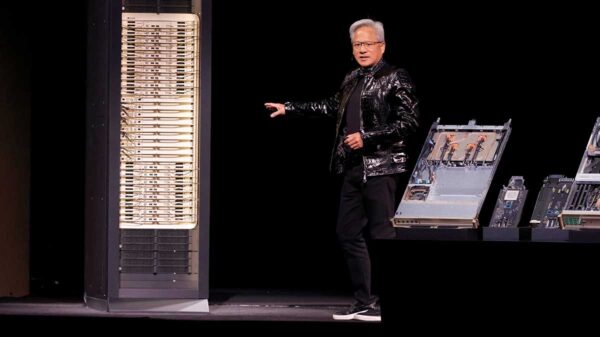

Nvidia (NVDA) is set to make a significant impact at CES 2026, as its focus on artificial intelligence (AI) continues to attract investor attention. The company is poised to unveil its AI roadmap, with particular emphasis on new accelerators, the reopening of China’s economy, and substantial orders from major clients like ByteDance. These factors may play a pivotal role in determining the stock’s trajectory in the coming months.

The upcoming catalysts arrive after a period of volatility for Nvidia, which has seen a modest 30-day share price increase of 3.53%. However, the company’s impressive one-year total shareholder return of 30.75% indicates that while momentum may be cooling, it is far from broken. As interest in Nvidia’s AI capabilities grows, investors might also look toward other high-growth tech and AI stocks that could benefit from similar structural tailwinds.

Currently, Nvidia shares are trading approximately 34% below the average analyst target, which raises an essential question for investors: Is this a rare opportunity for a reset in a long-term AI leader, or has the market already accounted for the next wave of growth? Analysts at Restinglion suggest that Nvidia’s fair value is significantly higher than its most recent close of $188.85, positioning the company as potentially undervalued with considerable upside if its AI engine continues to gain traction.

Nvidia has reported a staggering $72 billion in profits, a figure that many publicly traded companies may never achieve. This revenue is expected to grow as AI continues to evolve under Nvidia’s leadership. The company’s narrative highlights rapid top-line expansion and high gross margins as critical components driving its valuation. Analysts estimate a fair value of $235.00 for Nvidia, reinforcing the idea that the stock may currently be undervalued if the company’s growth story holds true.

However, risks loom on the horizon. Sustained margin compression or an accelerated decline in spending on AI infrastructure could challenge this perception of undervaluation. Investors are cautioned to consider these potential pitfalls when evaluating Nvidia’s future prospects.

From an earnings perspective, Nvidia’s valuation appears less forgiving. The company trades at a premium price-to-earnings (P/E) ratio of 46.3, surpassing the US semiconductor average of 37.3. Despite being below its peers—who trade at ratios as high as 62.6—this raises pertinent questions about whether this premium offers protection against downside risks or if it simply heightens vulnerability.

For those interested in crafting their own investment narratives, resources are available to help evaluate Nvidia’s potential risks and rewards. The analysis details two key advantages and two critical warning signs that could influence investment decisions regarding Nvidia, providing a comprehensive overview for potential investors.

As the technology sector continues to evolve, Nvidia’s developments in AI will be closely monitored by investors. The ongoing innovations in AI are being driven by Nvidia’s capabilities, and industry sentiment remains high. With the launch of new products and services expected, the market dynamics surrounding Nvidia and its competitors could shift significantly in the near future.

In the context of a rapidly changing economy, the recent introduction of the New Payments ETF on NASDAQ offers investors an innovative avenue for direct exposure to real-time financial transactions. As companies like Nvidia lead the charge in AI and technology, such developments could reshape investment portfolios and strategies moving forward.

Investors are encouraged to stay informed as Nvidia navigates this critical period marked by technological advancements and shifting market dynamics. The forthcoming months will be telling as the company reveals its future direction and how it capitalizes on the burgeoning AI landscape.

See also Boston Dynamics’ Atlas Advances in AI Training for Factory Tasks, Targeting $38B Humanoid Market

Boston Dynamics’ Atlas Advances in AI Training for Factory Tasks, Targeting $38B Humanoid Market Top 3 AI Stocks Poised for Growth Amid Tech Disruption: Invest Now for Future Gains

Top 3 AI Stocks Poised for Growth Amid Tech Disruption: Invest Now for Future Gains Meta Acquires Manus for $2 Billion, Accelerates AI Ad Strategy Across Platforms

Meta Acquires Manus for $2 Billion, Accelerates AI Ad Strategy Across Platforms Western Digital’s Stock Soars 7% on AI-Driven Storage Demand Amid Valuation Reassessment

Western Digital’s Stock Soars 7% on AI-Driven Storage Demand Amid Valuation Reassessment