ServiceNow, the enterprise software company, reported a record quarter on February 21, 2026, achieving 21% growth in subscription revenue, totaling $3.47 billion, while more than doubling its revenue from AI products. Despite these strong results, the company has seen its stock price decline by 45% from recent highs, a trend reflective of a broader sell-off in the enterprise software sector. Analysts suggest that this drop may not accurately reflect ServiceNow’s potential, particularly as its AI Agent Fabric and AI Control Tower products position it as a crucial management layer for companies integrating AI agents into their operations.

The significance of ServiceNow’s performance is underscored by its growing role in the increasing adoption of AI agents for workflow automation. Rather than being sidelined by emerging technologies, ServiceNow is expected to be enhanced by AI agents, which will operate within its existing ecosystem. This “data gravity” strengthens ServiceNow’s appeal, contributing to an impressive 98% customer retention rate despite skepticism surrounding the future of traditional enterprise software amidst AI advancements.

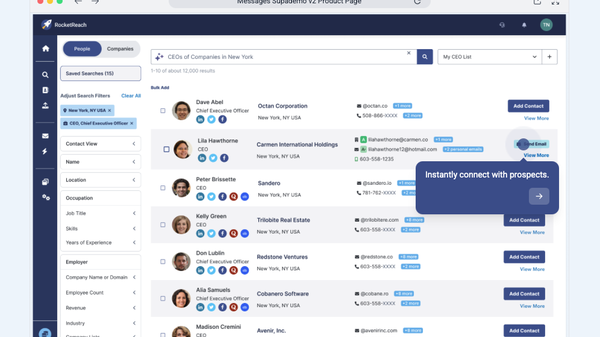

Last year, ServiceNow launched its AI Agent Fabric and AI Control Tower products, allowing interoperability among AI agents from various vendors. This innovation enables seamless task coordination while providing human managers with a unified dashboard for overseeing digital workforces. In addition to enhancing its product offerings, ServiceNow is implementing premium pricing tiers that reflect the value generated by AI productivity, rather than the customary per-seat charges. Strategic acquisitions like Armis and Moveworks have further bolstered its capabilities, solidifying its standing as an enterprise “control tower” for AI.

In its fourth quarter of 2025, ServiceNow surpassed expectations with subscription revenue of $3.47 billion. For the entire year, subscription revenue reached $12.88 billion, marking a 21% increase. The company’s current remaining performance obligations, a key indicator of contracted revenue, grew by 25% to $12.85 billion, showcasing strong future demand.

Bill McDermott, the CEO of ServiceNow, has extended his contract through at least 2030, indicating a sustained commitment to steering the company toward becoming the operational backbone for enterprise AI. In a recent earnings call, McDermott emphasized that ServiceNow is “the gateway to this shift, serving as the semantic layer that makes AI ubiquitous in the enterprise.”

Looking ahead, ServiceNow projects a subscription revenue range of $15.53 billion to $15.57 billion for 2026, representing an anticipated growth rate of approximately 20%. This outlook underscores the company’s strategic positioning in a rapidly evolving technological landscape.

As companies increasingly recognize the importance of managing and deploying AI agents effectively, ServiceNow is establishing itself as a vital platform for enterprises. By leveraging its extensive data integrations and workflow automation capabilities, the company aims to thrive amid the ongoing transformations in the enterprise software sector, even as questions linger about the impact of AI on traditional software models.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics