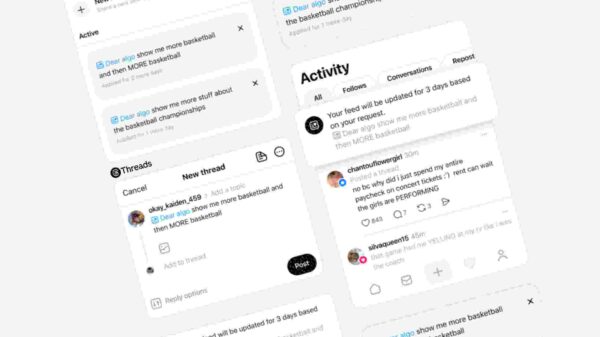

Meta Platforms is set to acquire the AI agent startup Manus for over US$2 billion as part of a broader strategy to enhance its AI-driven engagement and advertising tools across its platforms, including Facebook, Instagram, WhatsApp, and Threads. This acquisition comes as the company seeks to trim its metaverse spending plans for the upcoming year, indicating a strategic shift towards AI initiatives that could reshape how Meta monetizes its extensive user base.

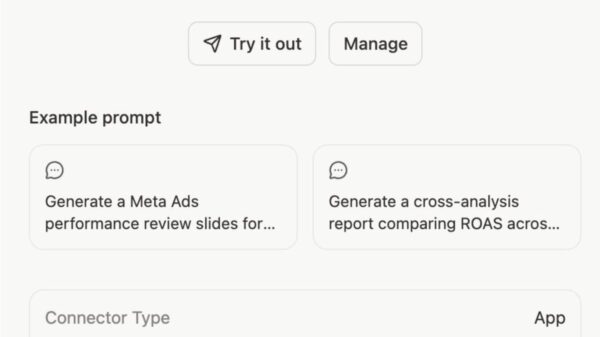

The merger with Manus, which achieved US$100 million in annual recurring revenue within its first year, supports Meta’s ongoing efforts to strengthen its monetization capabilities through advanced AI technologies. This focus aligns with recent improvements in ad performance and the gradual commercialization of messaging platforms like WhatsApp and Threads. The integration of Manus’ AI solutions could bolster Meta’s advertising strategies, yet it also raises concerns about the potential impact of increased AI capital expenditures on overall profit margins if revenue growth does not keep pace with rising costs.

Investors now face a nuanced landscape where the outlook for Meta’s financial health hinges on the efficacy of this AI spending. The Manus acquisition reinforces AI as a critical catalyst for Meta’s growth narrative, but it also adds to the company’s existing financial risks. With the Reality Labs division continuing to report losses and facing regulatory pressures, the stakes are particularly high. The immediate challenge for Meta will be ensuring that the anticipated returns from its AI investments justify the substantial outlay.

Meta’s investment narrative paints a picture of projected revenues hitting US$275.9 billion and earnings reaching US$92.1 billion by 2028. Analysts estimate a fair value of US$837.15 for the stock, reflecting a potential 29% upside from its current price. However, divergent views among market observers complicate this outlook. Estimates of Meta’s fair value among 103 members of the Simply Wall St Community range from US$538 to US$1,063 per share, highlighting significant disagreement about the company’s long-term growth potential.

The surge in AI spending, while promising, could also pressure Meta’s margins if revenue growth were to falter. Investors must consider the implications of this dynamic as the technology sector continues to evolve rapidly. While the Manus acquisition underscores Meta’s commitment to AI as a cornerstone of its growth strategy, it also amplifies concerns regarding the sustainability of its financial trajectory in a highly competitive market.

As Meta continues to navigate these challenges, the focus will remain on how effectively the company can leverage its robust user base and advanced technologies to generate revenue. The integration of AI capabilities is poised to play a pivotal role in this process, but the financial risks tied to high capital expenditures are a crucial factor that could shape investor sentiment going forward.

In conclusion, as Meta Platforms embraces AI as a driving force behind its revenue strategy, the implications of the Manus acquisition, alongside its broader AI investments, will be closely monitored. The ability of these initiatives to deliver tangible results will be critical in determining the company’s future financial health and its standing in the increasingly competitive tech landscape.

See also Western Digital’s Stock Soars 7% on AI-Driven Storage Demand Amid Valuation Reassessment

Western Digital’s Stock Soars 7% on AI-Driven Storage Demand Amid Valuation Reassessment Transforming Police Leadership: Embracing AI Governance for Community Trust by 2026

Transforming Police Leadership: Embracing AI Governance for Community Trust by 2026 Aptiv Unveils AI-Powered Edge Solutions for Safer Autonomous Vehicles at CES 2026

Aptiv Unveils AI-Powered Edge Solutions for Safer Autonomous Vehicles at CES 2026 University of Toronto Launches $20M Hinton AI Chair Backed by Google

University of Toronto Launches $20M Hinton AI Chair Backed by Google