As 2025 draws to a close, the global semiconductor market finds itself grappling with a severe shortage of memory chips, a situation that could impact smartphone and personal computer (PC) markets through 2027. Driven by the burgeoning demand from AI data centers, prices for DRAM and NAND flash memory have surged dramatically, creating a significant supply-demand imbalance. According to a recent analysis by the International Data Corporation (IDC), this crisis is expected to reshape the landscape of consumer electronics in the coming year.

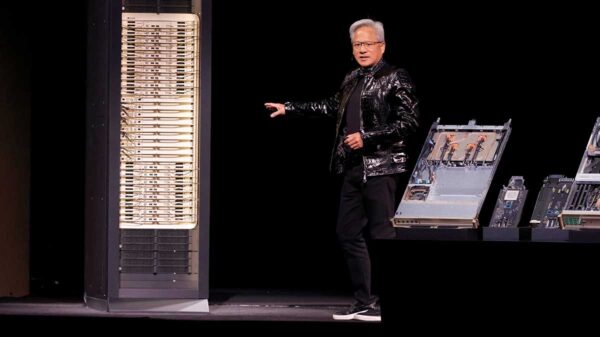

The semiconductor industry has long been characterized by cyclical fluctuations, but the current shortage represents a transformative shift, largely influenced by the rapid expansion of AI infrastructure. As companies like Nvidia and Microsoft ramp up their AI capabilities, memory manufacturers have redirected production resources away from conventional DRAM and NAND used in smartphones and PCs toward high-margin memory solutions tailored for AI applications. This strategic pivot has drastically reduced the availability of consumer-grade memory modules, pushing prices upward.

The crux of the issue lies in the disproportionate memory requirements of AI servers compared to consumer devices. AI systems, powered by hyperscalers such as Meta and Amazon, demand significantly more memory, leading suppliers to prioritize these orders over those from smartphone and PC manufacturers. Consequently, manufacturers that produce low-end devices, including brands like Xiaomi and Realme, will face the brunt of these supply constraints, resulting in heightened production costs and tighter margins.

IDC anticipates that the growth in DRAM and NAND supply will fall below historical norms in 2026, with estimates of 16% and 17% year-on-year growth, respectively. This decline is poised to have a cascading effect on the smartphone market, particularly among Android manufacturers who have been historically focused on offering high specifications at lower prices. As memory costs increase, original equipment manufacturers (OEMs) may be compelled to raise retail prices, downgrade specifications, or implement both strategies to mitigate costs.

In a moderate downside scenario, IDC forecasts a contraction of the global smartphone market by up to 2.9% in 2026, worsening to a potential decline of 5.2% in a more pessimistic outlook. Average selling prices are expected to rise correspondingly, with increases of 3% to 5% in the moderate scenario and 6% to 8% in the pessimistic scenario. The extent of these price hikes will disproportionately impact low-end devices, where margins are already minimal.

Conversely, major players like Apple and Samsung are somewhat insulated from these pressures thanks to their substantial cash reserves and long-term supply contracts, allowing them to secure memory supplies 12-24 months in advance. However, they may also have to make concessions, such as maintaining existing RAM specifications in new flagship models, limiting upgrades that consumers have come to expect.

The PC market faces a similar predicament. With the timing of the memory shortage coinciding with the end-of-life refresh cycle for Windows 10 and a burgeoning AI push in the PC sector, vendors are signaling impending price hikes of 15-20% as a direct response to supply pressures. Major brands like Lenovo, Dell, and HP are likely to gain market share from smaller competitors that may struggle to navigate the evolving supply landscape.

IDC remains firm on its official PC forecasts, with projected declines of 4.9% in a moderate downside scenario and as deep as 8.9% in a pessimistic one. Similar to smartphones, average selling prices for PCs are expected to rise by 4% to 6% under moderate conditions and by 6% to 8% under more dire circumstances. The memory crunch not only threatens the growth narrative surrounding AI PCs but also signals an era where technology becomes increasingly expensive due to supply constraints, rather than demand growth.

As the industry adjusts to this new reality, both the smartphone and PC markets are bracing for higher costs, altered product strategies, and slower growth in volume. What began as an AI infrastructure boom is now rippling through the market, reshaping pricing strategies and consumer expectations. For consumers and enterprises alike, the year 2026 is on track to usher in a new phase characterized by diminished access to affordable technology.

See also Midjourney Unveils Scrolling Style Creator, Enhancing User Experience and Artistic Exploration

Midjourney Unveils Scrolling Style Creator, Enhancing User Experience and Artistic Exploration AI Infrastructure Set to Drive Robust Growth Through 2026, Says F/m Investments’ Bido

AI Infrastructure Set to Drive Robust Growth Through 2026, Says F/m Investments’ Bido Maryland Secures $2.6M in AI Grants to Transform Public Benefits Access for 380K Residents

Maryland Secures $2.6M in AI Grants to Transform Public Benefits Access for 380K Residents Three AI and Cloud Stocks Poised for Growth with Analyst Support and Strong Fundamentals

Three AI and Cloud Stocks Poised for Growth with Analyst Support and Strong Fundamentals XPENG’s FastDriveVLA Framework Cuts Autonomous Driving Load by 7.5x, Enhancing Efficiency

XPENG’s FastDriveVLA Framework Cuts Autonomous Driving Load by 7.5x, Enhancing Efficiency