As the Federal Reserve grapples with the dual challenges of cooling inflation and a surge in productivity driven by technology, San Francisco Fed President Mary Daly has characterized the central bank’s current position as a “sweet spot.” Speaking on February 20, 2026, she noted that current monetary policy is “well-positioned” to address a stabilizing labor market while cautiously moving toward the targeted 2% inflation rate.

Daly’s remarks imply that the Federal Open Market Committee (FOMC) will likely adopt a “steady-as-she-goes” approach. By maintaining the federal funds rate in the 3.50%–3.75% range, the Fed seeks to create an adequately restrictive environment that curbs lingering price pressures in the services sector while allowing the positive effects of artificial intelligence (AI) to seep into the economy without the risk of premature tightening.

In an address at San Jose State University on February 17, 2026, titled “The AI Moment? Possibilities, Productivity, and Policy,” Daly provided an extensive review of the Fed’s position. Her speech came after a series of rate cuts in late 2025, totaling 75 basis points, which brought the federal funds rate down from its peak in 2024. She emphasized that this “deliberate calibration” has facilitated a new equilibrium in the labor market, transitioning from frantic hiring earlier in the decade to a more sustainable pace of job creation.

Daly’s analysis draws on recent research from the San Francisco Fed, which indicates that while macroeconomic data has yet to display a significant leap in productivity, micro-level evidence is compelling. She likened the current situation to the mid-1990s under former Fed Chair Alan Greenspan, who famously contended that productivity gains from the internet era were being underestimated, allowing for a longer period of lower interest rates amid non-inflationary growth.

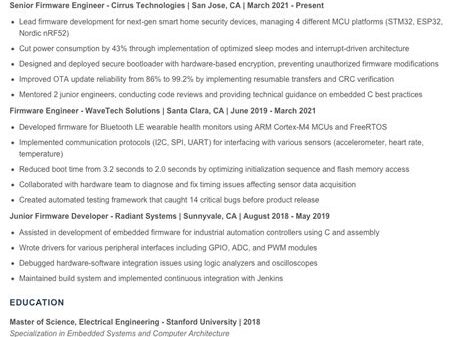

The preceding months have seen a shift in Fed rhetoric. Through 2025, officials debated the potential for AI to cause massive job displacement. However, Daly cited a November 2025 San Francisco Fed paper, “Job Transformation, Specialization, and the Labor Market Effects of AI,” which posited that AI is primarily augmenting human roles. Initial reactions to her assertions were positive, with Treasury yields stabilizing and equity markets buoyed by the prospect of a prolonged halt in rate hikes.

The Fed’s acknowledgment of AI-driven productivity gains creates an advantageous environment for companies providing the infrastructure for this technological transformation. For instance, **NVIDIA Corp** (NASDAQ: NVDA) stands to benefit significantly, as the Fed’s inclination to permit a slightly “hotter” economy based on productivity justifies substantial investments in data centers and AI infrastructure. Similarly, **Microsoft Corp** (NASDAQ: MSFT) and **Alphabet Inc** (NASDAQ: GOOGL) are poised to gain as their enterprise AI solutions start to yield measurable efficiency improvements, which Daly admits currently remain “under the hood” of official GDP figures.

Conversely, the shift toward AI-driven efficiency poses challenges for traditional business service providers and legacy firms that have been slow to adopt new technologies. **Salesforce Inc** (NASDAQ: CRM), despite being a leader in the space, must continually adapt to ensure its software remains a primary interface for an increasingly “augmented” workforce. Mid-market firms in the “information processing” sector may become the “losers” in this landscape, facing wage stagnation as tasks are automated, as highlighted in the SF Fed’s December 2025 research focused on lower-income service roles.

Daly’s mention of the “neutral rate” (r*) implies that the long-term cost of capital may surpass pre-pandemic levels, potentially creating headwinds for highly leveraged, non-tech firms that were anticipating a return to near-zero interest rates. The so-called “Daly Doctrine” suggests that the era of cheap money may be over, giving way to a “higher-for-longer” baseline supported by AI-driven growth.

The Broad Implications of Daly’s Remarks

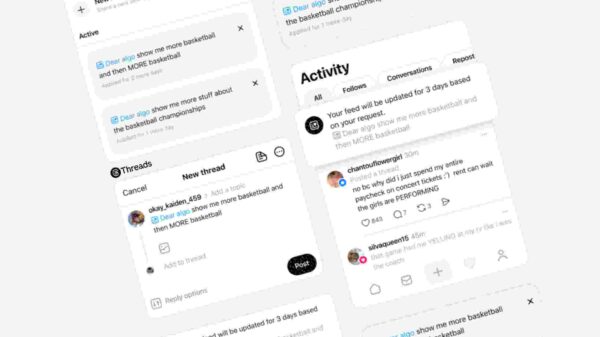

The broader significance of Daly’s comments lies in the potential recalibration of the U.S. economy’s “speed limit,” or the growth rate that can occur without triggering inflation. If AI indeed enhances productivity, the Fed could afford a less aggressive stance on interest rate hikes, even amid robust growth. This aligns with a growing trend where “hyper-efficiency” becomes the norm; recent discussions with venture capitalists revealed that AI agents enable “solo founders” to achieve outputs comparable to those of ten-person teams.

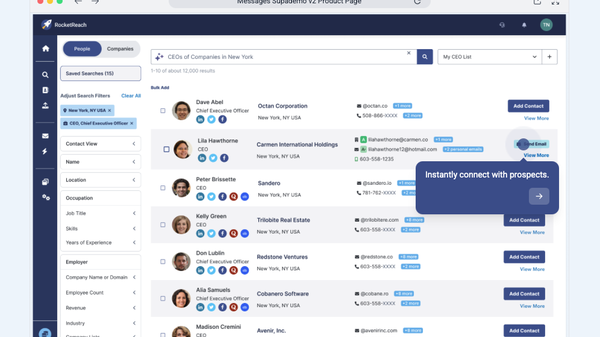

Regulatory and policy implications are also emerging. Daly’s emphasis on “disaggregated data” suggests a more precise approach to monetary policy, reminiscent of the late 1990s but enhanced by the SF Fed’s use of innovative tools like “ChatMacro,” a generative AI model for evaluating inflation forecasts. By incorporating AI into their predictive modeling, the Fed signals a notable shift toward tech-augmented governance.

This stance also provides resilience against global economic challenges. By recognizing that AI may be helping to keep domestic inflation in check through reduced production costs, the Fed stands ready to maintain stability even as other global central banks grapple with fluctuating energy prices and supply chain issues. This potential for “American exceptionalism” in productivity may bolster the dollar and attract global investment into U.S. tech equities.

In the immediate term, market observers should anticipate the Fed remaining on hold through the first half of 2026. The strategic focus for investors will shift from speculation about “when the next cut is” to understanding “how high is the neutral rate.” Should Daly’s assessment hold true and AI continues to push the neutral rate upward, we could witness a permanent adjustment in the valuation models for long-duration assets.

A potential risk lies in the “lag” associated with official data. Aggregate productivity statistics are often slow to reflect technological advancements. There exists a possibility that the Fed may react too late to a sudden growth surge or remain restrictive for too long if AI gains do not transition from the “micro” to the “macro” level. Investors should monitor the San Francisco Fed’s forthcoming “Business Inflation Expectations” surveys for early indicators of AI-driven price moderation.

Long-term, the landscape of “Job Transformation” will necessitate significant societal shifts in education and training. The Fed’s research suggests that the most successful workers in 2026 will be those who adapt to “coordination and customer-facing tasks” where human empathy retains a competitive edge. Companies investing in “reskilling” their workforce to collaborate with AI agents are likely to emerge as leaders in the late 2020s.

Mary Daly’s recent communications mark a critical juncture in central banking. By labeling policy as “well-positioned” and invoking the “Greenspan Parallel,” she signals the Federal Reserve’s readiness to embrace the productivity-enhancing potential of AI. The key takeaways are clear: the federal funds rate has likely found its floor at 3.50%–3.75%, and the Fed’s focus has shifted from combating “inflation at all costs” to fostering growth through technology. As AI continues to reshape the labor market, the Fed is set to be a neutral or even supportive force for equity markets, keeping a close watch on service-sector inflation and any revisions to “r*” estimates in the FOMC’s Summary of Economic Projections.

See also Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs Wall Street Recovers from Early Loss as Nvidia Surges 1.8% Amid Market Volatility

Wall Street Recovers from Early Loss as Nvidia Surges 1.8% Amid Market Volatility