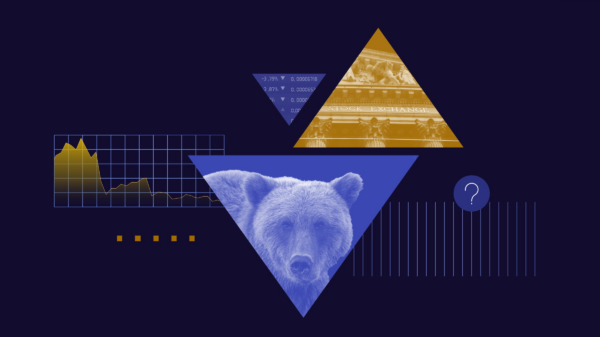

If there’s one thing markets hate more than bad news, it’s uncertainty. This week, Wall Street received a dose of clarity, prompting traders to respond swiftly. Dow Jones futures surged following a significant legal ruling that reshaped the tariff landscape tied to President Donald Trump’s trade policy. In tandem, rising tensions with Iran and renewed momentum surrounding Nvidia kept market volatility simmering beneath the surface.

The current market scenario features a blend of legal drama, geopolitical risk, and AI-driven optimism, all unfolding simultaneously.

The heart of this rally lies with a Supreme Court ruling that challenged the legal foundations of certain tariffs imposed under emergency powers. Investors interpreted this decision as a reduction in immediate trade uncertainty, leading to significant market gains. Companies reliant on imports—such as retailers, manufacturers, and consumer goods firms—stand to benefit, as lower tariffs can improve profit margins almost instantly.

This clarity catalyzed upward movements in the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite. Relief rallies often occur rapidly, especially when traders sense a decrease in policy risk. However, it is essential to note that tariffs are not entirely eliminated. The administration has suggested it may explore alternative legal avenues to reintroduce trade measures if required, indicating that the long-term trade narrative is evolving rather than concluding.

For corporate America, the implications are significant. Tariffs have acted like a hidden tax on companies importing goods or raw materials. The removal or reduction of these costs could yield immediate financial relief, potentially enhancing cash flow. Analysts suggest that billions of dollars could return to corporate balance sheets if companies begin receiving refunds for previously paid tariffs. This financial flexibility could bolster stock buyback programs, enhance potential dividends, and facilitate expansion plans.

While the recent rally is driven by tariff relief, Nvidia remains a substantial contributor to market momentum. The semiconductor giant is at the forefront of the AI revolution, with investors keenly observing its growth trajectory. The increasing demand for AI chips, data center expansion, and machine learning infrastructure has cemented Nvidia’s status as one of the market’s most influential stocks. Historically, when Nvidia moves, the Nasdaq often follows suit.

The company continues to garner strong earnings expectations, and ongoing investment themes around AI reinforce bullish sentiment. Broader economic concerns, including inflation and geopolitical risks, frequently take a back seat when AI enthusiasm dominates headlines. However, this concentration raises a critical question: is the market becoming overly reliant on a select few tech giants?

Despite Nvidia’s current influence, rising geopolitical tensions, particularly with Iran, remain a wild card in the market. Ongoing instability in the Middle East directly impacts oil prices, which in turn can affect inflation and consumer spending power. If tensions escalate—whether through military actions or failures in diplomatic negotiations—the risk appetite of investors could shift rapidly. Such a shift might compel traders to transition from growth stocks to defensive sectors or safe-haven assets.

As tariffs have been clarified and Nvidia continues to gain attention, investors are now focused on three key areas: the Federal Reserve’s policy, corporate earnings, and energy markets. If inflation proves persistent, interest rate cuts could be delayed, affecting growth stocks significantly. Corporate earnings reports from retailers and industrial firms will shed light on how much tariffs previously impacted profits and what relief might follow. Furthermore, volatility in oil prices tied to Iran could either support the rally through energy sector gains or exert pressure due to inflation fears.

Looking Ahead

While relief rallies can sometimes develop into longer-term uptrends, they require robust fundamentals for support. Investors will be watching for stable trade policy, solid earnings growth, controlled inflation, and geopolitical containment. Should these elements align, the current market rally could extend. Conversely, if they do not, volatility could return swiftly, reminding traders that policy shifts and global tensions can alter market direction overnight.

This week’s rally exemplifies the market’s desire for certainty. The tariff ruling has not resolved economic challenges but has removed one layer of unpredictability. Nvidia’s sustained dominance adds confidence, solidifying AI as a structural growth driver. Yet, the concentration of market momentum in a few tech giants necessitates caution, as unexpected earnings surprises can have outsized impacts.

As geopolitical risks loom, investors must navigate the balance between optimism and vigilance. The recent surge in the Dow indicates a bullish sentiment among traders, but seasoned investors understand that rallies based on headlines require substantiation through hard data. For now, momentum favors the bulls, but in a market shaped by political dynamics and global tensions, flexibility may prove to be the most valuable asset.

In the ever-changing landscape of the markets, the next headline could alter the course yet again.

See also Mistral AI’s Arthur Mensch Advocates for Decentralized AI Power at India Summit

Mistral AI’s Arthur Mensch Advocates for Decentralized AI Power at India Summit Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs