Shares of Micron Technology surged to a record high on Tuesday, driven by a landmark $24 billion investment plan and a bullish analyst upgrade. The memory chip specialist is channeling its growth strategy into a massive expansion in Singapore, aiming to capture what one market expert describes as significant untapped potential fueled by the ongoing artificial intelligence boom.

Adding momentum to the equity’s rally, Mizuho analyst Vijay Rakesh raised his price target on Micron stock to $480 from $390, marking his second upward revision in a matter of weeks. This optimistic outlook is rooted in a forecasted supply-demand imbalance within the NAND memory market. Industry observers anticipate a 20% surge in demand this year, while production capacity is expected to remain largely flat. Such a disparity typically leads to higher prices and improved margins for manufacturers like Micron.

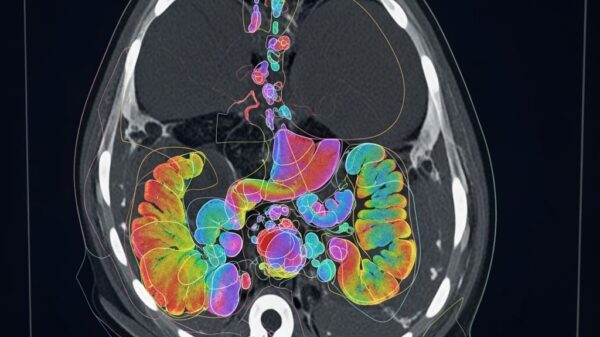

The company’s management has characterized the current environment as an “unprecedented” memory shortage. A critical factor is the intensive allocation of production resources to complex High-Bandwidth Memory (HBM), a component essential for AI servers. This shift is creating a growing deficit of conventional chips for PCs and smartphones. Market analysts suggest this shortfall could persist until the end of 2027, likely driving enterprise SSD prices even higher.

The catalyst for the recent share price advance, which pushed the stock above $404, was the formal groundbreaking for a major new project. Micron has initiated a long-term strategy to invest approximately $24 billion over the next decade into its existing NAND manufacturing complex in Singapore.

Should investors sell immediately? Or is it worth buying Micron?

The centerpiece of this plan is a new fabrication facility featuring nearly 65,000 square meters of cleanroom space. Production at this site is scheduled to commence in the second half of 2028. This expansion is a direct response to exploding demand for memory technology, driven by data-intensive applications and AI. The development is expected to create roughly 3,000 new jobs.

Concurrently, Micron is progressing on schedule with a separate Singapore-based facility dedicated to HBM production. This operation is poised to begin significant volume shipments in 2027, a key operational milestone for investors next year that will further solidify Micron’s position in the competitive AI landscape.

This substantial investment in Singapore aligns with a broader corporate realignment. The move follows Micron’s substantial exit from the server chip market in China in October 2025. By strengthening its advanced manufacturing footprint in Singapore, the company is positioning itself to navigate the tight market conditions and capitalize on the structural drivers of memory demand for years to come.

The developments at Micron highlight a growing trend in the tech industry, where memory technology is increasingly intertwined with advancements in artificial intelligence. As the demand for AI capabilities continues to rise, companies like Micron are positioning themselves to meet the future needs of a data-driven economy. This strategic pivot not only promises to bolster Micron’s market share but also serves as a beacon of innovation within a sector that remains vital to the global tech landscape.

For more information on Micron Technology, visit their official site at Micron Technology.

See also UK Firms Cut Jobs Amid 11.5% Productivity Boost from AI; Unemployment Hits Four-Year High

UK Firms Cut Jobs Amid 11.5% Productivity Boost from AI; Unemployment Hits Four-Year High Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs