threat, prompting a wave of redesigns aimed at minimizing silver usage.

This rally represents a unique intersection of 1970s-style geopolitical hedging with modern technological demand. The “AI-driven market shift” encompasses not just trading algorithms but also physical infrastructure; data centers for generative AI require massive amounts of energy, prompting a pivot toward silver-intensive solar energy. This dual demand—silver for AI chips and for solar panels—has created a segment that is less sensitive to macroeconomic fluctuations, likely keeping silver prices elevated.

Looking ahead, the market trajectory largely hinges on the outcome of negotiations in Oman. Should a “Grand Bargain” emerge between the U.S. and Iran, it could trigger a $400-$500 correction in Gold prices. Analysts at J.P. Morgan anticipate that any dip will be shallow, projecting Gold to reach $6,300 by the end of 2026 due to a revaluation of the global monetary system that no longer relies solely on the U.S. Dollar.

Investors should also be vigilant about potential regulatory changes. As silver is increasingly recognized as a “strategic technology metal,” discussions regarding export controls or stockpiling mandates similar to those for lithium and cobalt are gaining traction in Washington and Brussels. Should Western governments compete with Big Tech for silver reserves, the current price floor of $112 could swiftly become a distant memory.

The events of February 2026 illustrate that traditional financial strategies are no longer sufficient. Gold at $5,100 and Silver at $112 reflect a profound loss of faith in fiat currency systems and a growing search for stability in an AI-driven, geopolitically fragmented world. The key takeaway is that the “industrialization” of precious metals, particularly silver, has significantly altered the supply-demand balance. As the market navigates high volatility, the focus will shift towards the outcomes of the Oman talks and the quarterly reports of major tech players to determine if the current market dynamics will disrupt existing paper markets.

See also Micron Stock Soars 10% as HBM4 Production Begins, 2026 Supply Sold Out Amid AI Demand

Micron Stock Soars 10% as HBM4 Production Begins, 2026 Supply Sold Out Amid AI Demand Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs