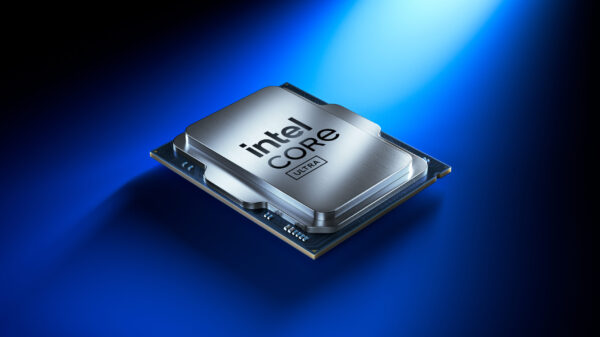

Shares of memory chip manufacturer Micron Technology saw a significant rally this week, propelled by a crucial corporate update that addressed key market concerns. The company detailed its production status for next-generation memory products, which are essential for artificial intelligence infrastructure. Micron’s stock closed the trading session on Wednesday with a gain of approximately 10%, following clarifying statements from its leadership that effectively countered recent speculation about its competitive position in the AI supply chain.

The announcement focused on the company’s advancements in High Bandwidth Memory (HBM), a specialized component vital for high-performance AI processors. During an appearance at the Wolfe Research conference, Chief Financial Officer Mark Murphy confirmed that Micron has not only launched high-volume manufacturing of its HBM4 memory chips but has also started shipping these products to customers. Notably, this timeline is ahead of the original schedule, with the ramp-up of HBM4 deliveries commencing earlier than anticipated.

Perhaps the most striking indicator of market demand came with Micron’s disclosure that its entire HBM supply for the calendar year 2026 is already sold out. This underscores the intense need for these advanced components as data centers globally scale up their AI computing capabilities.

In the wake of this announcement, financial analysts swiftly adjusted their valuations. Morgan Stanley raised its price target for Micron from $350 to $450, maintaining an “Overweight” rating on the equity. The firm cited the company’s strong execution and the exceptionally high demand for AI-related memory solutions as key reasons for the upgrade. Other financial institutions echoed this sentiment, reflecting a growing consensus that Micron is well-positioned to retain its competitive stance against rivals such as SK Hynix and Samsung in the lucrative HBM market. Optimistic observers also highlight a sustained upcycle in the memory sector, driven in part by a constrained supply meeting robust demand.

The semiconductor sector is particularly sensitive to updates regarding production yields and qualification status for HBM products, which are considered critical for modern AI accelerators. Recent weeks had seen market reports fueling doubts about Micron’s capability to meet the technical specifications required for upcoming AI platforms, contributing to stock price volatility. However, Wednesday’s announcement seems to have alleviated those concerns, at least temporarily. By confirming its production and shipment milestones, Micron has reinforced its status as a key supplier for expanding AI infrastructure, providing clarity to investors about its near-term trajectory.

As the demand for AI-capable technologies continues to rise, stakeholders will be closely monitoring Micron’s ability to sustain its momentum and meet future needs. The company’s recent advancements not only position it favorably in the market but also highlight the critical role it will play as the AI landscape evolves.

For further updates on Micron and to explore the implications of its recent announcements, visit Micron’s official website.

See also NVIDIA and AMD Invest $315M in Runway as Company Shifts to World Model Technology

NVIDIA and AMD Invest $315M in Runway as Company Shifts to World Model Technology Investors Shift Strategies, Emphasizing Governance and Control in AI’s Evolving Landscape

Investors Shift Strategies, Emphasizing Governance and Control in AI’s Evolving Landscape Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032