The U.S. is maintaining its lead in the global artificial intelligence race, according to a recent report released by the Trump administration on Wednesday. The document, authored by the White House Council of Economic Advisers, highlights several economic indicators suggesting an increasing global divide in AI-driven growth, reminiscent of the impact of the Industrial Revolution.

The report underscores the economic implications of the AI revolution, describing it as a significant inflection point with the potential to substantially boost the GDPs of nations that adopt these technologies. Citing historical economic research on the Industrial Revolution and its associated Great Divergence—where countries embracing new technologies experienced accelerated growth compared to those that did not—the authors suggest that AI could catalyze a similar global transformation.

Central to the report’s findings is the economic concept of Total Factor Productivity, which measures an economy’s efficiency in utilizing inputs such as labor and resources to produce outputs like GDP. While this metric illustrates AI’s influence on productivity, the report emphasizes the need to assess investment across various AI sectors, from the development of models to supporting infrastructure. The authors argue that ongoing investment, even amid rising costs, reflects a commitment to advancing AI capabilities.

In evaluating AI growth in the U.S., the report points to the performance of AI systems in executing increasingly complex tasks, a decline in costs per input for large language models, and widespread adoption among individuals and businesses. It also highlights projected revenue growth for companies like OpenAI, which is anticipated to surpass the growth rates of prior tech unicorns.

A cross-country analysis ranks global players based on their investment, performance, and adoption of AI, with the U.S. emerging as a prominent leader. Notably, the report indicates that the U.S. attracted approximately $109 billion in private AI investment in 2024, dwarfing China’s $9 billion and surpassing other nations including the UK, Sweden, and Canada. The U.S. commands around 75% of reported venture funding in generative AI startups.

Furthermore, the U.S. boasts the largest share of AI models exceeding 1023 FLOPs of compute power—akin to that of GPT-3—accounting for 154 out of the world’s total 331 systems of that capability as of 2024. However, the report notes that the performance gap between the top models from different countries is narrowing due to rapid advancements in the field.

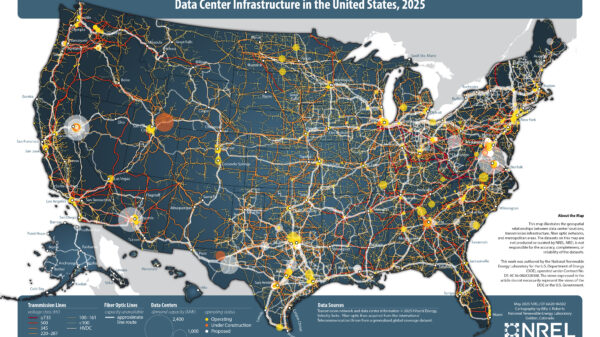

By May 2025, the U.S. was estimated to possess roughly 74% of the world’s AI compute capacity, with much of the hardware utilized to train AI models in other countries sourced from American manufacturers. The report lauds the “Trump Revolution,” characterized by significant investments in AI and deregulation, as pivotal for enhancing U.S. standing in the sector. The authors assert that investment-friendly provisions within the One Big Beautiful Bill Act and trade agreements facilitated by the administration will further bolster American AI investment. They also connect the administration’s focus on energy dominance to improving the adoption and operation of energy-intensive AI systems.

The report concludes with a statement on the U.S.’s strategic efforts to establish global dominance through technology exports and deregulatory measures, asserting that these initiatives form the foundation for American AI leadership, as underscored by the comprehensive AI Action Plan and related executive orders from the Trump administration.

Experts like Susan Aaronson, a research professor at George Washington University, caution that the integration of AI into existing economic sectors, such as manufacturing, presents both opportunities and challenges. “When we think about AI, we need to also imagine how AI might be utilized to bolster existing economic sectors and create new sectors,” she said, emphasizing the need for policymakers to consider the potential economic disruptions caused by AI advancements.

Similarly, economist Tara Sinclair highlights the necessity of examining historical patterns to forecast AI’s economic impact, noting that while AI can yield both positive and negative consequences, its transformative potential may take decades to fully materialize. “People keep focusing on how fast AI can scale, and at the same time, we have to think about [the fact that] humans take a lot more time,” she observed, pointing out the need to develop new businesses and firms to effectively adopt this technology.

The implications of this report suggest that while the U.S. currently leads the global AI landscape, the broader economic impacts and the need for balanced policymaking will require ongoing attention as the technology continues to evolve.

See also SpaceX and xAI Explore Merger Ahead of Potential $1 Trillion IPO, Boosting AI Ambitions

SpaceX and xAI Explore Merger Ahead of Potential $1 Trillion IPO, Boosting AI Ambitions New Hampshire’s HB 124: Pioneering AI’s ‘Right to Compute’ for Enhanced Innovation

New Hampshire’s HB 124: Pioneering AI’s ‘Right to Compute’ for Enhanced Innovation Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032