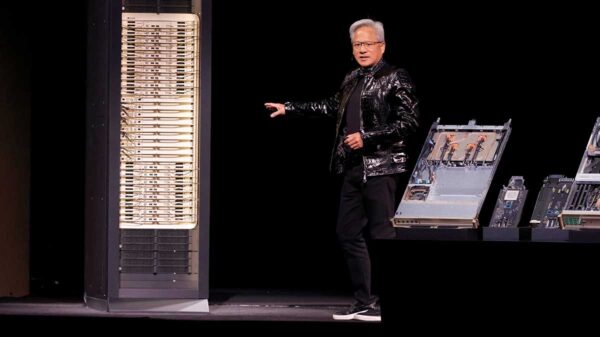

Few companies have reshaped the technology landscape in recent years quite like Nvidia. Once primarily known for powering high-end gaming graphics, Nvidia has transformed into the backbone of the artificial intelligence revolution. From massive data centers to autonomous vehicles and generative AI systems, its chips are at the center of the modern computing boom.

As shares have experienced explosive gains over the past several years, investors are increasingly asking the critical question: Where could Nvidia’s stock be five years from now? While no prediction is guaranteed, examining growth trends, competitive pressures, and macroeconomic conditions provides a framework for a realistic long-term estimate.

Nvidia’s rise is inseparable from the AI explosion. Its graphics processing units (GPUs) have become the industry standard for training and running advanced machine learning models. Major technology players—including Microsoft, Amazon, and Google—have invested billions into AI infrastructure powered largely by Nvidia chips. Analysts project that the global AI market could exceed $1 trillion in economic impact over the next decade. If Nvidia can maintain even a dominant fraction of this ecosystem, robust revenue growth could continue for years.

However, sustaining today’s growth rates indefinitely is unrealistic. A more pressing question is whether Nvidia can compound earnings at a pace that justifies its premium valuation. The company’s data center segment has been the primary engine of expansion, with explosive demand for AI training hardware leading to record-breaking quarterly revenue figures. Over a five-year horizon, even if annual growth moderates to 15–25%, that would still represent significant expansion for a company of Nvidia’s size.

Nvidia also has additional catalysts for growth, including expansion into AI inference markets, automotive AI systems, robotics and industrial automation, edge computing, and software services. Diversifying beyond just chip sales could improve long-term margins and stabilize earnings.

Despite its strong position, Nvidia’s dominance is not uncontested. Competitors like Advanced Micro Devices and Intel are aggressively expanding their AI hardware offerings, while major cloud providers are designing in-house AI chips to reduce reliance on Nvidia. This raises the risk of margin compression; if customers have alternatives, Nvidia’s pricing power could weaken. Yet, the company benefits from a powerful competitive moat: its Cuda software ecosystem. Developers worldwide are trained on Nvidia’s platform, creating switching costs that are difficult to overcome. Unless a disruptive architectural shift occurs, Nvidia appears positioned to remain a leader in AI acceleration at least in the medium term.

Valuation considerations must also be factored into stock price predictions. Nvidia has often traded at premium price-to-earnings ratios due to its growth profile. Over five years, two scenarios are plausible. In a bullish case, earnings could grow rapidly while valuation multiples remain elevated due to sustained AI dominance. Conversely, in a moderate case, earnings could grow strongly, but multiples might contract as growth stabilizes and competition increases. Historically, high-growth tech companies often see some degree of multiple compression over time, which does not necessarily mean stock prices fall but rather that gains may track earnings more closely.

To build a hypothetical scenario, assume Nvidia grows earnings at an average annual rate of 20% while experiencing some modest multiple contraction. Under this framework, Nvidia’s stock could potentially rise between 60% and 120% over five years. If shares compound at roughly 15% annually, that would effectively double the stock price in five years. However, if AI demand slows dramatically or competitive threats intensify, returns could be more muted.

Broader economic conditions also play a crucial role. Rising interest rates tend to pressure high-growth stocks, as future earnings become less valuable in present-value terms. A stable or declining rate environment could support higher valuations. Global semiconductor demand cycles, geopolitical tensions involving chip manufacturing, and regulatory policy toward AI will also influence Nvidia’s trajectory. Export restrictions to certain international markets could limit growth in specific regions, while domestic semiconductor investment initiatives could boost long-term production capacity.

Even strong companies face risks. For Nvidia, key concerns include a potential AI spending slowdown after the initial infrastructure buildout, intensified competition reducing margins, supply chain disruptions, and regulatory scrutiny surrounding AI deployment. Market sentiment can also shift rapidly, with high-flying stocks often experiencing volatility, particularly during earnings seasons. Investors should prepare for significant price swings along the way, even if the long-term trajectory remains positive.

Some analysts argue that AI is comparable to electricity or the internet in terms of transformational impact. If this analogy holds true, Nvidia could remain central to global infrastructure for decades to come. In such an optimistic scenario, earnings growth may exceed expectations, and valuation multiples could stay elevated longer than skeptics anticipate. Conversely, skeptics caution that AI enthusiasm may be front-loaded. Once data centers are built and initial model training demand subsides, growth could decelerate, leading to potential downside pressure if earnings growth slows sharply while the stock trades at a premium valuation.

Taking into account growth prospects, competitive dynamics, valuation normalization, and macroeconomic conditions, a balanced projection suggests Nvidia’s stock could reasonably trade between 1.6x and 2.2x its current level within five years. This implies steady but potentially less explosive returns compared to the extraordinary gains of recent years. Ultimately, the key question for long-term investors is not whether volatility will occur—it almost certainly will—but whether Nvidia can maintain its leadership in one of the most transformative technological shifts of our era. If it does, the next five years may still reward patient shareholders, even if the path forward proves less dramatic than in the recent past.

See also Yogi Adityanath Launches IBM AI GovTech Innovation Centre to Propel Quantum Computing in Uttar Pradesh

Yogi Adityanath Launches IBM AI GovTech Innovation Centre to Propel Quantum Computing in Uttar Pradesh Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse