Investment in artificial intelligence (AI) is experiencing a pivotal shift as capital flows into the sector accelerate. Recent discussions with over 60 institutional limited partners (LPs) across Europe, North America, and Southeast Asia reveal that while investor appetite for AI remains robust, the criteria for evaluating potential returns and associated risks are evolving significantly.

As AI technologies transition from experimental phases to becoming integral components of economic and institutional frameworks, governance and compliance considerations are re-emerging as critical factors in investment decisions. Issues such as procurement risk, loss of operational control, and regulatory exposure are not merely peripheral concerns but now represent binding commercial constraints.

Investors are increasingly aware that early design choices related to data control, model dependencies, interoperability, and accountability are shaping the viability of AI systems. These decisions influence not only individual companies but also the broader portfolios that investors manage. In a climate marked by geopolitical instability and heightened regulatory scrutiny, the demand for AI systems that ensure control, resilience, and agency has transformed from a preference to a necessity for deployment.

This development indicates a material shift in the landscape; architecture itself has become an investable variable, with control emerging as a competitive advantage. AI systems that are not designed with governance and long-term operability in mind are now confronting limitations that pure capital investment cannot surmount. The ongoing discourse has shifted from mere transparency and alignment to a focus on strategic necessity as AI systems integrate into core operational structures.

As the landscape continues to evolve, investors are beginning to grapple with the question: what constitutes “good” AI investment? This inquiry extends beyond merely utilizing AI tools to optimize outcomes in sectors like healthcare and education; it involves investing directly in the AI stack, which serves as digital infrastructure influencing decision-making, information flows, and value creation.

A better AI stack

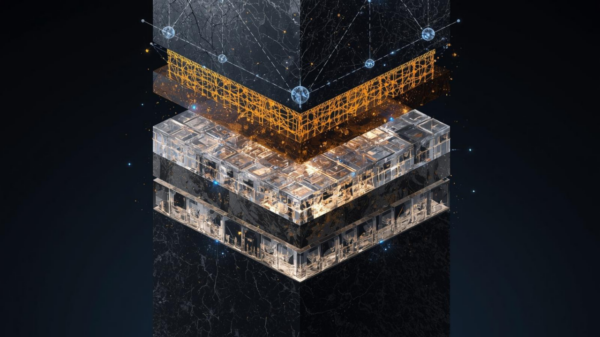

Impact investment in AI can be understood as a systemic approach aimed at fostering a pro-human AI stack across three interlinked layers: infrastructure, applications, and assurance.

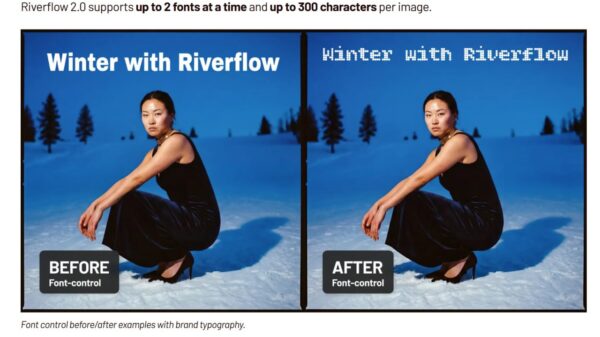

At the infrastructure layer, focus shifts toward the technical foundations that govern how AI is built and managed. Investments are directed toward data architectures, model governance, and protocols that emphasize privacy-preserving machine learning and interoperability standards. Rather than attempting to replicate the dominance of hyperscale players, these approaches aim to foster pluralistic and resilient AI ecosystems, addressing the increasing demand from governments and enterprises for secure, auditable infrastructure.

Moving to the application layer, the emphasis is on how AI systems integrate into everyday services across various sectors. Applications that prioritize accountability, user trust, and human oversight are crucial as AI systems take on greater autonomy in decision-making. The challenge lies in scaling these applications without generating new forms of dependency or systemic fragility.

The assurance layer targets the expanding market for AI governance and accountability technologies. As AI systems become more deeply embedded in critical functions, scalable human oversight requires dedicated monitoring and compliance tools. The growing maturity of regulatory frameworks signals that assurance is no longer just a cost but a prerequisite for large-scale deployment.

As demand for open and resilient AI systems rises, capital is increasingly directed toward architectures that guarantee user agency and accountability. Governments and enterprises are integrating AI-related governance into their procurement processes, thereby shaping market demands. This shift is reshaping investor expectations and driving venture firms to reassess their strategies regarding AI investment, particularly in light of heightened regulatory requirements.

Family offices, often cautious about the rapid inflow of capital into AI, are beginning to explore more systemic investment strategies that align with public interests. Their unique position allows them to deploy capital across various instruments, potentially influencing the early market dynamics that could define the future of AI returns.

While the field of impact investment in AI is still developing, the direction is clear. Market signals are becoming more consistent, driven by a shared understanding of the importance of governance and accountability in AI design. As the conversation transitions from speculative investments to consideration of long-term viability, the focus is on how to create, protect, and capture value in an increasingly regulated environment.

The broader implication is also taking shape: as AI becomes a foundational element of economic activity, the line between impact and mainstream investment is likely to blur. Investors must consider not only the potential for AI technologies but also the governance frameworks that will determine their scalability and resilience in the face of emerging regulatory landscapes.

The next phase of opportunity in AI investment will be defined not by speed but by the ability to build systems that ensure long-term viability and adaptability. Capital that supports the development of a robust AI stack is poised to capture enduring value, facilitating access to markets while mitigating the risks of obsolescence.

See also Montage’s $902M IPO Soars 64%, Signaling Investment Surge in China’s AI Ecosystem

Montage’s $902M IPO Soars 64%, Signaling Investment Surge in China’s AI Ecosystem Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs